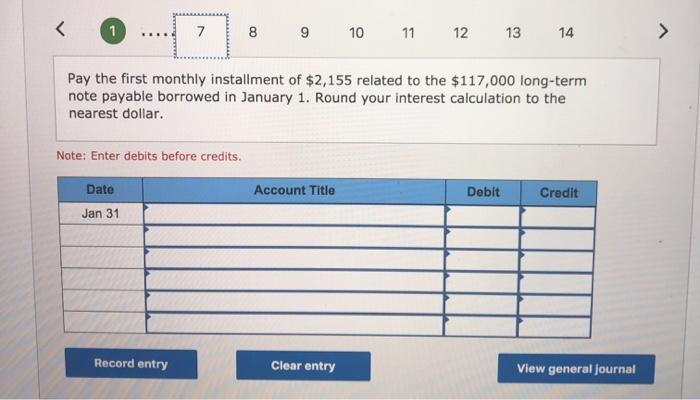

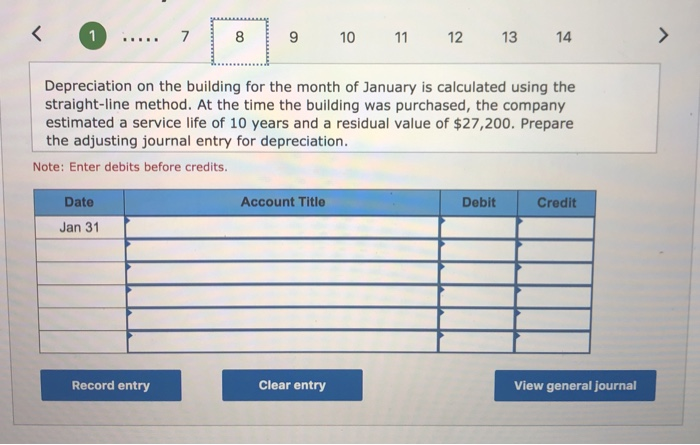

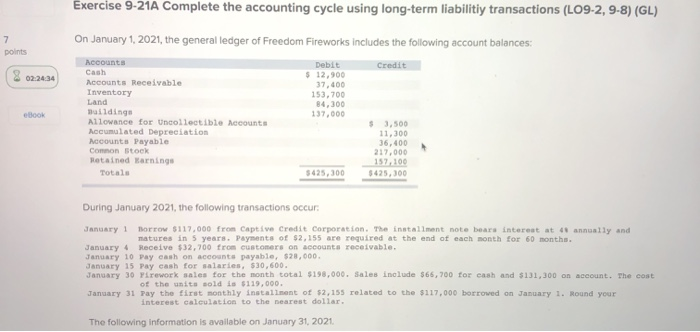

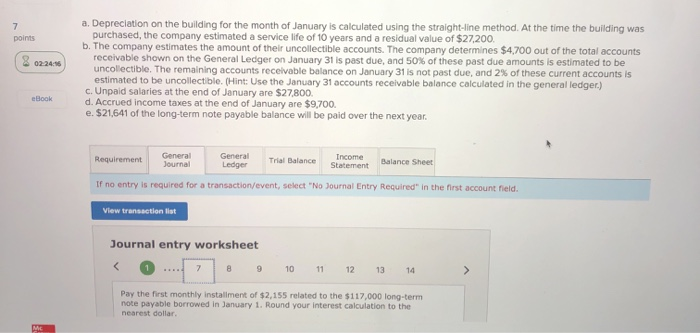

8 9 10 11 12 13 14 Pay the first monthly installment of $2,155 related to the $117,000 long-term note payable borrowed in January 1. Round your interest calculation to the nearest dollar. Note: Enter debits before credits. Account Title Debit Credit Date Jan 31 Record entry Clear entry View general journal 1 ..... 7 8 9 10 11 12 13 14 Depreciation on the building for the month of January is calculated using the straight-line method. At the time the building was purchased, the company estimated a service life of 10 years and a residual value of $27,200. Prepare the adjusting journal entry for depreciation. Note: Enter debits before credits. Account Title Debit Credit Date Jan 31 Record entry Clear entry View general journal Exercise 9-21A Complete the accounting cycle using long-term liability transactions (LO9-2, 9.8) (GL) On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: points Credit 2 02:2434 Debit $ 12,900 37,000 153.700 84.300 137,000 eBook Accounts Cash Accounts Receivable Inventory Land Halldings Allowance for Uncollectible Accumulated Depreciation Accounts Payable Common stock Retained Harnings Totale counts $ 3,500 11,300 36,400 217,000 157.100 $425,300 $425,300 During January 2021, the following transactions occur. January 1 Torrow $117.000 from Captive Credit Corporation. The installment note bara interest at 40 annually and matures in 5 years. Payments of $2,155 are required at the end of each month for 60 months. January 4 Receive $32,700 from customers on accounts receivable. January 10 Pay cash on accounts payable, $28,000. January 15 Pay cash for salaries, $30,600. January 30 Pirework sales for the month total $198.000. Sales include $66,700 for cash and $131,300 on account. The cost of the units sold is $119,000. January 31 Pay the first monthly installment of $2,155 related to the $117.000 borrowed on January 1. Round your interest calculation to the nearest dollar. The following information is available on January 31, 2021 points 8 02:24:16 a. Depreciation on the building for the month of January is calculated using the straight-line method. At the time the building was purchased, the company estimated a service life of 10 years and a residual value of $27,200 b. The company estimates the amount of their uncollectible accounts. The company determines $4,700 out of the total accounts receivable shown on the General Ledger on January 31 is past due, and 50% of these past due amounts is estimated to be uncollectible. The remaining accounts receivable balance on January 31 is not past due, and 2% of these current accounts is estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) c. Unpaid salaries at the end of January are $27.800. d. Accrued income taxes at the end of January are $9,700. e. $21,641 of the long-term note payable balance will be paid over the next year. eBook Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field. View transaction list Journal entry worksheet 1 ...nd 7 8 9 10 11 12 13 14 Pay the first monthly installment of $2,155 related to the $117,000 long-term note payable borrowed in January 1. Round your interest calculation to the nearest dollar 8 9 10 11 12 13 14 Pay the first monthly installment of $2,155 related to the $117,000 long-term note payable borrowed in January 1. Round your interest calculation to the nearest dollar. Note: Enter debits before credits. Account Title Debit Credit Date Jan 31 Record entry Clear entry View general journal 1 ..... 7 8 9 10 11 12 13 14 Depreciation on the building for the month of January is calculated using the straight-line method. At the time the building was purchased, the company estimated a service life of 10 years and a residual value of $27,200. Prepare the adjusting journal entry for depreciation. Note: Enter debits before credits. Account Title Debit Credit Date Jan 31 Record entry Clear entry View general journal Exercise 9-21A Complete the accounting cycle using long-term liability transactions (LO9-2, 9.8) (GL) On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: points Credit 2 02:2434 Debit $ 12,900 37,000 153.700 84.300 137,000 eBook Accounts Cash Accounts Receivable Inventory Land Halldings Allowance for Uncollectible Accumulated Depreciation Accounts Payable Common stock Retained Harnings Totale counts $ 3,500 11,300 36,400 217,000 157.100 $425,300 $425,300 During January 2021, the following transactions occur. January 1 Torrow $117.000 from Captive Credit Corporation. The installment note bara interest at 40 annually and matures in 5 years. Payments of $2,155 are required at the end of each month for 60 months. January 4 Receive $32,700 from customers on accounts receivable. January 10 Pay cash on accounts payable, $28,000. January 15 Pay cash for salaries, $30,600. January 30 Pirework sales for the month total $198.000. Sales include $66,700 for cash and $131,300 on account. The cost of the units sold is $119,000. January 31 Pay the first monthly installment of $2,155 related to the $117.000 borrowed on January 1. Round your interest calculation to the nearest dollar. The following information is available on January 31, 2021 points 8 02:24:16 a. Depreciation on the building for the month of January is calculated using the straight-line method. At the time the building was purchased, the company estimated a service life of 10 years and a residual value of $27,200 b. The company estimates the amount of their uncollectible accounts. The company determines $4,700 out of the total accounts receivable shown on the General Ledger on January 31 is past due, and 50% of these past due amounts is estimated to be uncollectible. The remaining accounts receivable balance on January 31 is not past due, and 2% of these current accounts is estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) c. Unpaid salaries at the end of January are $27.800. d. Accrued income taxes at the end of January are $9,700. e. $21,641 of the long-term note payable balance will be paid over the next year. eBook Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field. View transaction list Journal entry worksheet 1 ...nd 7 8 9 10 11 12 13 14 Pay the first monthly installment of $2,155 related to the $117,000 long-term note payable borrowed in January 1. Round your interest calculation to the nearest dollar