Answered step by step

Verified Expert Solution

Question

1 Approved Answer

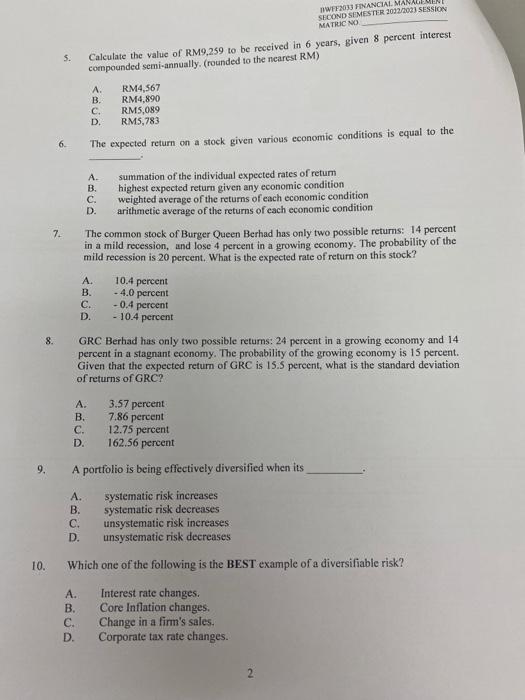

8. 9. 10. 7. 5. 6. Calculate the value of RM9,259 to be received in 6 years, given 8 percent interest compounded semi-annually. (rounded

8. 9. 10. 7. 5. 6. Calculate the value of RM9,259 to be received in 6 years, given 8 percent interest compounded semi-annually. (rounded to the nearest RM) A. RM4,567 RM4,890 B. C. D. A. B. C. D. A. B. C. D. A. B. C. D. RM5,089 RM5,783 The expected return on a stock given various economic conditions is equal to the A. B. C. D. The common stock of Burger Queen Berhad has only two possible returns: 14 percent in a mild recession, and lose 4 percent in a growing economy. The probability of the mild recession is 20 percent. What is the expected rate of return on this stock? MENT DWFF2033 FINANCIAL MANAGE SECOND SEMESTER 2022/2023 SESSION MATRIC NO summation of the individual expected rates of return highest expected return given any economic condition weighted average of the returns of each economic condition arithmetic average of the returns of each economic condition 10.4 percent -4.0 percent -0.4 percent - 10.4 percent GRC Berhad has only two possible returns: 24 percent in a growing economy and 14 percent in a stagnant economy. The probability of the growing economy is 15 percent. Given that the expected return of GRC is 15.5 percent, what is the standard deviation of returns of GRC? 3.57 percent 7.86 percent 12.75 percent 162.56 percent A portfolio is being effectively diversified when its A. systematic risk increases B. systematic risk decreases C. D. unsystematic risk increases unsystematic risk decreases Which one of the following is the BEST example of a diversifiable risk? Interest rate changes. Core Inflation changes. Change in a firm's sales. Corporate tax rate changes. 2 8. 9. 10. 7. 5. 6. Calculate the value of RM9,259 to be received in 6 years, given 8 percent interest compounded semi-annually. (rounded to the nearest RM) A. RM4,567 RM4,890 B. C. D. A. B. C. D. A. B. C. D. A. B. C. D. RM5,089 RM5,783 The expected return on a stock given various economic conditions is equal to the A. B. C. D. The common stock of Burger Queen Berhad has only two possible returns: 14 percent in a mild recession, and lose 4 percent in a growing economy. The probability of the mild recession is 20 percent. What is the expected rate of return on this stock? MENT DWFF2033 FINANCIAL MANAGE SECOND SEMESTER 2022/2023 SESSION MATRIC NO summation of the individual expected rates of return highest expected return given any economic condition weighted average of the returns of each economic condition arithmetic average of the returns of each economic condition 10.4 percent -4.0 percent -0.4 percent - 10.4 percent GRC Berhad has only two possible returns: 24 percent in a growing economy and 14 percent in a stagnant economy. The probability of the growing economy is 15 percent. Given that the expected return of GRC is 15.5 percent, what is the standard deviation of returns of GRC? 3.57 percent 7.86 percent 12.75 percent 162.56 percent A portfolio is being effectively diversified when its A. systematic risk increases B. systematic risk decreases C. D. unsystematic risk increases unsystematic risk decreases Which one of the following is the BEST example of a diversifiable risk? Interest rate changes. Core Inflation changes. Change in a firm's sales. Corporate tax rate changes. 2

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

7 Calculate the value of RM9259 to be received in 6 years given 8 percent interest compounded semiannually rounded to the nearest RM The formula for compound interest is given by FVPV1rnnt Where FV is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started