Answered step by step

Verified Expert Solution

Question

1 Approved Answer

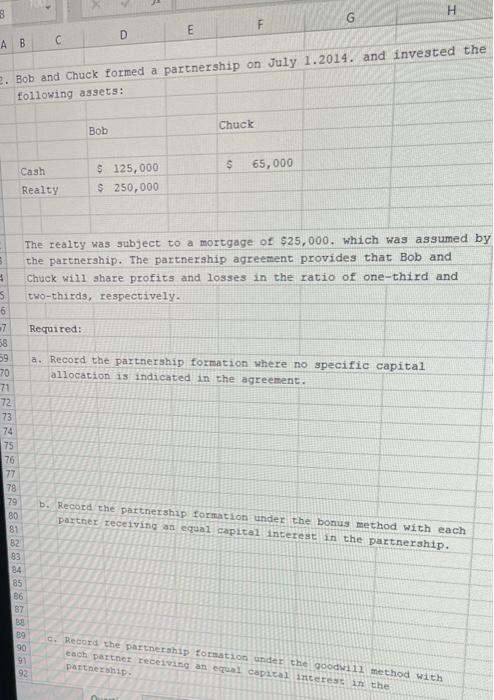

8 A B C > x D E F G H 2. Bob and Chuck formed a partnership on July 1.2014. and invested the

8 A B C > x D E F G H 2. Bob and Chuck formed a partnership on July 1.2014. and invested the following assets: Bob Chuck Cash Realty $ 125,000 $ 65,000 $ 250,000 6 7 58 59 70 71 $ 5 The realty was subject to a mortgage of $25,000. which was assumed by the partnership. The partnership agreement provides that Bob and Chuck will share profits and losses in the ratio of one-third and two-thirds, respectively. Required: a. Record the partnership formation where no specific capital allocation is indicated in the agreement. 72 73 74 75 76 77 78 79 80 81 b. Record the partnership formation under the bonus method with each partner receiving an equal capital interest in the partnership. 82 83 84 85 86 87 88 89 90 91 92 c. Record the partnership formation under the goodwill method with each partner receiving an equal capital interest in the partnership.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started