Answered step by step

Verified Expert Solution

Question

1 Approved Answer

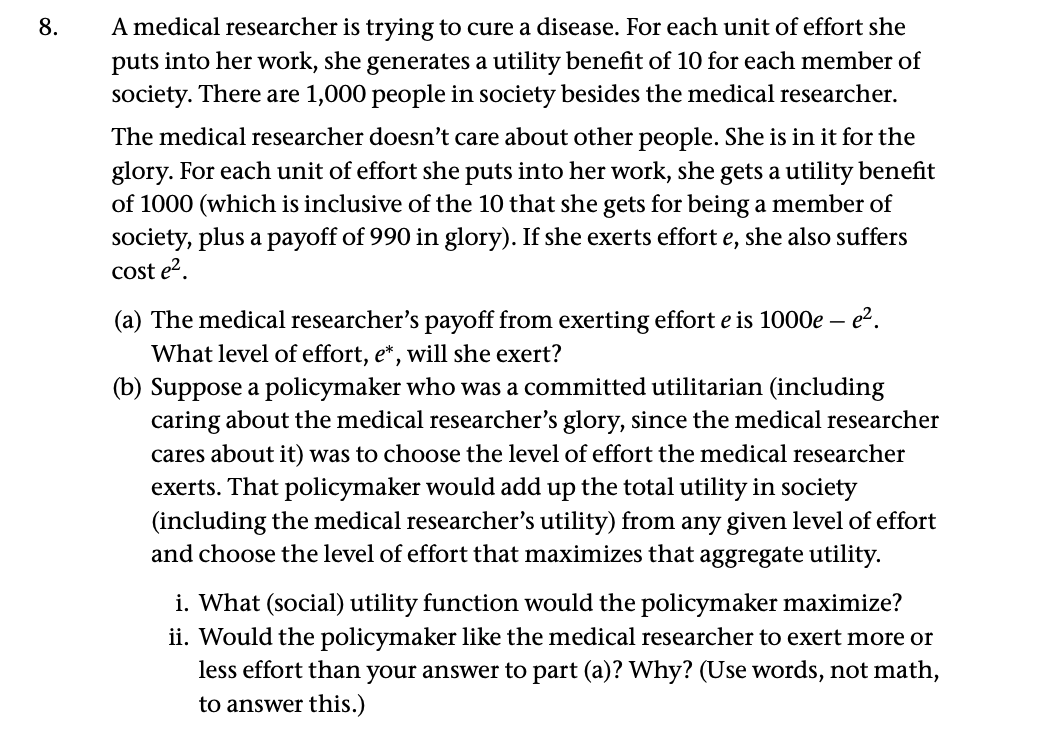

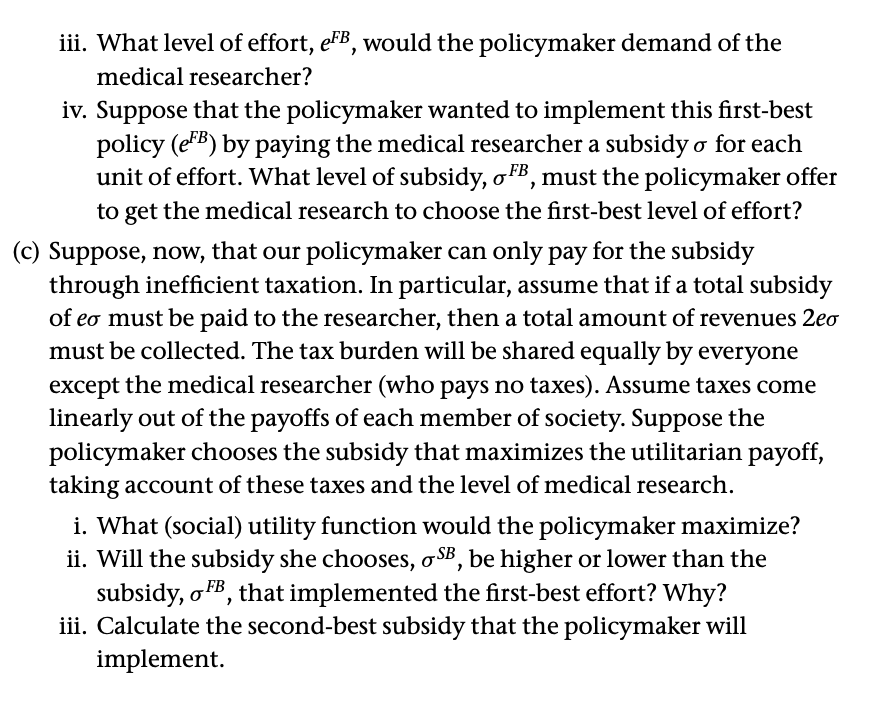

8. A medical researcher is trying to cure a disease. For each unit of effort she puts into her work, she generates a utility

8. A medical researcher is trying to cure a disease. For each unit of effort she puts into her work, she generates a utility benefit of 10 for each member of society. There are 1,000 people in society besides the medical researcher. The medical researcher doesn't care about other people. She is in it for the glory. For each unit of effort she puts into her work, she gets a utility benefit of 1000 (which is inclusive of the 10 that she gets for being a member of society, plus a payoff of 990 in glory). If she exerts effort e, she also suffers cost e. - e. (a) The medical researcher's payoff from exerting effort e is 1000e - What level of effort, e*, will she exert? (b) Suppose a policymaker who was a committed utilitarian (including caring about the medical researcher's glory, since the medical researcher cares about it) was to choose the level of effort the medical researcher exerts. That policymaker would add up the total utility in society (including the medical researcher's utility) from any given level of effort and choose the level of effort that maximizes that aggregate utility. i. What (social) utility function would the policymaker maximize? ii. Would the policymaker like the medical researcher to exert more or less effort than your answer to part (a)? Why? (Use words, not math, to answer this.) iii. What level of effort, eFB, would the policymaker demand of the medical researcher? iv. Suppose that the policymaker wanted to implement this first-best policy (eFB) by paying the medical researcher a subsidy o for each unit of effort. What level of subsidy, o FB, must the policymaker offer to get the medical research to choose the first-best level of effort? (c) Suppose, now, that our policymaker can only pay for the subsidy through inefficient taxation. In particular, assume that if a total subsidy of eo must be paid to the researcher, then a total amount of revenues 2eo must be collected. The tax burden will be shared equally by everyone except the medical researcher (who pays no taxes). Assume taxes come linearly out of the payoffs of each member of society. Suppose the policymaker chooses the subsidy that maximizes the utilitarian payoff, taking account of these taxes and the level of medical research. i. What (social) utility function would the policymaker maximize? ii. Will the subsidy she chooses, OSB, be higher or lower than the subsidy, o FB, that implemented the first-best effort? Why? iii. Calculate the second-best subsidy that the policymaker will implement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Medical researchers payoff 1000e e2 Take the derivative and set equal to 0 1000 2e 0 e 500 b i Soc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started