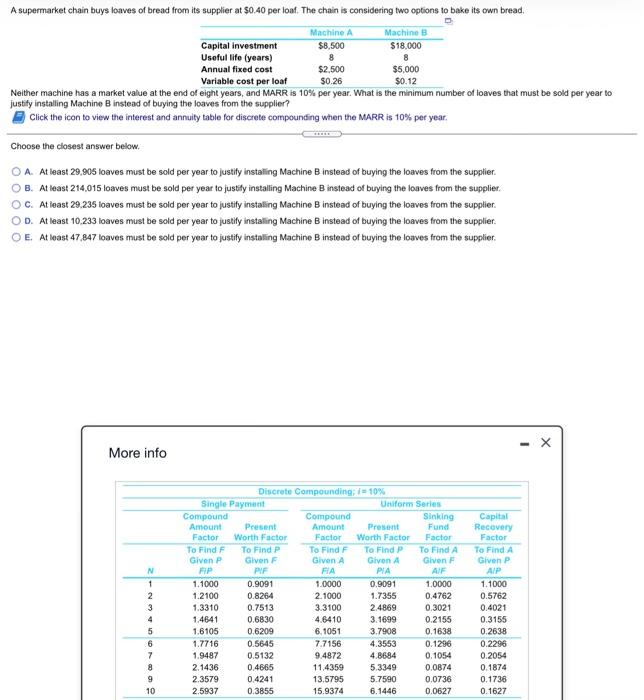

8 A supermarket chain buys loaves of bread from its supplier at $0.40 per loaf. The chain is considering two options to bake its own bread, Machine A Machine B Capital investment $8.500 $18,000 Useful life (years) 8 Annual fixed cost $2.500 $5,000 Variable cost per loaf $0.26 $0.12 Neither machine has a market value at the end of eight years, and MARR is 10% per year. What is the minimum number of loaves that must be sold per year to justify installing Machine B instead of buying the loaves from the supplier? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. Choose the closest answer below. A. At least 29,905 foaves must be sold per year to justify installing Machine B instead of buying the loaves from the supplier. B. At least 214,015 loaves must be sold per year to justify installing Machine B instead of buying the loaves from the supplier C. At least 29,235 loaves must be sold per year to justify installing Machine B instead of buying the loaves from the supplier. D. At least 10.233 loaves must be sold per year to justify installing Machine B instead of buying the loaves from the supplier. OE. At least 47,847 loaves must be sold per year to justify installing Machine B instead of buying the loaves from the supplier. More info N 1 2 3 4 5 Discrete Compounding; 1= 10% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given Given A Given A Given FIP PUF FIA PIA AIR 1.1000 0.9091 1.0000 0.9091 1.0000 1.2100 0.8264 2.1000 1.7355 0.4762 1.3310 0.7513 3.3100 2.4869 0.3021 1.4641 0.6830 4.6410 3.1699 0.2155 1.6105 0.6209 6.1051 3.7908 0.1638 1.7716 0.5645 7.7156 4.3553 0.1296 1.9487 0.5132 9.4872 4.8684 0.1054 2.1436 0.4665 11,4359 5.3349 0.0874 2.3579 0.4241 13.5795 5.7590 0.0736 2.5937 0.3855 15.9374 6.1446 0.0627 Capital Recovery Factor To Find A Given P AIP 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 6 7 8 9 10