Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. ABC generates about 90% of revenue from the domestic market, recently shifted its business strategy and moved into more export markets, which resulted

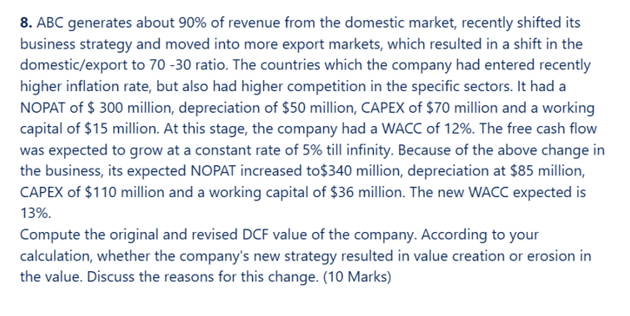

8. ABC generates about 90% of revenue from the domestic market, recently shifted its business strategy and moved into more export markets, which resulted in a shift in the domestic/export to 70 -30 ratio. The countries which the company had entered recently higher inflation rate, but also had higher competition in the specific sectors. It had a NOPAT of $ 300 million, depreciation of $50 million, CAPEX of $70 million and a working capital of $15 million. At this stage, the company had a WACC of 12%. The free cash flow was expected to grow at a constant rate of 5% till infinity. Because of the above change in the business, its expected NOPAT increased to $340 million, depreciation at $85 million, CAPEX of $110 million and a working capital of $36 million. The new WACC expected is 13%. Compute the original and revised DCF value of the company. According to your calculation, whether the company's new strategy resulted in value creation or erosion in the value. Discuss the reasons for this change. (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started