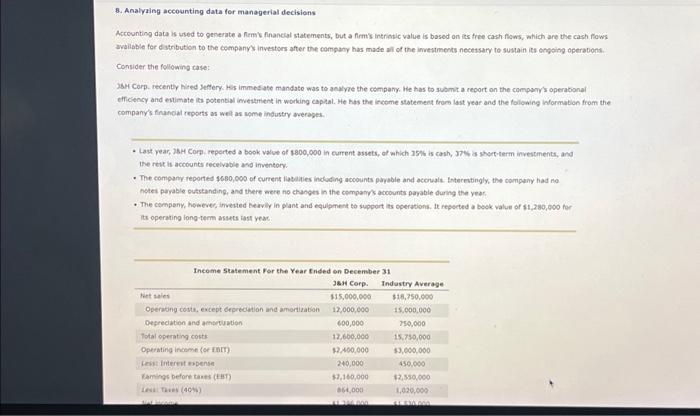

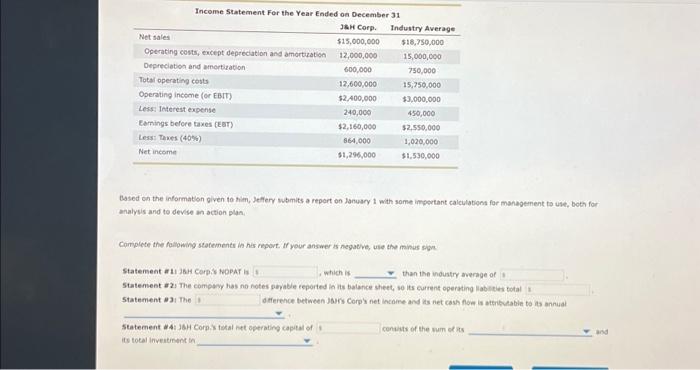

8. Analyaing accounting data for manogerial decisions Accounting data is used to generate a Rern' financlat statements, but a firmis intriasic value is based on its free cash fows, ahich ane the cash fows available for datnbution to the company's investors after the company has made all of the imvestments nectsary to sustain its ongaing operabons. Consider the following case: efficiency and estimate its potential imestment in working capial. He has the income statement from last year and the following information from the company's financial reports as welt as upme industry werages. the rest is accounts ecceivable avd imventory. - The company-reported $680,000 of currens lasalies indoding acoounts parable and accusia. Interestingly, the compamy had no notes parvable outstanding, and there eere no changes in the cempamrs accounts parable durng the year. - The compeny, however, imested Nervily in plant and equlpment to support its operations. 1t reperted a beok value of $1,280,000 fer its operating long-term assets tast yeac. Income Statement For the Year Ended on December 31 Based on the information given to hien, Jeflery wbmits a report on January 1 with some important calculations for manapenent to use, both for analysis and to devise an action plan, Complete the following statements in has repovt. If your answer as negative, use the minus sibn. Statement a 11 is Corpis NopAr is , which is than the industry avenge of Statement a 2: The compawy has no notes powable ceported in is balance sheet, so its current operating llablities total Statement e3! The Statement waijaH Corps total net operation capiul of conasts of the wum elos its tocal investinent in 8. Analyaing accounting data for manogerial decisions Accounting data is used to generate a Rern' financlat statements, but a firmis intriasic value is based on its free cash fows, ahich ane the cash fows available for datnbution to the company's investors after the company has made all of the imvestments nectsary to sustain its ongaing operabons. Consider the following case: efficiency and estimate its potential imestment in working capial. He has the income statement from last year and the following information from the company's financial reports as welt as upme industry werages. the rest is accounts ecceivable avd imventory. - The company-reported $680,000 of currens lasalies indoding acoounts parable and accusia. Interestingly, the compamy had no notes parvable outstanding, and there eere no changes in the cempamrs accounts parable durng the year. - The compeny, however, imested Nervily in plant and equlpment to support its operations. 1t reperted a beok value of $1,280,000 fer its operating long-term assets tast yeac. Income Statement For the Year Ended on December 31 Based on the information given to hien, Jeflery wbmits a report on January 1 with some important calculations for manapenent to use, both for analysis and to devise an action plan, Complete the following statements in has repovt. If your answer as negative, use the minus sibn. Statement a 11 is Corpis NopAr is , which is than the industry avenge of Statement a 2: The compawy has no notes powable ceported in is balance sheet, so its current operating llablities total Statement e3! The Statement waijaH Corps total net operation capiul of conasts of the wum elos its tocal investinent in