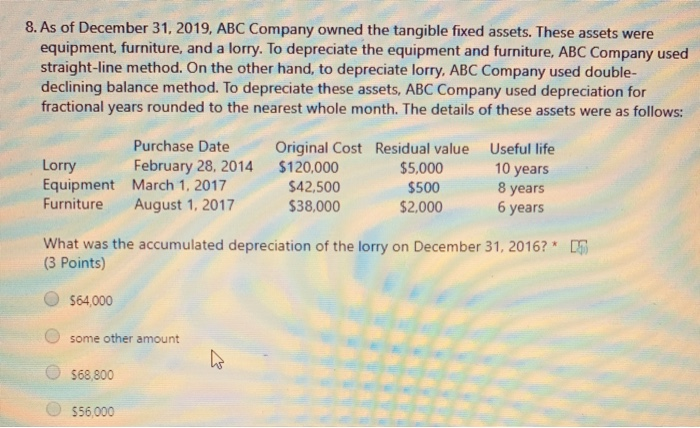

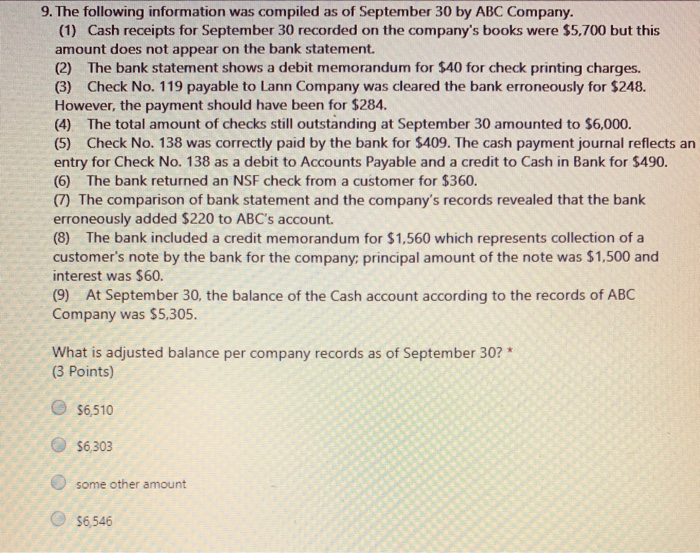

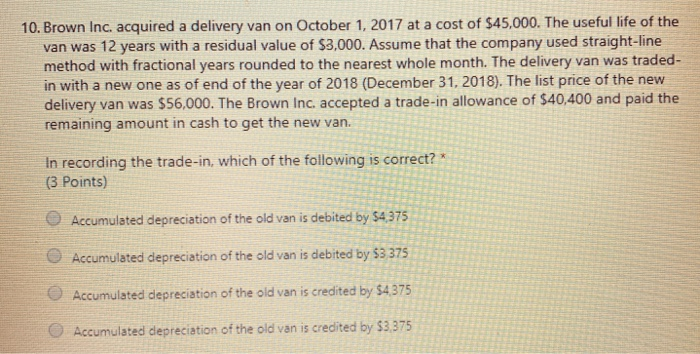

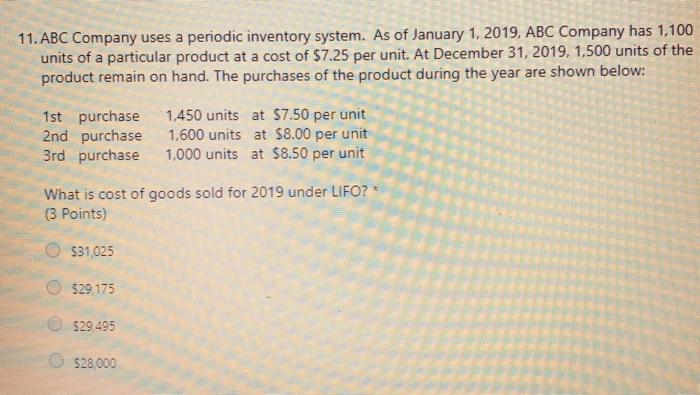

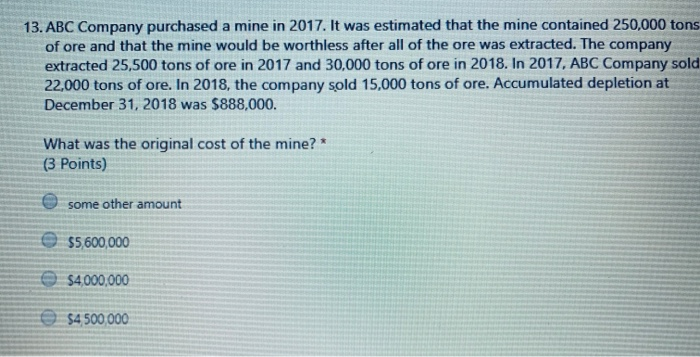

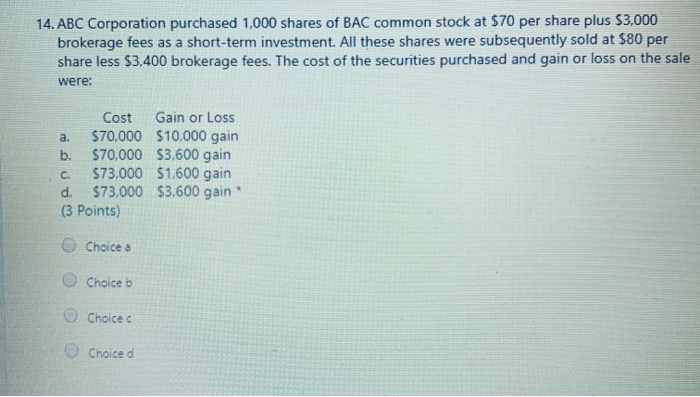

8. As of December 31, 2019, ABC Company owned the tangible fixed assets. These assets were equipment furniture, and a lorry. To depreciate the equipment and furniture, ABC Company used straight-line method. On the other hand, to depreciate lorry, ABC Company used double- declining balance method. To depreciate these assets, ABC Company used depreciation for fractional years rounded to the nearest whole month. The details of these assets were as follows: Purchase Date Original Cost Residual value Useful life Lorry February 28, 2014 $120,000 $5,000 10 years Equipment March 1, 2017 $42,500 $500 8 years Furniture August 1, 2017 $38,000 $2,000 6 years What was the accumulated depreciation of the lorry on December 31, 2016?* 05 (3 Points) $64,000 some other amount $68,800 $56,000 9. The following information was compiled as of September 30 by ABC Company. (1) Cash receipts for September 30 recorded on the company's books were $5,700 but this amount does not appear on the bank statement. (2) The bank statement shows a debit memorandum for $40 for check printing charges. (3) Check No. 119 payable to Lann Company was cleared the bank erroneously for $248. However, the payment should have been for $284. (4) The total amount of checks still outstanding at September 30 amounted to $6,000. (5) Check No. 138 was correctly paid by the bank for $409. The cash payment journal reflects an entry for Check No. 138 as a debit to Accounts Payable and a credit to Cash in Bank for $490. (6) The bank returned an NSF check from a customer for $360. (7) The comparison of bank statement and the company's records revealed that the bank erroneously added $220 to ABC's account. (8) The bank included a credit memorandum for $1,560 which represents collection of a customer's note by the bank for the company, principal amount of the note was $1,500 and interest was $60. (9) At September 30, the balance of the Cash account according to the records of ABC Company was $5,305. What is adjusted balance per company records as of September 30? * (3 Points) 56,510 $6,303 some other amount $6,546 10. Brown Inc. acquired a delivery van on October 1, 2017 at a cost of $45,000. The useful life of the van was 12 years with a residual value of $3,000. Assume that the company used straight-line method with fractional years rounded to the nearest whole month. The delivery van was traded- in with a new one as of end of the year of 2018 (December 31, 2018). The list price of the new delivery van was $56,000. The Brown Inc. accepted a trade-in allowance of $40,400 and paid the remaining amount in cash to get the new van. In recording the trade-in, which of the following is correct? * (3 Points) Accumulated depreciation of the old van is debited by $4,375 Accumulated depreciation of the old van is debited by $3 375 Accumulated depreciation of the old van is credited by $4 375 Accumulated depreciation of the old van is credited by $3,375 11. ABC Company uses a periodic inventory system. As of January 1, 2019, ABC Company has 1,100 units of a particular product at a cost of $7.25 per unit. At December 31, 2019, 1,500 units of the product remain on hand. The purchases of the product during the year are shown below: 1st purchase 1,450 units at $7.50 per unit 2nd purchase 1,600 units at $8.00 per unit 3rd purchase 1,000 units at $8.50 per unit What is cost of goods sold for 2019 under LIFO? (3 Points) $31,025 $29.175 529495 $28.000 13.ABC Company purchased a mine in 2017. It was estimated that the mine contained 250,000 tons of ore and that the mine would be worthless after all of the ore was extracted. The company extracted 25,500 tons of ore in 2017 and 30,000 tons of ore in 2018. In 2017, ABC Company sold 22,000 tons of ore. In 2018, the company sold 15,000 tons of ore. Accumulated depletion at December 31, 2018 was $888,000. What was the original cost of the mine?* (3 Points) some other amount $5,600,000 $4,000,000 $4,500,000 14. ABC Corporation purchased 1,000 shares of BAC common stock at $70 per share plus $3,000 brokerage fees as a short-term investment. All these shares were subsequently sold at $80 per share less $3,400 brokerage fees. The cost of the securities purchased and gain or loss on the sale were: a. Cost Gain or Loss $70,000 $10,000 gain b. $70,000 $3,600 gain $73,000 $1,600 gain d. $73,000 $3,600 gain (3 Points) C. Choice a Choice b Choice Choiced