Question

8.) Assume General Motors has a weighted average cost of capital of 9%. GM is considering investing in a new plant that will save

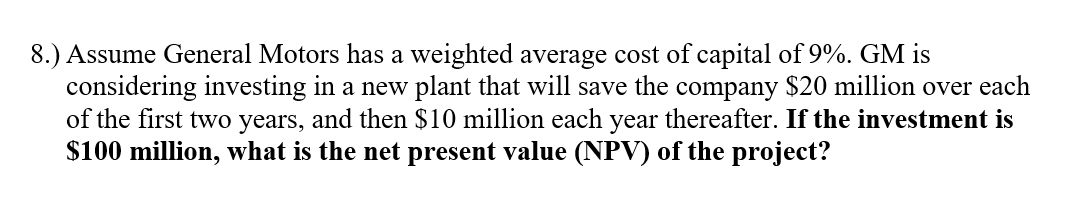

8.) Assume General Motors has a weighted average cost of capital of 9%. GM is considering investing in a new plant that will save the company $20 million over each of the first two years, and then $10 million each year thereafter. If the investment is $100 million, what is the net present value (NPV) of the project?

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Heres how to calculate the Net Present Value NPV of the project for General Motors 1 Identify the variables Initial investment Outlay 100 million nega...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Operations Management Processes And Supply Chains

Authors: Lee Krajewski, Naresh Malhotra, Larry Ritzman

13th Global Edition

129240986X, 978-1292409863

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App