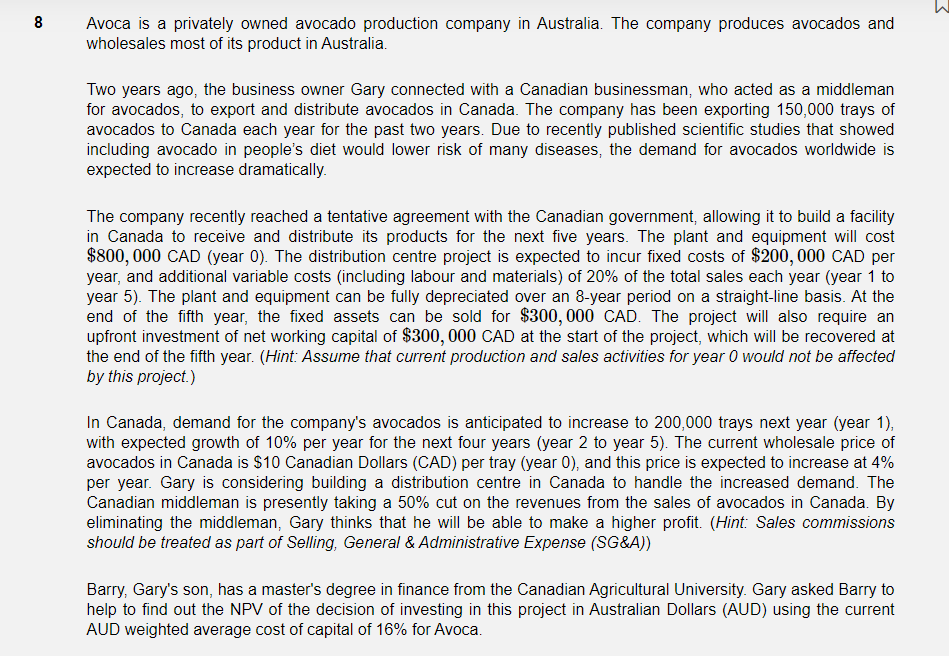

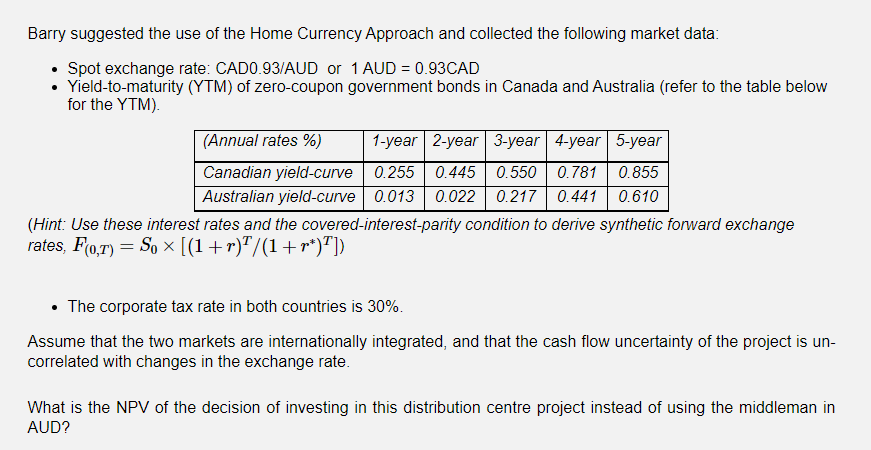

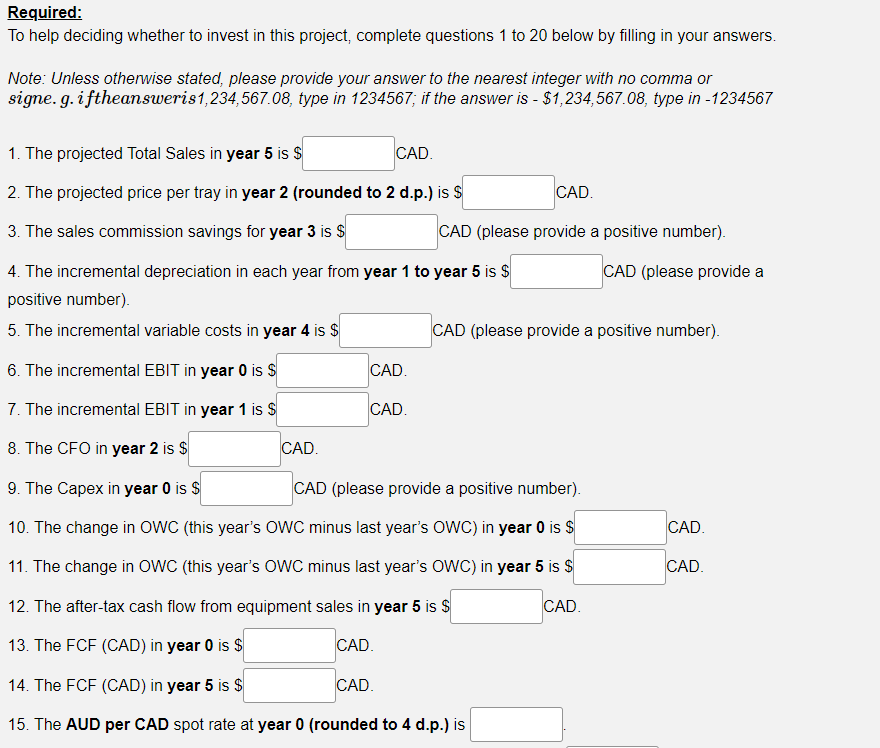

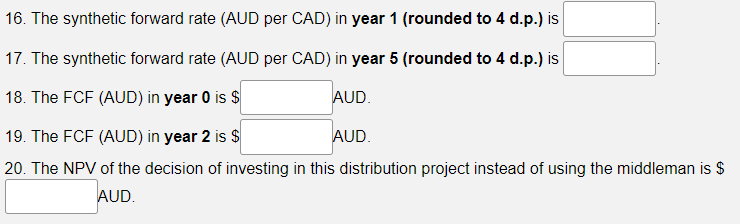

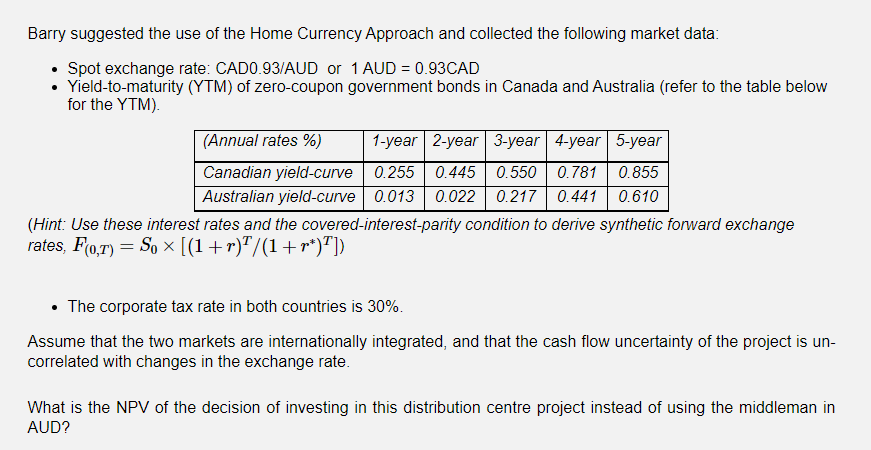

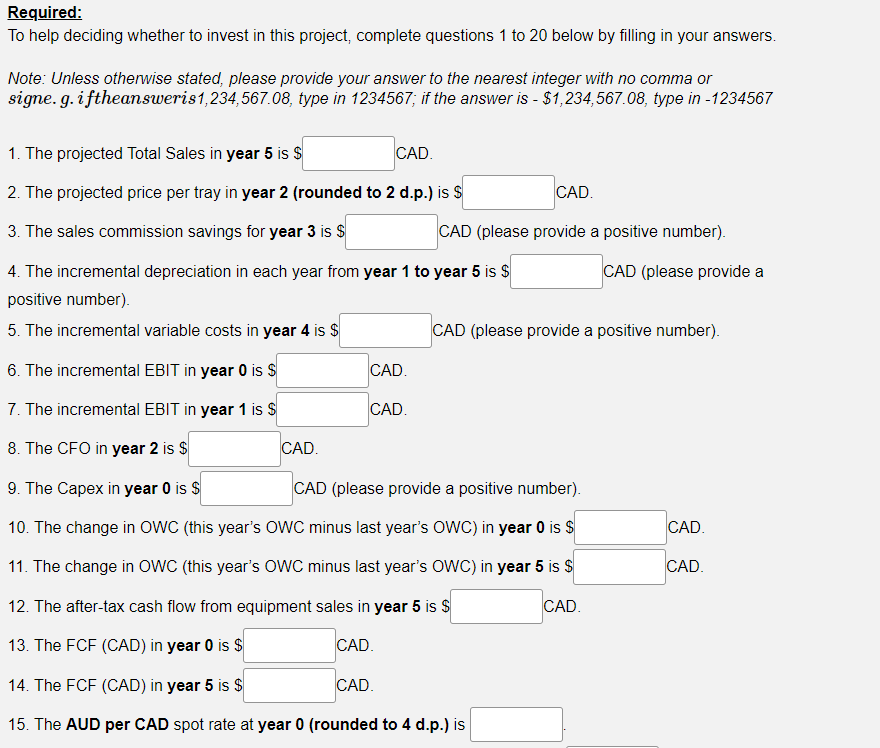

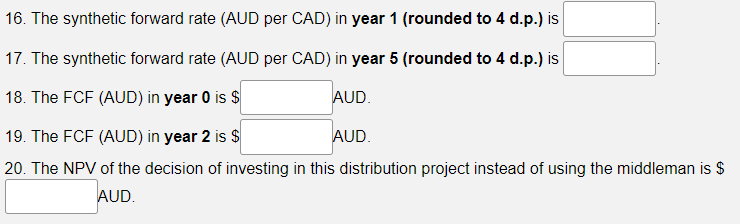

8 Avoca is a privately owned avocado production company in Australia. The company produces avocados and wholesales most of its product in Australia. Two years ago, the business owner Gary connected with a Canadian businessman, who acted as a middleman for avocados, to export and distribute avocados in Canada. The company has been exporting 150,000 trays of avocados to Canada each year for the past two years. Due to recently published scientific studies that showed including avocado in people's diet would lower risk of many diseases, the demand for avocados worldwide is expected to increase dramatically. The company recently reached a tentative agreement with the Canadian government, allowing it to build a facility in Canada to receive and distribute its products for the next five years. The plant and equipment will cost $800,000 CAD (year 0). The distribution centre project is expected to incur fixed costs of $200,000 CAD per year, and additional variable costs (including labour and materials) of 20% of the total sales each year (year 1 to year 5). The plant and equipment can be fully depreciated over an 8-year period on a straight-line basis. At the end of the fifth year, the fixed assets can be sold for $300,000 CAD. The project will also require an upfront investment of net working capital of $300,000 CAD at the start of the project, which will be recovered at the end of the fifth year. (Hint: Assume that current production and sales activities for year 0 would not be affected by this project.) In Canada, demand for the company's avocados is anticipated to increase to 200,000 trays next year (year 1), with expected growth of 10% per year for the next four years (year 2 to year 5). The current wholesale price of avocados in Canada is $10 Canadian Dollars (CAD) per tray (year 0), and this price is expected to increase at 4% per year. Gary is considering building a distribution centre in Canada to handle the increased demand. The Canadian middleman is presently taking a 50% cut on the revenues from the sales of avocados in Canada. By eliminating the middleman, Gary thinks that he will be able to make a higher profit. (Hint: Sales commissions should be treated as part of Selling, General & Administrative Expense (SG&A)) Barry, Gary's son, has a master's degree in finance from the Canadian Agricultural University. Gary asked Barry to help to find out the NPV of the decision of investing in this project in Australian Dollars (AUD) using the current AUD weighted average cost of capital of 16% for Avoca. Barry suggested the use of the Home Currency Approach and collected the following market data: Spot exchange rate: CADO.93/AUD or 1 AUD = 0.93CAD Yield-to-maturity (YTM) of zero-coupon government bonds in Canada and Australia (refer to the table below for the YTM). (Annual rates %) 1-year 2-year 3-year 4-year 5-year Canadian yield-curve 0.255 0.445 0.550 0.781 0.855 Australian yield-curve 0.013 0.022 0.2170.441 0.610 (Hint: Use these interest rates and the covered-interest-parity condition to derive synthetic forward exchange rates, F0T) = So ((1+r)/(1+r*)?]) The corporate tax rate in both countries is 30%. Assume that the two markets are internationally integrated, and that the cash flow uncertainty of the project is un- correlated with changes in the exchange rate. What is the NPV of the decision of investing in this distribution centre project instead of using the middleman in AUD? Required: To help deciding whether to invest in this project, complete questions 1 to 20 below by filling in your answers. Note: Unless otherwise stated, please provide your answer to the nearest integer with no comma or signe.g. iftheansweris1,234,567.08, type in 1234567; if the answer is - $1,234,567.08, type in -1234567 1. The projected Total Sales in year 5 is $ CAD 2. The projected price per tray in year 2 (rounded to 2 d.p.) is $ CAD. 3. The sales commission savings for year 3 is $ CAD (please provide a positive number). 4. The incremental depreciation in each year from year 1 to year 5 is $ CAD (please provide a positive number). 5. The incremental variable costs in year 4 is $ CAD (please provide a positive number). 6. The incremental EBIT in year 0 is $ CAD. 7. The incremental EBIT in year 1 is $ CAD. 8. The CFO in year 2 is $ CAD 9. The Capex in year 0 is $ CAD (please provide a positive number). 10. The change in OWC (this year's OWC minus last year's OWC) in year 0 is $ CAD 11. The change in OWC (this year's OWC minus last year's OWC) in year 5 is $ CAD. 12. The after-tax cash flow from equipment sales in year 5 is $ CAD 13. The FCF (CAD) in year 0 is $ CAD 14. The FCF (CAD) in year 5 is $ CAD. 15. The AUD per CAD spot rate at year 0 (rounded to 4 d.p.) is 16. The synthetic forward rate (AUD per CAD) in year 1 (rounded to 4 d.p.) is 17. The synthetic forward rate (AUD per CAD) in year 5 (rounded to 4 d.p.) is 18. The FCF (AUD) in year 0 is $ AUD 19. The FCF (AUD) in year 2 is $ AUD 20. The NPV of the decision of investing in this distribution project instead of using the middleman is $ AUD 8 Avoca is a privately owned avocado production company in Australia. The company produces avocados and wholesales most of its product in Australia. Two years ago, the business owner Gary connected with a Canadian businessman, who acted as a middleman for avocados, to export and distribute avocados in Canada. The company has been exporting 150,000 trays of avocados to Canada each year for the past two years. Due to recently published scientific studies that showed including avocado in people's diet would lower risk of many diseases, the demand for avocados worldwide is expected to increase dramatically. The company recently reached a tentative agreement with the Canadian government, allowing it to build a facility in Canada to receive and distribute its products for the next five years. The plant and equipment will cost $800,000 CAD (year 0). The distribution centre project is expected to incur fixed costs of $200,000 CAD per year, and additional variable costs (including labour and materials) of 20% of the total sales each year (year 1 to year 5). The plant and equipment can be fully depreciated over an 8-year period on a straight-line basis. At the end of the fifth year, the fixed assets can be sold for $300,000 CAD. The project will also require an upfront investment of net working capital of $300,000 CAD at the start of the project, which will be recovered at the end of the fifth year. (Hint: Assume that current production and sales activities for year 0 would not be affected by this project.) In Canada, demand for the company's avocados is anticipated to increase to 200,000 trays next year (year 1), with expected growth of 10% per year for the next four years (year 2 to year 5). The current wholesale price of avocados in Canada is $10 Canadian Dollars (CAD) per tray (year 0), and this price is expected to increase at 4% per year. Gary is considering building a distribution centre in Canada to handle the increased demand. The Canadian middleman is presently taking a 50% cut on the revenues from the sales of avocados in Canada. By eliminating the middleman, Gary thinks that he will be able to make a higher profit. (Hint: Sales commissions should be treated as part of Selling, General & Administrative Expense (SG&A)) Barry, Gary's son, has a master's degree in finance from the Canadian Agricultural University. Gary asked Barry to help to find out the NPV of the decision of investing in this project in Australian Dollars (AUD) using the current AUD weighted average cost of capital of 16% for Avoca. Barry suggested the use of the Home Currency Approach and collected the following market data: Spot exchange rate: CADO.93/AUD or 1 AUD = 0.93CAD Yield-to-maturity (YTM) of zero-coupon government bonds in Canada and Australia (refer to the table below for the YTM). (Annual rates %) 1-year 2-year 3-year 4-year 5-year Canadian yield-curve 0.255 0.445 0.550 0.781 0.855 Australian yield-curve 0.013 0.022 0.2170.441 0.610 (Hint: Use these interest rates and the covered-interest-parity condition to derive synthetic forward exchange rates, F0T) = So ((1+r)/(1+r*)?]) The corporate tax rate in both countries is 30%. Assume that the two markets are internationally integrated, and that the cash flow uncertainty of the project is un- correlated with changes in the exchange rate. What is the NPV of the decision of investing in this distribution centre project instead of using the middleman in AUD? Required: To help deciding whether to invest in this project, complete questions 1 to 20 below by filling in your answers. Note: Unless otherwise stated, please provide your answer to the nearest integer with no comma or signe.g. iftheansweris1,234,567.08, type in 1234567; if the answer is - $1,234,567.08, type in -1234567 1. The projected Total Sales in year 5 is $ CAD 2. The projected price per tray in year 2 (rounded to 2 d.p.) is $ CAD. 3. The sales commission savings for year 3 is $ CAD (please provide a positive number). 4. The incremental depreciation in each year from year 1 to year 5 is $ CAD (please provide a positive number). 5. The incremental variable costs in year 4 is $ CAD (please provide a positive number). 6. The incremental EBIT in year 0 is $ CAD. 7. The incremental EBIT in year 1 is $ CAD. 8. The CFO in year 2 is $ CAD 9. The Capex in year 0 is $ CAD (please provide a positive number). 10. The change in OWC (this year's OWC minus last year's OWC) in year 0 is $ CAD 11. The change in OWC (this year's OWC minus last year's OWC) in year 5 is $ CAD. 12. The after-tax cash flow from equipment sales in year 5 is $ CAD 13. The FCF (CAD) in year 0 is $ CAD 14. The FCF (CAD) in year 5 is $ CAD. 15. The AUD per CAD spot rate at year 0 (rounded to 4 d.p.) is 16. The synthetic forward rate (AUD per CAD) in year 1 (rounded to 4 d.p.) is 17. The synthetic forward rate (AUD per CAD) in year 5 (rounded to 4 d.p.) is 18. The FCF (AUD) in year 0 is $ AUD 19. The FCF (AUD) in year 2 is $ AUD 20. The NPV of the decision of investing in this distribution project instead of using the middleman is $ AUD