Question

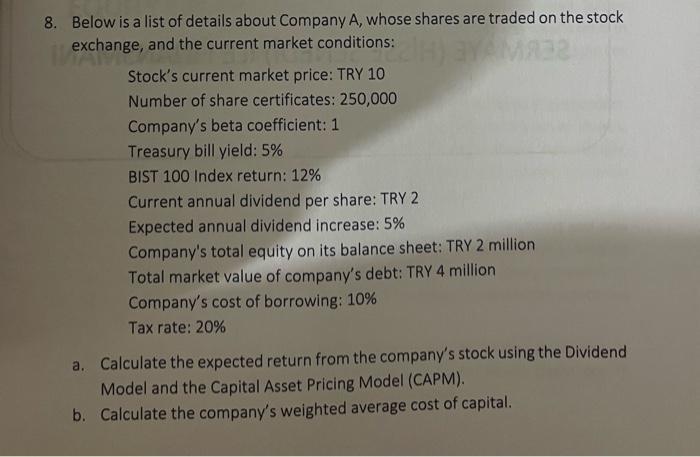

8. Below is a list of details about Company A, whose shares are traded on the stock exchange, and the current market conditions: SH)

8. Below is a list of details about Company A, whose shares are traded on the stock exchange, and the current market conditions: SH) BY MA32 Stock's current market price: TRY 10 Number of share certificates: 250,000 Company's beta coefficient: 1 Treasury bill yield: 5% BIST 100 Index return: 12% Current annual dividend per share: TRY 2 Expected annual dividend increase: 5% Company's total equity on its balance sheet: TRY 2 million Total market value of company's debt: TRY 4 million Company's cost of borrowing: 10% Tax rate: 20% a. Calculate the expected return from the company's stock using the Dividend Model and the Capital Asset Pricing Model (CAPM). b. Calculate the company's weighted average cost of capital.

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Canadian Income Taxation 2018-2019

Authors: William Buckwold, Joan Kitunen

21st Edition

1259464296, 978-1259464294

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App