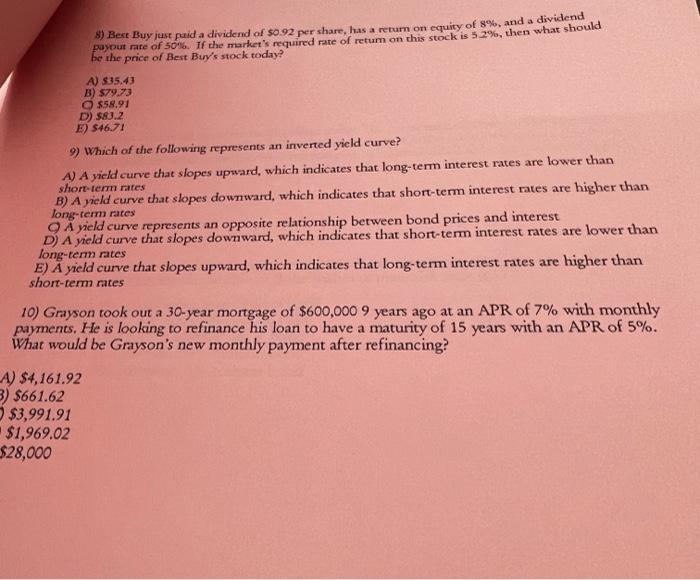

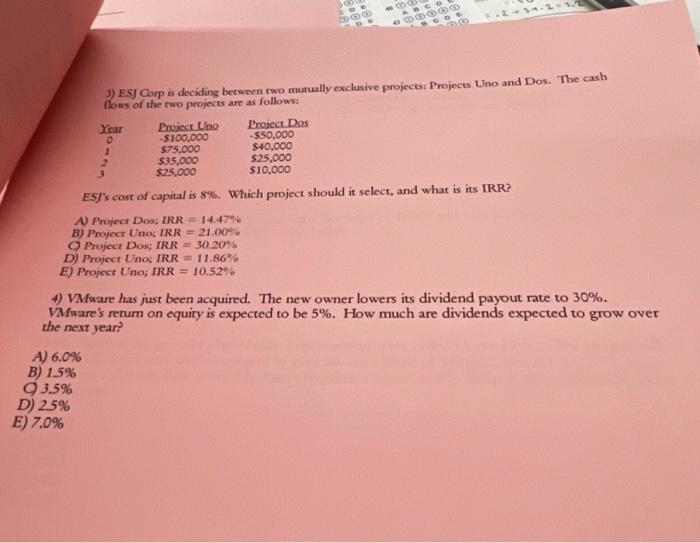

8) Best Buy just paid a dividend of 50.92 per share, has a return on equity of 8%, and a dividend poyout rare of 50Ba. If the market's required rate of retum on this stock is 52%, then what should be the price of Best Buy's stock today? A) $35.43 B) $79.73 Q $58.91 D) 583.2 E) 546.71 9) Which of the following represents an inverted yield curve? A) A yield curve that slopes upward, which indicates that long-term interest rates are lower than B) A yicld curve that slopes downward, which indicates that short-term interest rates are higher than short-term rates Q. A yield curve represents an opposite relationship between bond prices and interest lomg-term rates D) A yield curve that slopes downward, which indicates that short-tem interest rates are lower than long-term rates E) A yield curve that slopes upward, which indicates that long-term interest rates are higher than short-term rates 10) Grayson took out a 30-year mortgage of $600,0009 years ago at an APR of 7% with monthly payments, He is looking to refinance his loan to have a maturity of 15 years with an APR of 5%. What would be Grayson's new monthly payment after refinancing? 1) $4,161.92 $661.62 $3,991.91 $1,969.02 28,000 3) ESJ Corp is deciding berween two mutually exelusive projects: Projects Uno and Dos. The cash fows of the two projects are as follows: ESf's cost of capital is 8%. Which project should it select, and what is its IRR? A) Project Dos; LRR =14.47% B) Project Uno: IRR =21.00% C Project Dos; IR.R =30.208% D) Project Uno, IRR =11.86% E) Project Uno; IRR=10.52% 4) VMware has just been acquired. The new owner lowers its dividend payout rate to 30%. VMare's retum on equity is expected to be 5%. How much are dividends expected to grow over the next year? A) 6.0% B) 1.59 3.5%2.5%7.0% 5) Bert Buy just paid a dividend of 50.92 per share, has a return on equity of 8%, and a dividend poyput nate of 50%. If the market's required rate of retum on this stock is 5.2%, then what should be the price of Best Buy/s stock today? A) 535.43 B) 579.73 (.) 558.91 D) 583.2 E) 546.71 9) Which of the following represents an inverted yield curve? A) A yield curve that slopes upward, which indicates that long-term interest rates are lower than B) A yield curve that slopes downward, which indicates that short-term interest rates are higher than short-tern rates Q) A yield curve represents an opposite relationship between bond prices and interest long-term rates D) A yield curve that slopes downward, which indicates that short-term interest rates are lower than long-term rates E) A yield curve that slopes upward, which indicates that long-term interest rates are higher than short-term rates 10) Grayson took out a 30-year mortgage of $600,0009 years ago at an APR of 7% with monthly payments. He is looking to refinance his loan to have a maturity of 15 years with an APR of 5%. What would be Grayson's new monthly payment after refinancing? 1) $4,161.92 $661.62$3,991.91$1,969.0228,000