Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. Black Corporation began business operations on December 1, 2008. The year end for their tax reporting purposes is December 31. Relevant information for completion

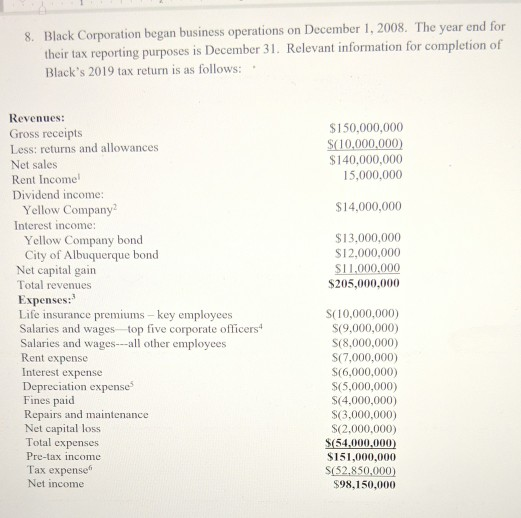

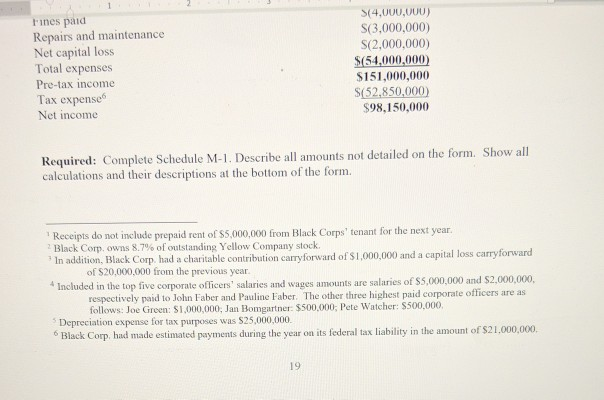

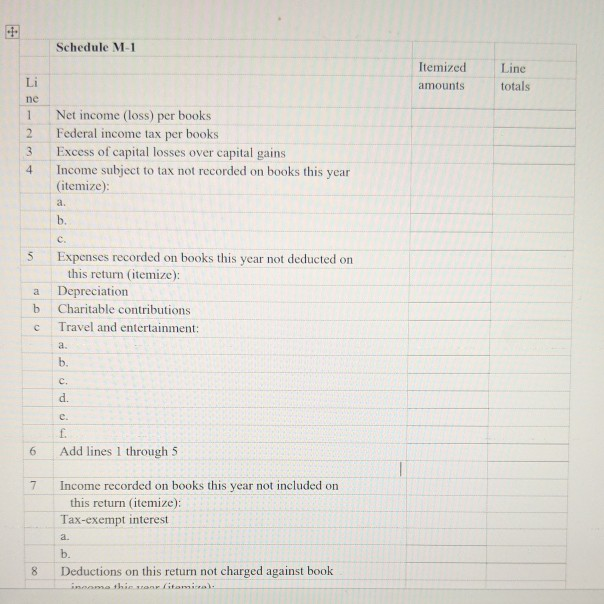

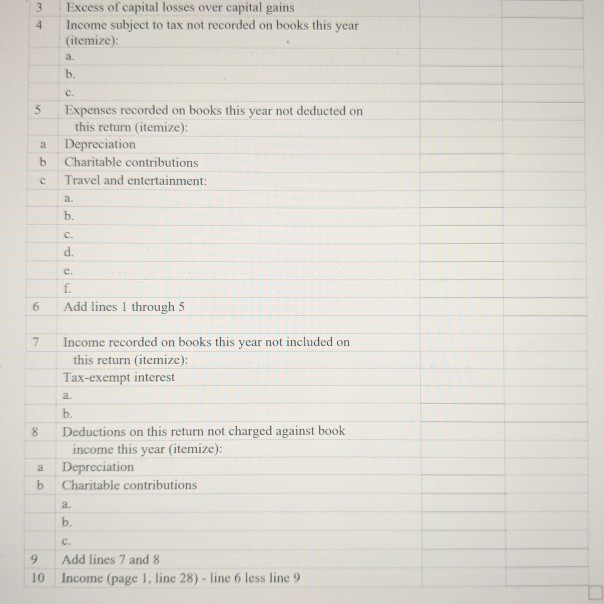

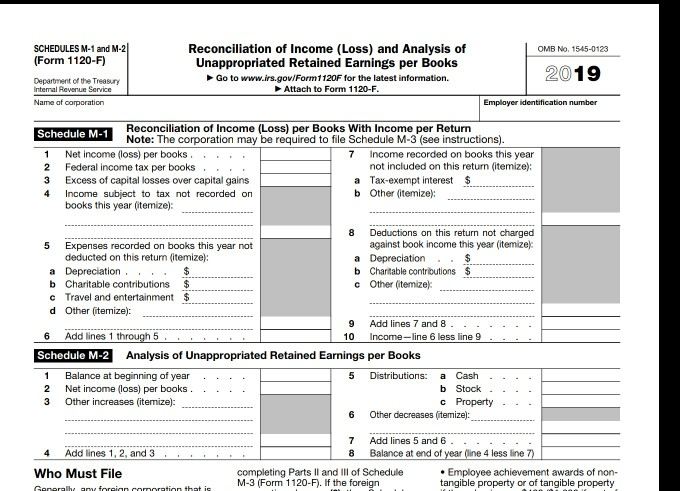

8. Black Corporation began business operations on December 1, 2008. The year end for their tax reporting purposes is December 31. Relevant information for completion of Black's 2019 tax return is as follows: $150,000,000 $(10,000,000) $140,000,000 15,000,000 $14,000,000 $13,000,000 $12,000,000 $11,000,000 $205,000,000 Revenues: Gross receipts Less: returns and allowances Net sales Rent Incomel Dividend income: Yellow Company Interest income: Yellow Company bond City of Albuquerque bond Net capital gain Total revenues Expenses.' Life insurance premiums - key employees Salaries and wages top five corporate officers Salaries and wages---all other employees Rent expense Interest expense Depreciation expense Fines paid Repairs and maintenance Net capital loss Total expenses Pre-tax income Tax expenses Net income S(10,000,000) $(9,000,000) S(8,000,000) S(7,000,000) $6,000,000) S(5,000,000) S(4,000,000) S(3,000,000) S(2,000,000) $(54,000,000) $151,000,000 $(52.850,000) $98,150,000 Fines paid Repairs and maintenance Net capital loss Total expenses Pre-tax income Tax expense Net income (4,000,000) S(3,000,000) S(2,000,000) $(54,000,000) $151,000,000 S(52,850,000) $98,150,000 Required: Complete Schedule M-1. Describe all amounts not detailed on the form. Show all calculations and their descriptions at the bottom of the form Receipts do not include prepaid rent of $5,000,000 from Black Corps' tenant for the next year. 2 Black Corp. owns 8.7% of outstanding Yellow Company stock In addition, Black Corp. had a charitable contribution carryforward of S1,000,000 and a capital loss carryforward of S20.000.000 from the previous year. Included in the top five corporate officers' salaries and wages amounts are salaries of $5,000,000 and $2,000,000 respectively paid to John Faber and Pauline Faber. The other three highest paid corporate officers are as follows: Joe Green: $1,000,000: Jan Bomgartner: $500,000; Pete Watcher: S500.000, Depreciation expense for tax purposes was $25,000,000 Black Corp had made estimated payments during the year on its federal tax liability in the amount of $21,000,000 19 Schedu Itemized amounts Line totals ne 1 2 3 4 Net income (loss) per books Federal income tax per books Excess of capital losses over capital gains Income subject to tax not recorded on books this year (itemize): a. b. 5 a b C Expenses recorded on books this year not deducted on this return (itemize): Depreciation Charitable contributions Travel and entertainment: b. 6 Add lines 1 through 5 Income recorded on books this year not included on this return (itemize): Tax-exempt interest Deductions on this return not charged against book this mani 3 4 Excess of capital losses over capital gains Income subject to tax not recorded on books this year (itemize): b. a b C Expenses recorded on books this year not deducted on this return (itemize): Depreciation Charitable contributions Travel and entertainment: 6 Add lines 1 through 5 7 Income recorded on books this year not included on this return (itemize): Tax-exempt interest Deductions on this return not charged against book income this year (itemize): Depreciation Charitable contributions a b Add lines 7 and 8 Income (page 1, line 28) - line 6 less line 9 10 OMB No. 1545-0123 SCHEDULES M-1 and M-2 (Form 1120-F) Reconciliation of Income (Loss) and Analysis of Unappropriated Retained Earnings per Books Go to www.irs.gov/Form1120F for the latest information. Attach to Form 1120-F. 2019 Department of the Treasury Internal Revenue Service Name of corporation Employer identification number Reconciliation of Income (Loss) per Books With Income per Return Schedule M-1 Note: The corporation may be required to file Schedule M-3 (see instructions). 1 Net Income (loss) per books... 7 Income recorded on books this year 2 Federal income tax per books... not included on this return (itemize): 3 Excess of capital losses over capital gains a Tax-exempt interest $ Income subject to tax not recorded on b Other (itemize): books this year (itemize): 8 Deductions on this return not charged 5 Expenses recorded on books this year not against book income this year (itemize deducted on this return itemize): a Depreciation . $ a Depreciation .... b Charitable contributions $ b Charitable contributions c Other (itemize) c Travel and entertainment d Other (itemize): 9 Add lines 7 and 8. ...... 6 Add lines 1 through 5 ... . . 10 Income-line 6 less line 9 . . . Schedule M-2 Analysis of Unappropriated Retained Earnings per Books 1 Balance at beginning of year .. . 5 Distributions: a Cash .. . . 2 Net income (loss) per books..... b Stock .... 3 Other increases (itemize): C Property . . . 6 Other decreases (itemize): 4 Add lines 1, 2, and 3 7 Add lines 5 and 6 . . . . . . 8 Balance at end of year (line 4 less line 7) completing Parts II and III of Schedule Employee achievement awards of non- M-3 (Form 1120-F). If the foreign tangible property or of tangible property Who Must File Generalhe a foreign comoration that is 8. Black Corporation began business operations on December 1, 2008. The year end for their tax reporting purposes is December 31. Relevant information for completion of Black's 2019 tax return is as follows: $150,000,000 $(10,000,000) $140,000,000 15,000,000 $14,000,000 $13,000,000 $12,000,000 $11,000,000 $205,000,000 Revenues: Gross receipts Less: returns and allowances Net sales Rent Incomel Dividend income: Yellow Company Interest income: Yellow Company bond City of Albuquerque bond Net capital gain Total revenues Expenses.' Life insurance premiums - key employees Salaries and wages top five corporate officers Salaries and wages---all other employees Rent expense Interest expense Depreciation expense Fines paid Repairs and maintenance Net capital loss Total expenses Pre-tax income Tax expenses Net income S(10,000,000) $(9,000,000) S(8,000,000) S(7,000,000) $6,000,000) S(5,000,000) S(4,000,000) S(3,000,000) S(2,000,000) $(54,000,000) $151,000,000 $(52.850,000) $98,150,000 Fines paid Repairs and maintenance Net capital loss Total expenses Pre-tax income Tax expense Net income (4,000,000) S(3,000,000) S(2,000,000) $(54,000,000) $151,000,000 S(52,850,000) $98,150,000 Required: Complete Schedule M-1. Describe all amounts not detailed on the form. Show all calculations and their descriptions at the bottom of the form Receipts do not include prepaid rent of $5,000,000 from Black Corps' tenant for the next year. 2 Black Corp. owns 8.7% of outstanding Yellow Company stock In addition, Black Corp. had a charitable contribution carryforward of S1,000,000 and a capital loss carryforward of S20.000.000 from the previous year. Included in the top five corporate officers' salaries and wages amounts are salaries of $5,000,000 and $2,000,000 respectively paid to John Faber and Pauline Faber. The other three highest paid corporate officers are as follows: Joe Green: $1,000,000: Jan Bomgartner: $500,000; Pete Watcher: S500.000, Depreciation expense for tax purposes was $25,000,000 Black Corp had made estimated payments during the year on its federal tax liability in the amount of $21,000,000 19 Schedu Itemized amounts Line totals ne 1 2 3 4 Net income (loss) per books Federal income tax per books Excess of capital losses over capital gains Income subject to tax not recorded on books this year (itemize): a. b. 5 a b C Expenses recorded on books this year not deducted on this return (itemize): Depreciation Charitable contributions Travel and entertainment: b. 6 Add lines 1 through 5 Income recorded on books this year not included on this return (itemize): Tax-exempt interest Deductions on this return not charged against book this mani 3 4 Excess of capital losses over capital gains Income subject to tax not recorded on books this year (itemize): b. a b C Expenses recorded on books this year not deducted on this return (itemize): Depreciation Charitable contributions Travel and entertainment: 6 Add lines 1 through 5 7 Income recorded on books this year not included on this return (itemize): Tax-exempt interest Deductions on this return not charged against book income this year (itemize): Depreciation Charitable contributions a b Add lines 7 and 8 Income (page 1, line 28) - line 6 less line 9 10 OMB No. 1545-0123 SCHEDULES M-1 and M-2 (Form 1120-F) Reconciliation of Income (Loss) and Analysis of Unappropriated Retained Earnings per Books Go to www.irs.gov/Form1120F for the latest information. Attach to Form 1120-F. 2019 Department of the Treasury Internal Revenue Service Name of corporation Employer identification number Reconciliation of Income (Loss) per Books With Income per Return Schedule M-1 Note: The corporation may be required to file Schedule M-3 (see instructions). 1 Net Income (loss) per books... 7 Income recorded on books this year 2 Federal income tax per books... not included on this return (itemize): 3 Excess of capital losses over capital gains a Tax-exempt interest $ Income subject to tax not recorded on b Other (itemize): books this year (itemize): 8 Deductions on this return not charged 5 Expenses recorded on books this year not against book income this year (itemize deducted on this return itemize): a Depreciation . $ a Depreciation .... b Charitable contributions $ b Charitable contributions c Other (itemize) c Travel and entertainment d Other (itemize): 9 Add lines 7 and 8. ...... 6 Add lines 1 through 5 ... . . 10 Income-line 6 less line 9 . . . Schedule M-2 Analysis of Unappropriated Retained Earnings per Books 1 Balance at beginning of year .. . 5 Distributions: a Cash .. . . 2 Net income (loss) per books..... b Stock .... 3 Other increases (itemize): C Property . . . 6 Other decreases (itemize): 4 Add lines 1, 2, and 3 7 Add lines 5 and 6 . . . . . . 8 Balance at end of year (line 4 less line 7) completing Parts II and III of Schedule Employee achievement awards of non- M-3 (Form 1120-F). If the foreign tangible property or of tangible property Who Must File Generalhe a foreign comoration that is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started