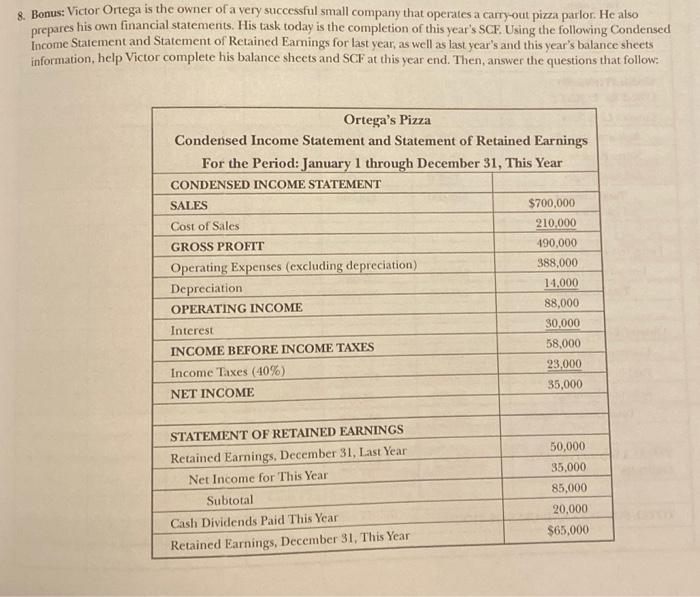

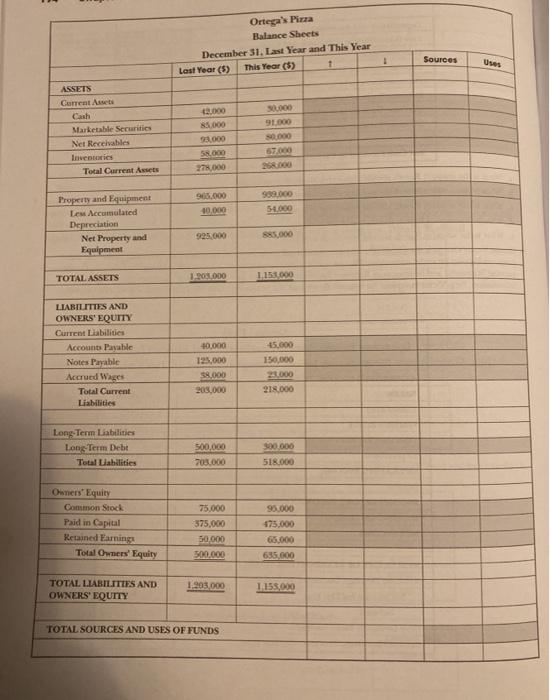

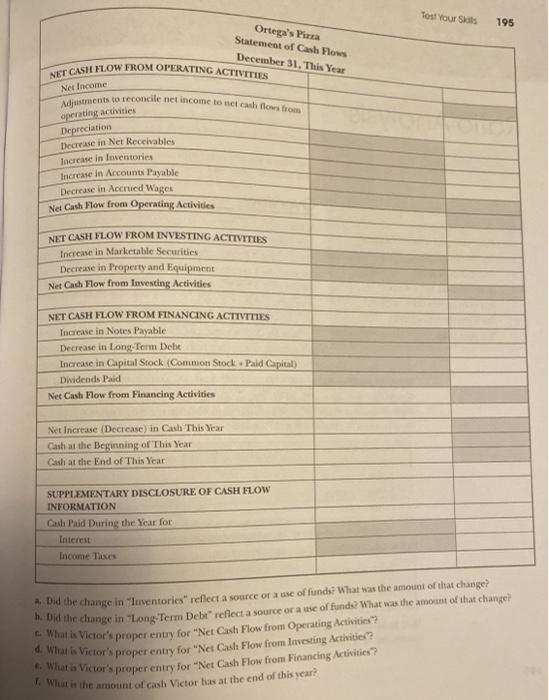

8. Bonus: Victor Ortega is the owner of a very successful small company that operates a carry out pizza parlor. He also prepares his own financial statements. His task today is the completion of this year's SCF. Using the following Condensed Income Statement and Statement of Retained Earnings for last year, as well as last year's and this year's balance sheets information, help Victor complete his balance sheets and SCE at this year end. Then, answer the questions that follow: Ortega's Pizza Condensed Income Statement and Statement of Retained Earnings For the Period: January 1 through December 31, This Year CONDENSED INCOME STATEMENT SALES $700,000 Cost of Sales 210.000 GROSS PROFIT 490,000 Operating Expenses (excluding depreciation) 388,000 Depreciation 14.000 OPERATING INCOME 88,000 Interest 30,000 INCOME BEFORE INCOME TAXES 58,000 Income Taxes (40%) 23,000 NET INCOME 35,000 STATEMENT OF RETAINED EARNINGS Retained Earnings, December 31, Last Year Net Income for This Year Subtotal Cash Dividends Paid This Year Retained Earnings, December 31, This Year 50,000 35,000 85,000 20,000 $65.000 Ortega's Pizza Balance Sheets December 31. Last year and This Year Last Year (5) This Year (5) 1 Sources 50.000 91.000 ASSETS Current Anti Cash Marketable Serurities Net Receivables Inventaries Total Current Assets 2.000 85.000 2.000 58.000 278.000 968.000 40.000 999.000 50.000 Property and Equipment Le Accumulated Depreciation Net Property and Equipment 85.000 TOTAL ASSETS 1903.000 1153000 LIABILITIES AND OWNERS' EQUITY Current Liabilities Accounts Payable Notes Payable Accrued Wages Total Current Liabilities 10,000 125,000 58.000 200,000 15.000 150,000 2.000 218.000 Long-Term Liabilities Long-Term Debt Total Liabilities 300.000 500,000 703.000 518.000 95.000 Owners' Equity Common Stock Paid in Capital Kebained Earnings Total Owners' Equity 75,000 375,000 50.000 300.000 175.000 635.600 TOTAL LIABILITIES AND OWNERS' EQUITY 1.903.000 1158.000 TOTAL SOURCES AND USES OF FUNDS Tost Your Skals 195 Ortega's Pirza Statement of Cash Flows December 31, This Year NET CASH FLOW FROM OPERATING ACTIVITIES Net Income Muistents to reconcile net income to net cash flow from operating activities Depreciation Decrease in Net Rechables Increase in Inventories Increase in Accounts Payable Decrease in Accrued Wages Net Cash Flow from Operating Activities NET CASH FLOW FROM INVESTING ACTIVITIES Increase in Marketable Securities Decrease in Property and Equipment Net Cash Flow from Investing Activities NET CASH FLOW FROM FINANCING ACTIVITIES Increase in Notes Payable Decrease in Long Term Dcht Increase in Capital Stock (Common Stock Paid Capital) Dividends Paid Net Cash Flow from Financing Activities Net Increase (Decrease) in Cash This Wear Cash at the Beginning of This Year Cash at the End of This Year SUPPLEMENTARY DISCLOSURE OF CASH FLOW INFORMATION Cash Paid During the Year for Interest Income Taxes Did the change in "Imentories" reflect a source or a use of funds? What was the amount of that change? . Died the change in "Long-Term Debe reflect a source or a use of funds? What was the amount of that changed What is Victor's proper entry for "Net Cash Flow from Operating Activities? What is Victor's proper entry for "Net Cash Flow from Investing Arthities? What is Victor's proper entry for "Net Cash Flow from Financing Activities? What is the amount of cash Victor has at the end of this year? 8. Bonus: Victor Ortega is the owner of a very successful small company that operates a carry out pizza parlor. He also prepares his own financial statements. His task today is the completion of this year's SCF. Using the following Condensed Income Statement and Statement of Retained Earnings for last year, as well as last year's and this year's balance sheets information, help Victor complete his balance sheets and SCE at this year end. Then, answer the questions that follow: Ortega's Pizza Condensed Income Statement and Statement of Retained Earnings For the Period: January 1 through December 31, This Year CONDENSED INCOME STATEMENT SALES $700,000 Cost of Sales 210.000 GROSS PROFIT 490,000 Operating Expenses (excluding depreciation) 388,000 Depreciation 14.000 OPERATING INCOME 88,000 Interest 30,000 INCOME BEFORE INCOME TAXES 58,000 Income Taxes (40%) 23,000 NET INCOME 35,000 STATEMENT OF RETAINED EARNINGS Retained Earnings, December 31, Last Year Net Income for This Year Subtotal Cash Dividends Paid This Year Retained Earnings, December 31, This Year 50,000 35,000 85,000 20,000 $65.000 Ortega's Pizza Balance Sheets December 31. Last year and This Year Last Year (5) This Year (5) 1 Sources 50.000 91.000 ASSETS Current Anti Cash Marketable Serurities Net Receivables Inventaries Total Current Assets 2.000 85.000 2.000 58.000 278.000 968.000 40.000 999.000 50.000 Property and Equipment Le Accumulated Depreciation Net Property and Equipment 85.000 TOTAL ASSETS 1903.000 1153000 LIABILITIES AND OWNERS' EQUITY Current Liabilities Accounts Payable Notes Payable Accrued Wages Total Current Liabilities 10,000 125,000 58.000 200,000 15.000 150,000 2.000 218.000 Long-Term Liabilities Long-Term Debt Total Liabilities 300.000 500,000 703.000 518.000 95.000 Owners' Equity Common Stock Paid in Capital Kebained Earnings Total Owners' Equity 75,000 375,000 50.000 300.000 175.000 635.600 TOTAL LIABILITIES AND OWNERS' EQUITY 1.903.000 1158.000 TOTAL SOURCES AND USES OF FUNDS Tost Your Skals 195 Ortega's Pirza Statement of Cash Flows December 31, This Year NET CASH FLOW FROM OPERATING ACTIVITIES Net Income Muistents to reconcile net income to net cash flow from operating activities Depreciation Decrease in Net Rechables Increase in Inventories Increase in Accounts Payable Decrease in Accrued Wages Net Cash Flow from Operating Activities NET CASH FLOW FROM INVESTING ACTIVITIES Increase in Marketable Securities Decrease in Property and Equipment Net Cash Flow from Investing Activities NET CASH FLOW FROM FINANCING ACTIVITIES Increase in Notes Payable Decrease in Long Term Dcht Increase in Capital Stock (Common Stock Paid Capital) Dividends Paid Net Cash Flow from Financing Activities Net Increase (Decrease) in Cash This Wear Cash at the Beginning of This Year Cash at the End of This Year SUPPLEMENTARY DISCLOSURE OF CASH FLOW INFORMATION Cash Paid During the Year for Interest Income Taxes Did the change in "Imentories" reflect a source or a use of funds? What was the amount of that change? . Died the change in "Long-Term Debe reflect a source or a use of funds? What was the amount of that changed What is Victor's proper entry for "Net Cash Flow from Operating Activities? What is Victor's proper entry for "Net Cash Flow from Investing Arthities? What is Victor's proper entry for "Net Cash Flow from Financing Activities? What is the amount of cash Victor has at the end of this year