8

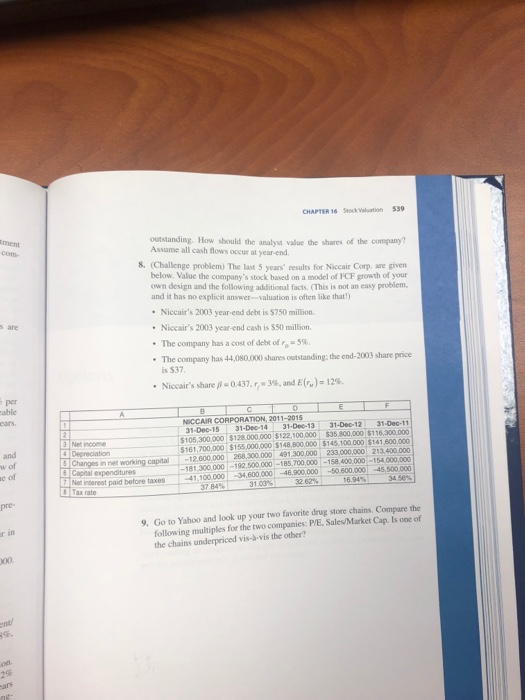

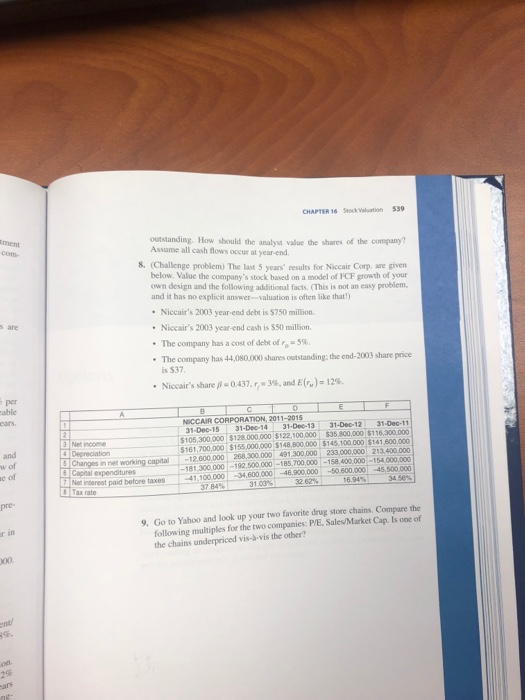

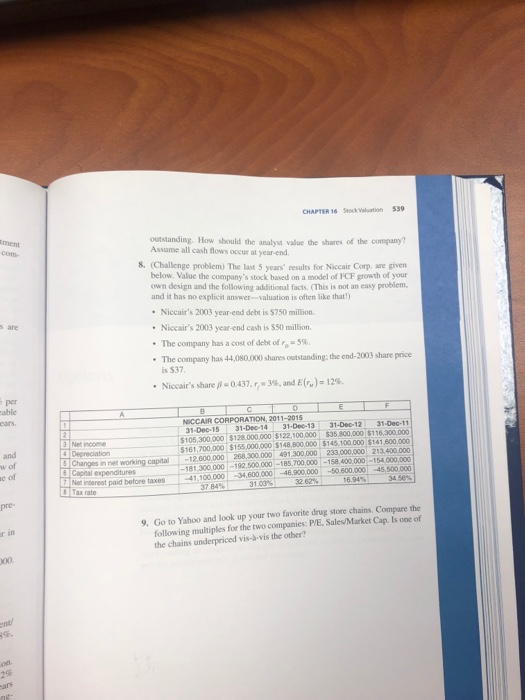

CHAPTER 16 Stock Valuation 539 outstanding. How should the analyst value the shares of the company? Assume all cash flows occur at year-end com- 8 (Challenge problem) The last 5 years' results for Niccair Corp, are given below. Value the company's stock hased on a model of FCF growth of your own design and the following additional facts. (This is not an easy problem. and it has no explicit answervaluation is often like that!) Niceair's 2003 year-end debt is $750 million Niccair's 2003 year-end cash is $50 million. The company has a cost of debt of,,-5%. The company has 44,080,000 shares outstanding: the end-2003 share price . is $37 Niceair's share-0437.?" 3%, and E(,)-12%. . per able ears NICCAIR CORPORATION, 2011-2015 31-Dec-12 31-Dec-11 $105,300,000 $128.000,000 $122,100.000 $35.800,000 $116.300.000 161,700,000 $155,000.000 $148,800,000 $145.100 000 $141 600,000 Changes in net working capital-12600,000 268.300,00 491.300,000 233,000,000 213.400,000 1-Dec-1531-Dec-14 31-Dee-13 3 Net income dDepreciation and w of e of 181.300.000-192,500.000-185,700,000-158,400,000 -154 000,000 Net inberest paid betore taxes 41,100.000 -34.600,000 -46,900.000 -50.600,000 -45,500.000 3262% 3103% 9. Go to Yahoo and look up your two favorite drug store chains, Compare the following multiples for the two companies: P/E, Sales/Market Cap. Is one of the chains underpriced vis--vis the other? r in 00. CHAPTER 16 Stock Valuation 539 outstanding. How should the analyst value the shares of the company? Assume all cash flows occur at year-end com- 8 (Challenge problem) The last 5 years' results for Niccair Corp, are given below. Value the company's stock hased on a model of FCF growth of your own design and the following additional facts. (This is not an easy problem. and it has no explicit answervaluation is often like that!) Niceair's 2003 year-end debt is $750 million Niccair's 2003 year-end cash is $50 million. The company has a cost of debt of,,-5%. The company has 44,080,000 shares outstanding: the end-2003 share price . is $37 Niceair's share-0437.?" 3%, and E(,)-12%. . per able ears NICCAIR CORPORATION, 2011-2015 31-Dec-12 31-Dec-11 $105,300,000 $128.000,000 $122,100.000 $35.800,000 $116.300.000 161,700,000 $155,000.000 $148,800,000 $145.100 000 $141 600,000 Changes in net working capital-12600,000 268.300,00 491.300,000 233,000,000 213.400,000 1-Dec-1531-Dec-14 31-Dee-13 3 Net income dDepreciation and w of e of 181.300.000-192,500.000-185,700,000-158,400,000 -154 000,000 Net inberest paid betore taxes 41,100.000 -34.600,000 -46,900.000 -50.600,000 -45,500.000 3262% 3103% 9. Go to Yahoo and look up your two favorite drug store chains, Compare the following multiples for the two companies: P/E, Sales/Market Cap. Is one of the chains underpriced vis--vis the other? r in 00