Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8) Claire's mother, Lynn, died on June 5, 2013, leaving Claire her entire estate. Included in the estate was Lynn's residence (205 South 17th

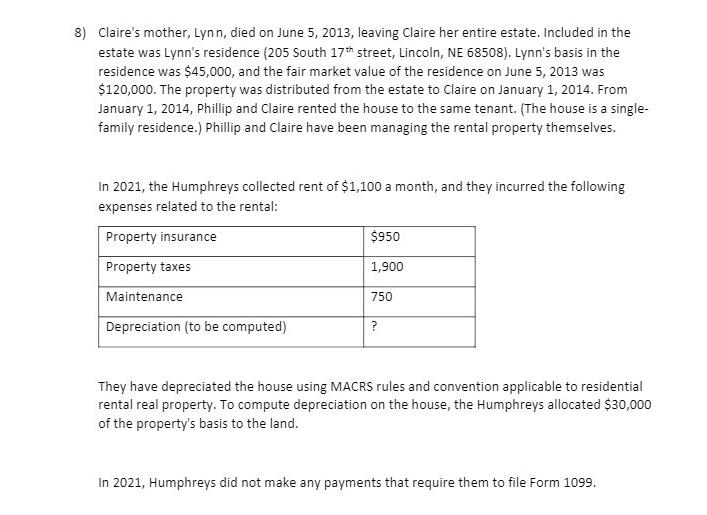

8) Claire's mother, Lynn, died on June 5, 2013, leaving Claire her entire estate. Included in the estate was Lynn's residence (205 South 17th street, Lincoln, NE 68508). Lynn's basis in the residence was $45,000, and the fair market value of the residence on June 5, 2013 was $120,000. The property was distributed from the estate to Claire on January 1, 2014. From January 1, 2014, Phillip and Claire rented the house to the same tenant. (The house is a single- family residence.) Phillip and Claire have been managing the rental property themselves. In 2021, the Humphreys collected rent of $1,100 a month, and they incurred the following expenses related to the rental: Property insurance Property taxes Maintenance Depreciation (to be computed) $950 1,900 750 ? They have depreciated the house using MACRS rules and convention applicable to residential rental real property. To compute depreciation on the house, the Humphreys allocated $30,000 of the property's basis to the land. In 2021, Humphreys did not make any payments that require them to file Form 1099.

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the depreciation expense for the rental property we need to determine the depreciable b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started