Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. Conceptually, what does the days' sales in receivables ratio measure for a firm? A) The number of days it takes to generate dollar sales

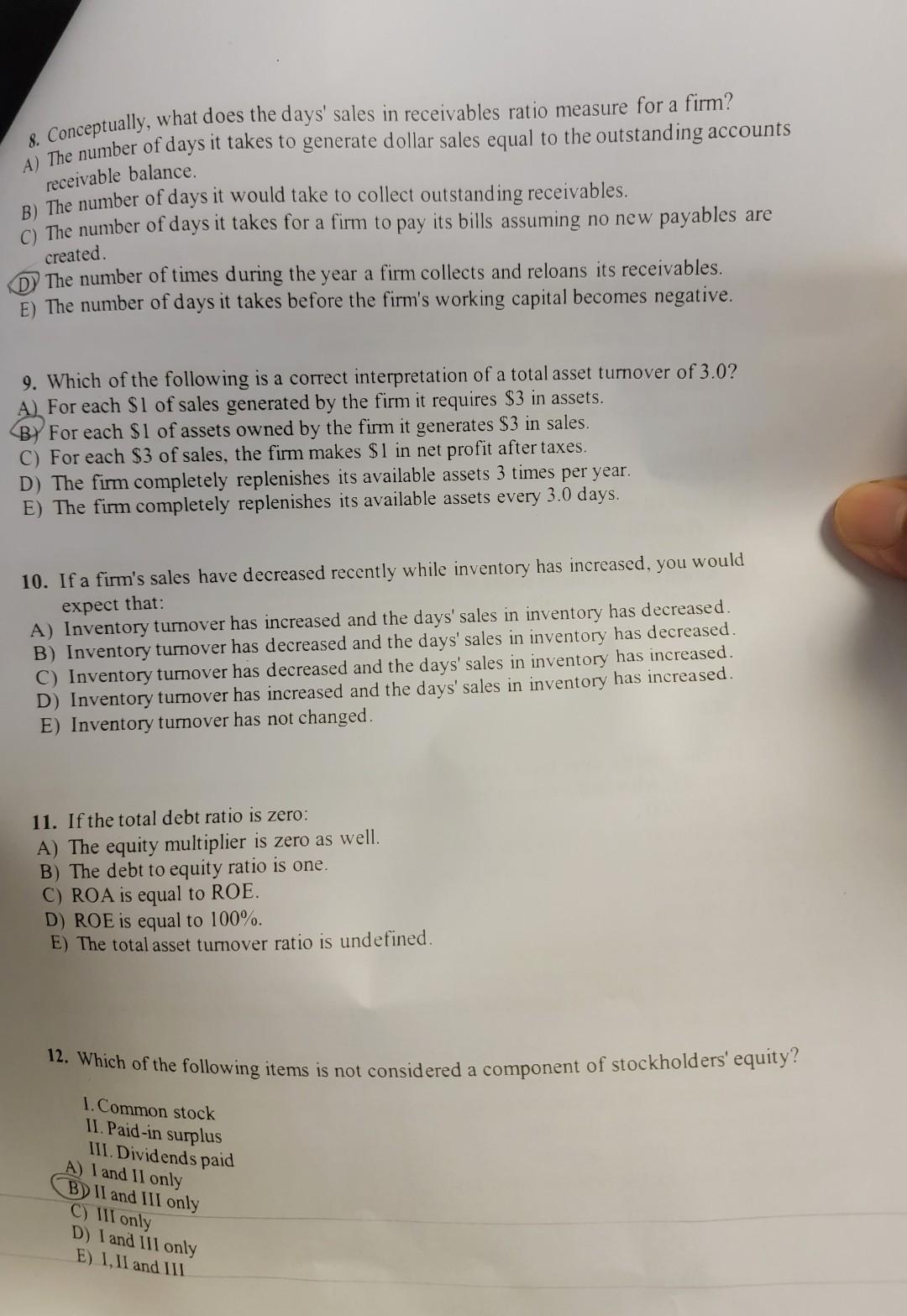

8. Conceptually, what does the days' sales in receivables ratio measure for a firm? A) The number of days it takes to generate dollar sales equal to the outstanding accounts receivable balance. B) The number of days it would take to collect outstanding receivables. C) The number of days it takes for a firm to pay its bills assuming no new payables are created. (D) The number of times during the year a firm collects and reloans its receivables. E) The number of days it takes before the firm's working capital becomes negative. 9. Which of the following is a correct interpretation of a total asset turnover of 3.0 ? A) For each $1 of sales generated by the firm it requires $3 in assets. B) For each $1 of assets owned by the firm it generates $3 in sales. C) For each $3 of sales, the firm makes $1 in net profit after taxes. D) The firm completely replenishes its available assets 3 times per year. E) The firm completely replenishes its available assets every 3.0 days. 10. If a firm's sales have decreased recently while inventory has increased, you would expect that: A) Inventory turnover has increased and the days' sales in inventory has decreased. B) Inventory turnover has decreased and the days' sales in inventory has decreased. C) Inventory turnover has decreased and the days' sales in inventory has increased. D) Inventory turnover has increased and the days' sales in inventory has increased. E) Inventory turnover has not changed. 11. If the total debt ratio is zero: A) The equity multiplier is zero as well. B) The debt to equity ratio is one. C) ROA is equal to ROE. D) ROE is equal to 100%. E) The total asset turnover ratio is undefined. 12. Which of the following items is not considered a component of stockholders' equity? 1. Common stock II. Paid-in surplus III. Dividends paid A) 1 and 11 only B. II and III only C) III only D) I and 1II only E) I, II and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started