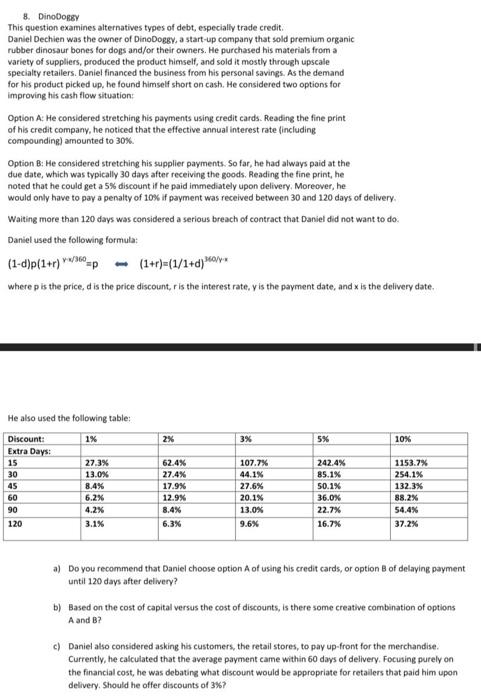

8. DinoBORY This question examines alternatives types of debt, especially trade credit Daniel Dechien was the owner of DinoDoggy, a start-up company that sold premium organic rubber dinosaur bones for dogs and/or their owners. He purchased his materials from a variety of suppliers, produced the product himself, and sold it mostly through upscale Specialty retailers. Daniel financed the business from his personal savings. As the demand for his product picked up, he found himself short on cash. He considered two options for improving his cash flow situation Option A He considered stretching his payments using credit cards. Reading the fine print of his credit company, he noticed that the effective annual interest rate (including compounding) amounted to 30%. Option B: He considered stretching his supplier payments. So far, he had always paid at the due date, which was typically 30 days after receiving the goods. Reading the fine print, he noted that he could get a 5% discount if he paid immediately upon delivery. Moreover, he would only have to pay a penalty of 10% if payment was received between 30 and 120 days of delivery Waiting more than 120 days was considered a serious breach of contract that Daniel did not want to do Daniel used the following formula: vw360 (1-d)p(1+r)/800-p - (1+r)=(1/1+d) where is the price, d is the price discount, r is the interest rate, is the payment date, and x is the delivery date. He also used the following table 1% 2% 3% 5% 10% Discount: Extra Days: 15 30 45 60 90 120 27.3% 13.0% 8.4% 6.2% 4.2% 3.1% 62.4% 27.4% 17.9% 12.9% 8.4% 6.3% 107.7% 44.1% 27.6% 20.1% 13.0% 9.6% 242.4% 85.1% 50.1% 36.0% 22.7% 16.7% 1153.7% 254.1% 132.3% 88.2% 54.4% 37.2% a) Do you recommend that Daniel choose option A of using his credit cards, or option of delaying payment until 120 days after delivery? b) Based on the cost of capital versus the cost of discounts, is there some creative combination of options A and B? c) Daniel also considered asking his customers, the retail stores, to pay up-front for the merchandise. Currently, he calculated that the average payment came within 60 days of delivery, Focusing purely on the financial cost, he was debating what discount would be appropriate for retailers that paid him upon delivery. Should he offer discounts of 3%? 8. DinoBORY This question examines alternatives types of debt, especially trade credit Daniel Dechien was the owner of DinoDoggy, a start-up company that sold premium organic rubber dinosaur bones for dogs and/or their owners. He purchased his materials from a variety of suppliers, produced the product himself, and sold it mostly through upscale Specialty retailers. Daniel financed the business from his personal savings. As the demand for his product picked up, he found himself short on cash. He considered two options for improving his cash flow situation Option A He considered stretching his payments using credit cards. Reading the fine print of his credit company, he noticed that the effective annual interest rate (including compounding) amounted to 30%. Option B: He considered stretching his supplier payments. So far, he had always paid at the due date, which was typically 30 days after receiving the goods. Reading the fine print, he noted that he could get a 5% discount if he paid immediately upon delivery. Moreover, he would only have to pay a penalty of 10% if payment was received between 30 and 120 days of delivery Waiting more than 120 days was considered a serious breach of contract that Daniel did not want to do Daniel used the following formula: vw360 (1-d)p(1+r)/800-p - (1+r)=(1/1+d) where is the price, d is the price discount, r is the interest rate, is the payment date, and x is the delivery date. He also used the following table 1% 2% 3% 5% 10% Discount: Extra Days: 15 30 45 60 90 120 27.3% 13.0% 8.4% 6.2% 4.2% 3.1% 62.4% 27.4% 17.9% 12.9% 8.4% 6.3% 107.7% 44.1% 27.6% 20.1% 13.0% 9.6% 242.4% 85.1% 50.1% 36.0% 22.7% 16.7% 1153.7% 254.1% 132.3% 88.2% 54.4% 37.2% a) Do you recommend that Daniel choose option A of using his credit cards, or option of delaying payment until 120 days after delivery? b) Based on the cost of capital versus the cost of discounts, is there some creative combination of options A and B? c) Daniel also considered asking his customers, the retail stores, to pay up-front for the merchandise. Currently, he calculated that the average payment came within 60 days of delivery, Focusing purely on the financial cost, he was debating what discount would be appropriate for retailers that paid him upon delivery. Should he offer discounts of 3%