Question

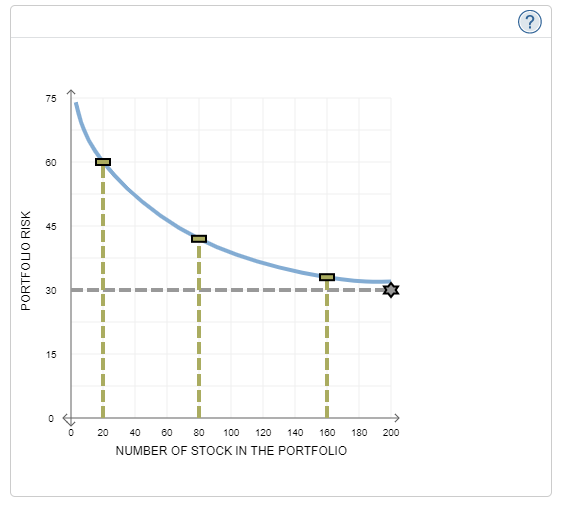

8. Effects of portfolio size on portfolio risk The following graph plots portfolio risk against the size of the portfolio as measured by the number

8. Effects of portfolio size on portfolio risk

The following graph plots portfolio risk against the size of the portfolio as measured by the number of stocks in the portfolio. (Hint: Hover the mouse over the graph to read the coordinates.)

Based on the data presented in the previous graph, which of the following statements are true? Check all that apply.

As the portfolio size increases, its market risk remains constant.

A portfolio of 80 stocks has a diversifiable risk of 42%.

Adding risky stocks increases the risk of the portfolio.

As the portfolio size increases, its total risk declines.

Diversifiable risk lies above = 30%.

The benchmark for a well-diversified stock portfolio is the market portfolio, which is a portfolio containing all stocks. The relevant risk of an individual stock is measured by its beta coefficient, which is defined under the Capital Asset Pricing Model (CAPM) as the amount of risk that the stock contributes to the well-diversified portfolio. Based on your understanding of the CAPM and beta, answer the following question:

Which of the following statements about stocks correlation with the market is true?

A stock with a high correlation with the market is risky.

A stock with a low correlation with the market is risky.

A stock with low stand-alone risk will tend to destabilize the portfolio.

75 60 45 0 PORTFOLIO RISK 0 30 15 0 off 20 40 80 80 100 120 140 180 180 200 NUMBER OF STOCK IN THE PORTFOLIOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started