Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. Emir Company purchased equipment that cost $110,000 cash on January 1, 2015. The equipment had an expected useful life of six years and

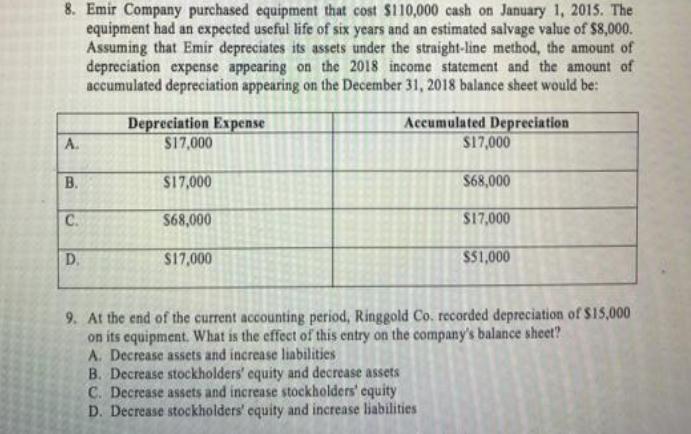

8. Emir Company purchased equipment that cost $110,000 cash on January 1, 2015. The equipment had an expected useful life of six years and an estimated salvage value of $8,000. Assuming that Emir depreciates its assets under the straight-line method, the amount of depreciation expense appearing on the 2018 income statement and the amount of accumulated depreciation appearing on the December 31, 2018 balance sheet would be: Accumulated Depreciation A. B. C. D. Depreciation Expense $17,000 $17,000 $68,000 $17,000 $17,000 B. Decrease stockholders' equity and decrease assets C. Decrease assets and increase stockholders' equity D. Decrease stockholders' equity and increase liabilities $68,000 $17,000 $51,000 9. At the end of the current accounting period, Ringgold Co. recorded depreciation of $15,000 on its equipment. What is the effect of this entry on the company's balance sheet? A. Decrease assets and increase liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

For the first question to calculate the amount of depreciation expense and accumulated depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started