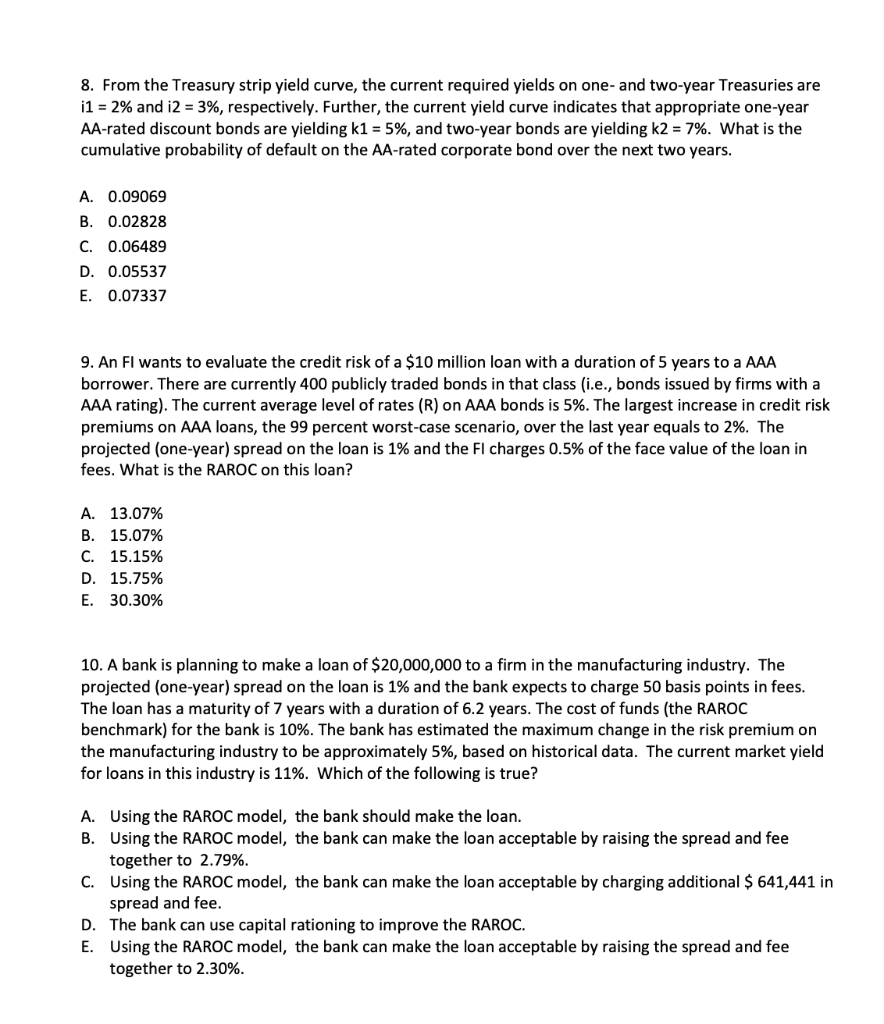

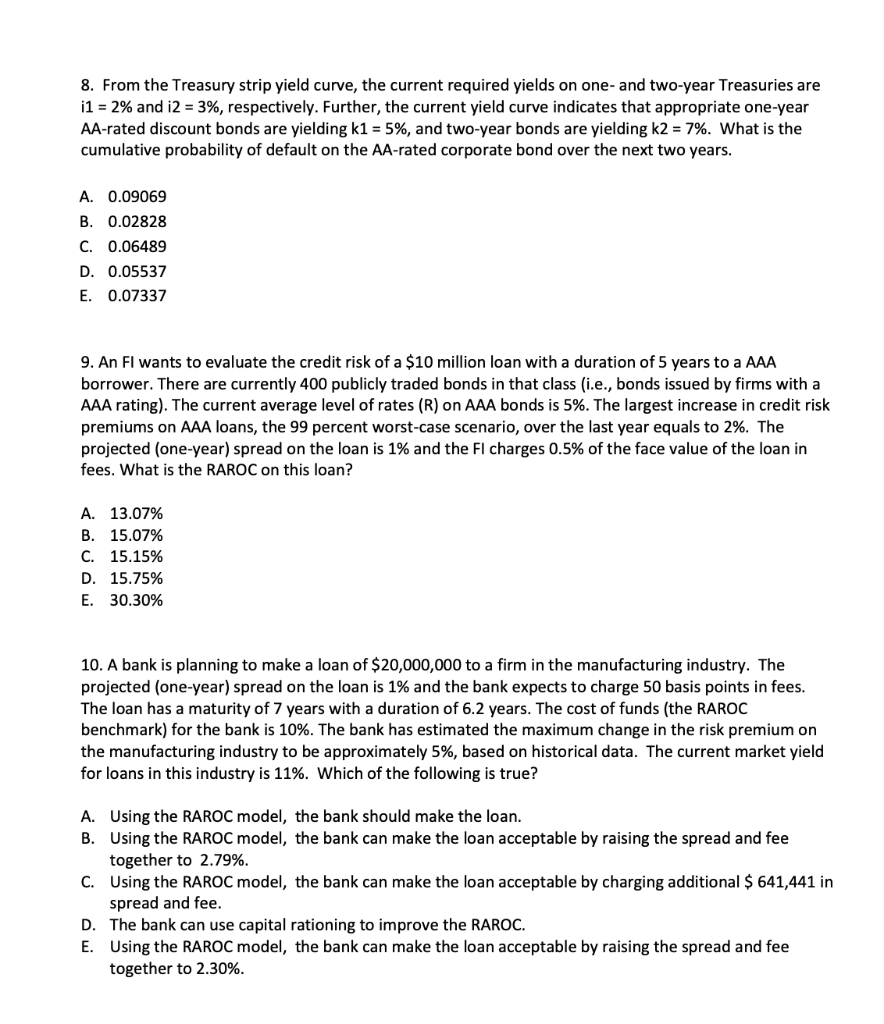

8. From the Treasury strip yield curve, the current required yields on one- and two-year Treasuries are i1 = 2% and i2 = 3%, respectively. Further, the current yield curve indicates that appropriate one-year AA-rated discount bonds are yielding k1 = 5%, and two-year bonds are yielding k2 = 7%. What is the cumulative probability of default on the AA-rated corporate bond over the next two years. A. 0.09069 B. 0.02828 C. 0.06489 D. 0.05537 E. 0.07337 9. An FI wants to evaluate the credit risk of a $10 million loan with a duration of 5 years to a AAA borrower. There are currently 400 publicly traded bonds in that class (i.e., bonds issued by firms with a AAA rating). The current average level of rates (R) on AAA bonds is 5%. The largest increase in credit risk premiums on AAA loans, the 99 percent worst-case scenario, over the last year equals to 2%. The projected (one-year) spread on the loan is 1% and the Fl charges 0.5% of the face value of the loan in fees. What is the RAROC on this loan? A. 13.07% B. 15.07% C. 15.15% D. 15.75% E. 30.30% 10. A bank is planning to make a loan of $20,000,000 to a firm in the manufacturing industry. The projected (one-year) spread on the loan is 1% and the bank expects to charge 50 basis points in fees. The loan has a maturity of 7 years with a duration of 6.2 years. The cost of funds (the RAROC benchmark) for the bank is 10%. The bank has estimated the maximum change in the risk premium on the manufacturing industry to be approximately 5%, based on historical data. The current market yield for loans in this industry is 11%. Which of the following is true? A. Using the RAROC model, the bank should make the loan. B. Using the RAROC model, the bank can make the loan acceptable by raising the spread and fee together to 2.79%. C. Using the RAROC model, the bank can make the loan acceptable by charging additional $ 641,441 in spread and fee. D. The bank can use capital rationing to improve the RAROC. E. Using the RAROC model, the bank can make the loan acceptable by raising the spread and fee together to 2.30%