Question

8. I go a grocery store in Durham and buy food costing a total of $86.71 and non-food items costing a total of $23.36.

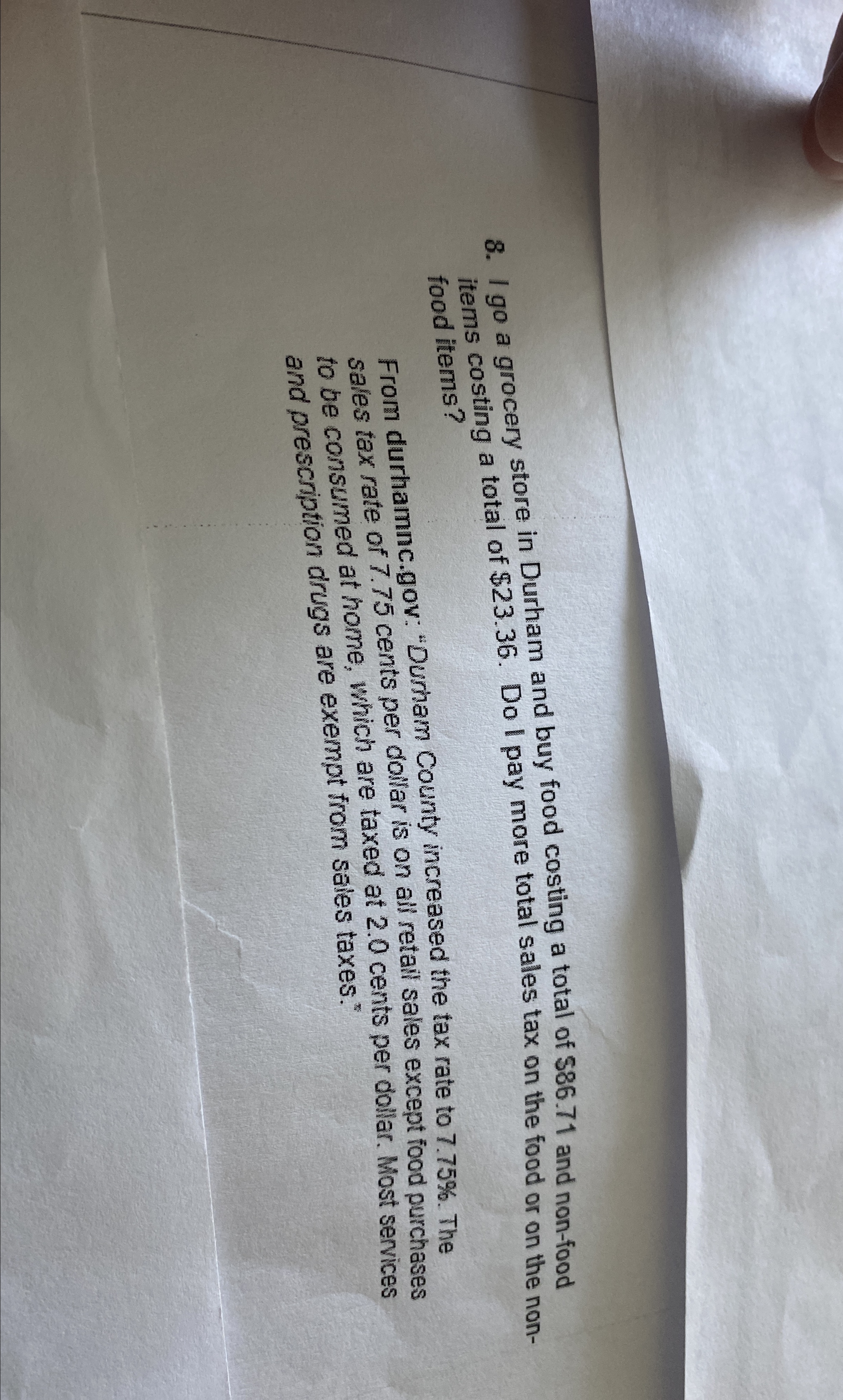

8. I go a grocery store in Durham and buy food costing a total of $86.71 and non-food items costing a total of $23.36. Do I pay more total sales tax on the food or on the non- food items? From durhamnc.gov: "Durham County increased the tax rate to 7.75%. The sales tax rate of 7.75 cents per dollar is on all retail sales except food purchases to be consumed at home, which are taxed at 2.0 cents per dollar. Most services and prescription drugs are exempt from sales taxes."

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Financial Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan E. Duchac

12th edition

1305041399, 1285078586, 978-1-133-9524, 9781133952428, 978-1305041394, 9781285078588, 1-133-95241-0, 978-1133952411

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App