Answered step by step

Verified Expert Solution

Question

1 Approved Answer

alt ctrl in ACC 330 - Instructions for Tax Return #3 in class 1. Assume it is March of 2023 and the taxpayers asked

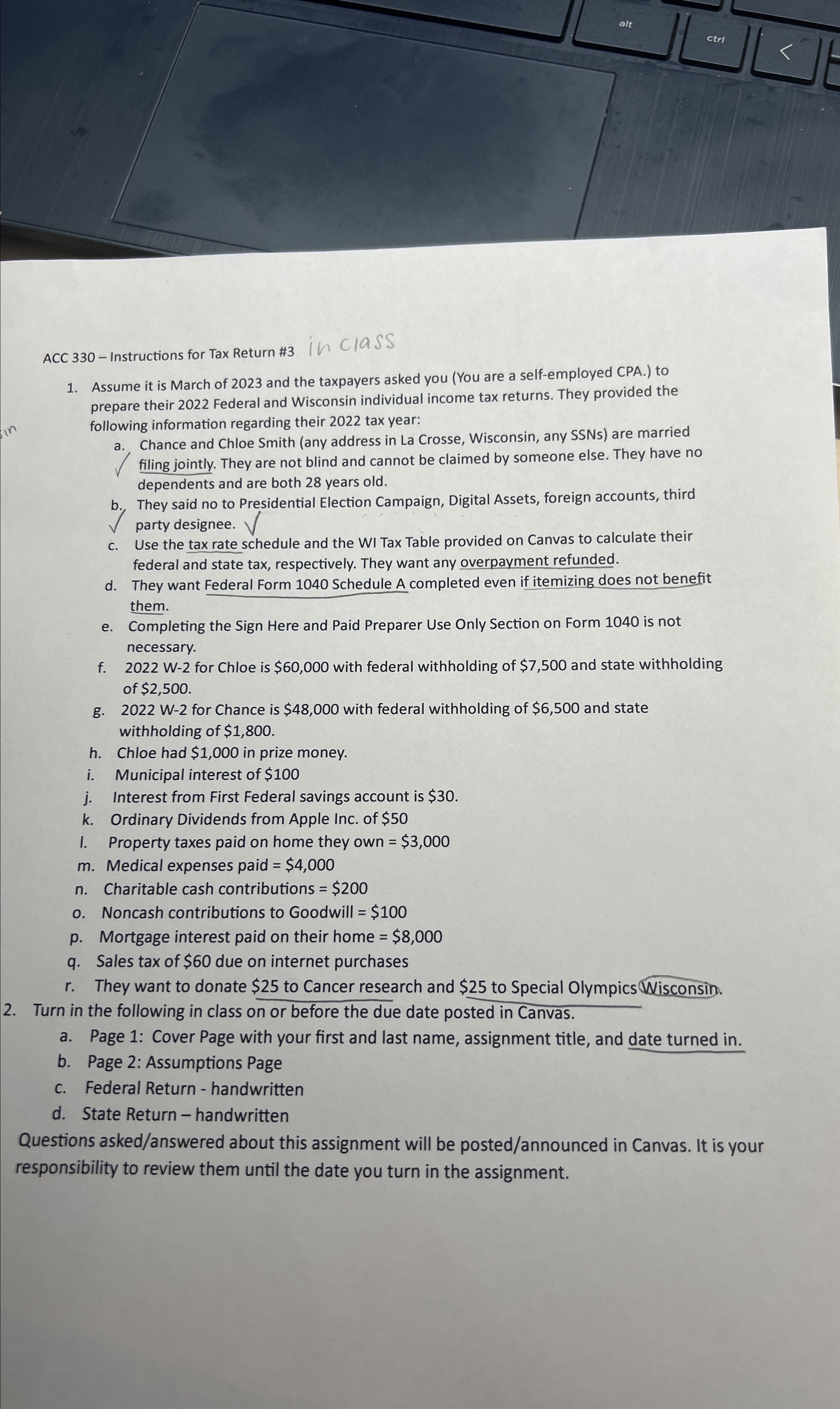

alt ctrl in ACC 330 - Instructions for Tax Return #3 in class 1. Assume it is March of 2023 and the taxpayers asked you (You are a self-employed CPA.) to prepare their 2022 Federal and Wisconsin individual income tax returns. They provided the following information regarding their 2022 tax year: a. Chance and Chloe Smith (any address in La Crosse, Wisconsin, any SSNs) are married filing jointly. They are not blind and cannot be claimed by someone else. They have no dependents and are both 28 years old. b., They said no to Presidential Election Campaign, Digital Assets, foreign accounts, third party designee. C. Use the tax rate schedule and the WI Tax Table provided on Canvas to calculate their federal and state tax, respectively. They want any overpayment refunded. d. They want Federal Form 1040 Schedule A completed even if itemizing does not benefit them. e. Completing the Sign Here and Paid Preparer Use Only Section on Form 1040 is not necessary. f. 2022 W-2 for Chloe is $60,000 with federal withholding of $7,500 and state withholding of $2,500. g. 2022 W-2 for Chance is $48,000 with federal withholding of $6,500 and state withholding of $1,800. h. Chloe had $1,000 in prize money. i. Municipal interest of $100 j. Interest from First Federal savings account is $30. k. Ordinary Dividends from Apple Inc. of $50 1. Property taxes paid on home they own = $3,000 m. Medical expenses paid = $4,000 n. Charitable cash contributions = $200 o. Noncash contributions to Goodwill = $100 p. Mortgage interest paid on their home = $8,000 q. Sales tax of $60 due on internet purchases r. They want to donate $25 to Cancer research and $25 to Special Olympics Wisconsin. 2. Turn in the following in class on or before the due date posted in Canvas. a. Page 1: Cover Page with your first and last name, assignment title, and date turned in. b. Page 2: Assumptions Page C. Federal Return - handwritten d. State Return - handwritten Questions asked/answered about this assignment will be posted/announced in Canvas. It is your responsibility to review them until the date you turn in the assignment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started