Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8.) I need to understand the steps on how to do this problem. the answer is already in picture just trying to understand how to

8.) I need to understand the steps on how to do this problem. the answer is already in picture just trying to understand how to get to that. thank you!!!

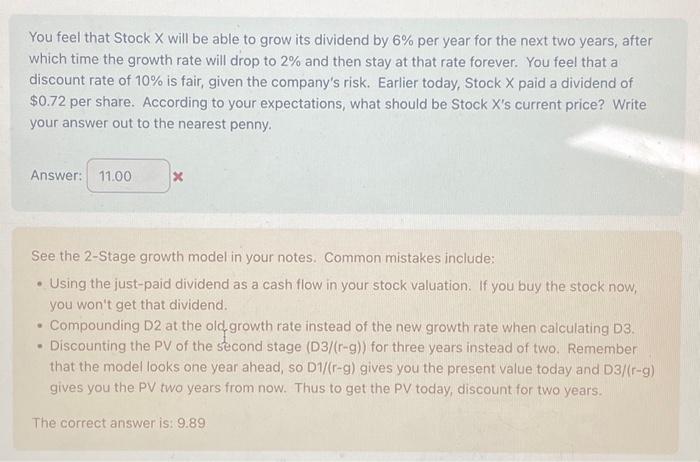

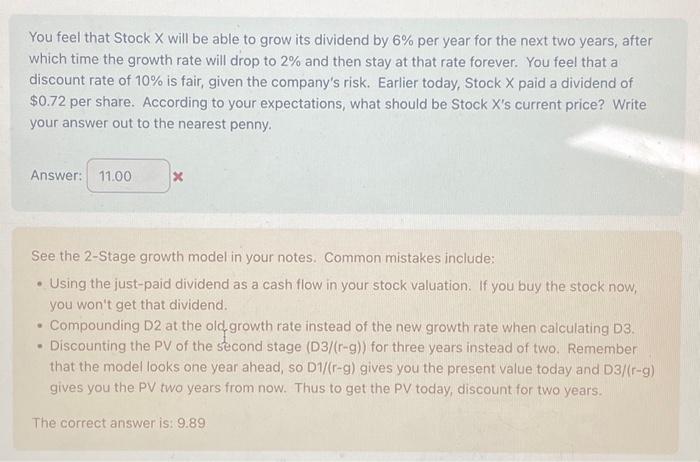

You feel that Stock X will be able to grow its dividend by 6% per year for the next two years, after which time the growth rate will drop to 2% and then stay at that rate forever. You feel that a discount rate of 10% is fair, given the company's risk. Earlier today, Stock X paid a dividend of $0.72 per share. According to your expectations, what should be Stock X 's current price? Write your answer out to the nearest penny. Answer: See the 2-Stage growth model in your notes. Common mistakes include: - Using the just-paid dividend as a cash flow in your stock valuation. If you buy the stock now, you won't get that dividend. - Compounding D2 at the old, growth rate instead of the new growth rate when calculating D3. - Discounting the PV of the second stage (D3/(rg)) for three years instead of two. Remember that the model looks one year ahead, so D1/(r-g) gives you the present value today and D3/(r-g) gives you the PV two years from now. Thus to get the PV today, discount for two years. The correct answer is: 9.89

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started