Answered step by step

Verified Expert Solution

Question

1 Approved Answer

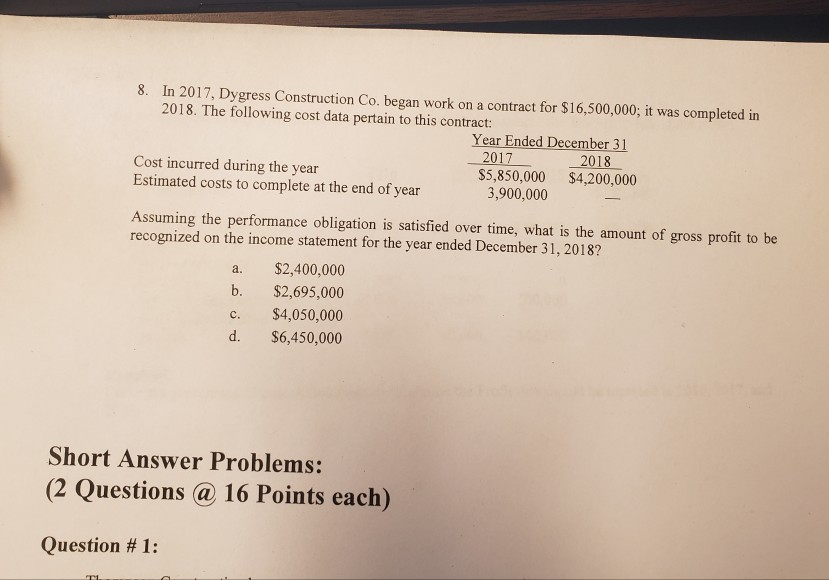

8. In 2017, Dygress Construction Co. began work on a contract for $16,500,000; it was completed in 2018. The following cost data pertain to this

8. In 2017, Dygress Construction Co. began work on a contract for $16,500,000; it was completed in 2018. The following cost data pertain to this contract: Year Ended December 31 2018 Cost incurred during the year Estimated costs to complete at the end of year $5,850,000 $4,200,000 3,900,000 Assuming the performance obligation is satisfied over time, what is the amount of gross profit to be recognized on the income statement for the year ended December 31, 2018? a. $2,400,000 b. $2,695,000 c. $4,050,000 d. $6,450,000 Short Answer Problems: (2 Questions 16 Points each) Question # 1: 8. In 2017, Dygress Construction Co. began work on a contract for $16,500,000; it was completed in 2018. The following cost data pertain to this contract: Year Ended December 31 2018 Cost incurred during the year Estimated costs to complete at the end of year $5,850,000 $4,200,000 3,900,000 Assuming the performance obligation is satisfied over time, what is the amount of gross profit to be recognized on the income statement for the year ended December 31, 2018? a. $2,400,000 b. $2,695,000 c. $4,050,000 d. $6,450,000 Short Answer Problems: (2 Questions 16 Points each) Question # 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started