Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8% in the final Problem: 1 MAY Lorax Corporation is considering the acquisition of a new machine that is expected to produce annual savings in

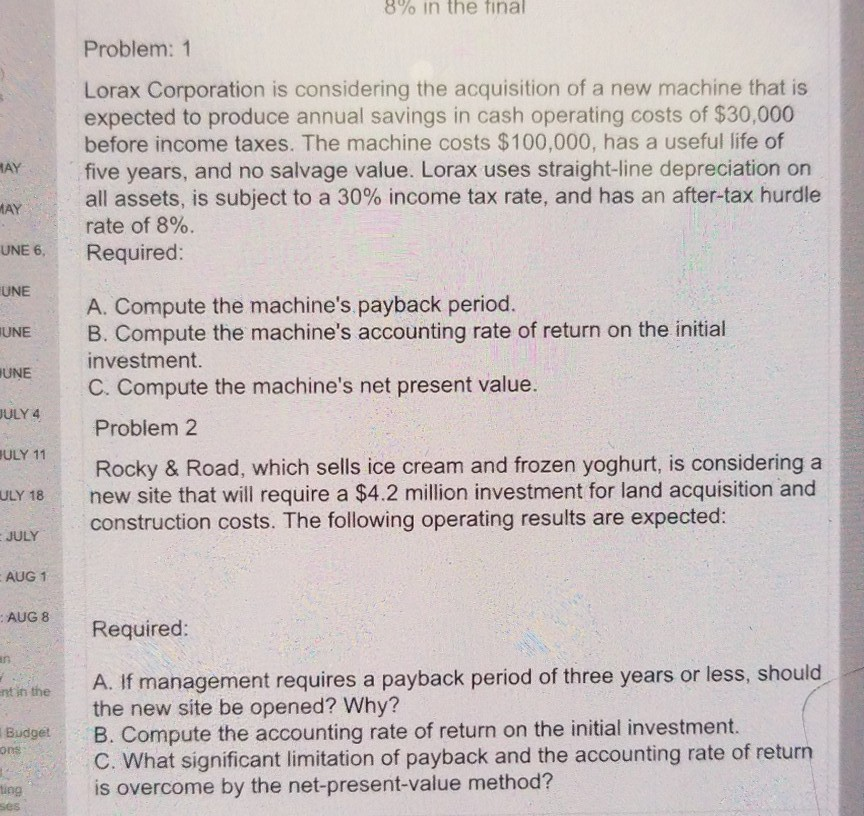

8% in the final Problem: 1 MAY Lorax Corporation is considering the acquisition of a new machine that is expected to produce annual savings in cash operating costs of $30,000 before income taxes. The machine costs $100,000, has a useful life of five years, and no salvage value. Lorax uses straight-line depreciation on all assets, is subject to a 30% income tax rate, and has an after-tax hurdle rate of 8%. Required: MAY UNE 6, UNE UNE A. Compute the machine's payback period. B. Compute the machine's accounting rate of return on the initial investment. C. Compute the machine's net present value. UNE JULY 4 Problem 2 JULY 11 ULY 18 Rocky & Road, which sells ice cream and frozen yoghurt, is considering a new site that will require a $4.2 million investment for land acquisition and construction costs. The following operating results are expected: JULY AUG 1 AUG 8 Required: ant in the Budget ons A. If management requires a payback period of three years or less, should the new site be opened? Why? B. Compute the accounting rate of return on the initial investment. C. What significant limitation of payback and the accounting rate of return is overcome by the net-present-value method? ting Ses 8% in the final Problem: 1 MAY Lorax Corporation is considering the acquisition of a new machine that is expected to produce annual savings in cash operating costs of $30,000 before income taxes. The machine costs $100,000, has a useful life of five years, and no salvage value. Lorax uses straight-line depreciation on all assets, is subject to a 30% income tax rate, and has an after-tax hurdle rate of 8%. Required: MAY UNE 6, UNE UNE A. Compute the machine's payback period. B. Compute the machine's accounting rate of return on the initial investment. C. Compute the machine's net present value. UNE JULY 4 Problem 2 JULY 11 ULY 18 Rocky & Road, which sells ice cream and frozen yoghurt, is considering a new site that will require a $4.2 million investment for land acquisition and construction costs. The following operating results are expected: JULY AUG 1 AUG 8 Required: ant in the Budget ons A. If management requires a payback period of three years or less, should the new site be opened? Why? B. Compute the accounting rate of return on the initial investment. C. What significant limitation of payback and the accounting rate of return is overcome by the net-present-value method? ting Ses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started