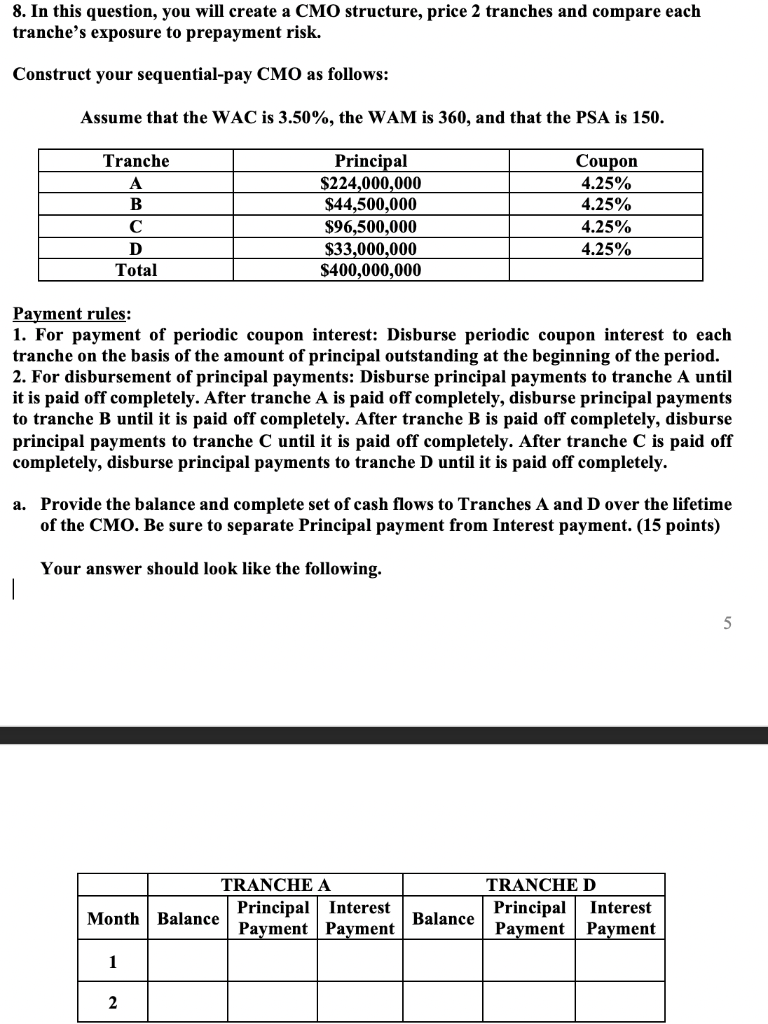

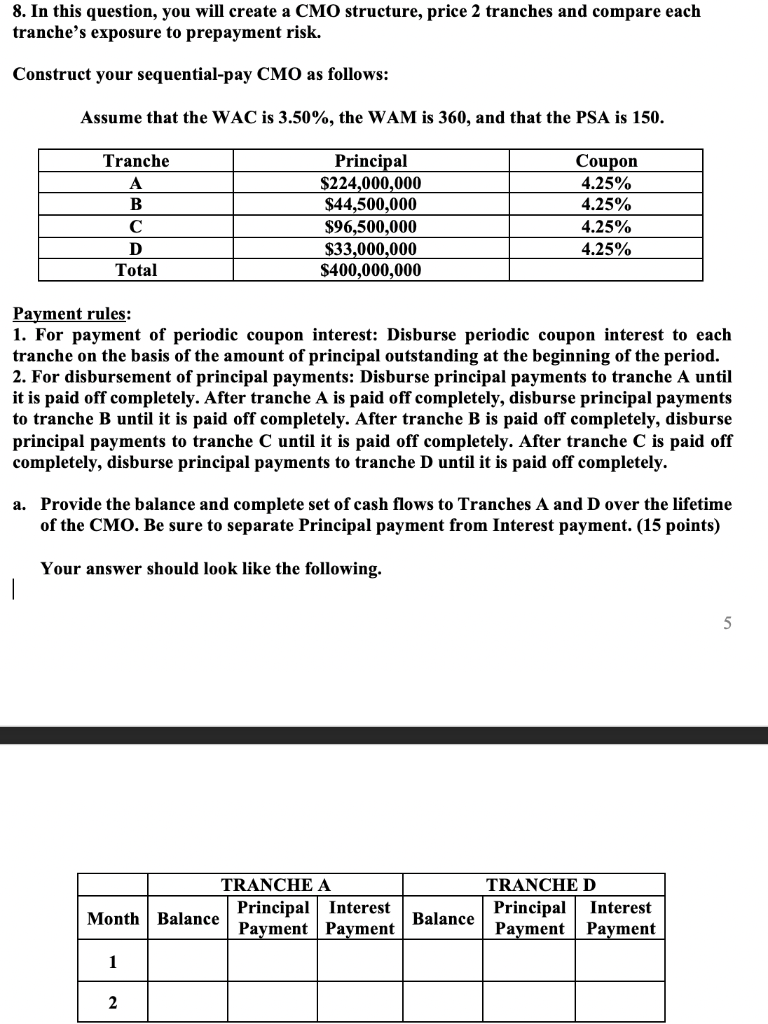

8. In this question, you will create a CMO structure, price 2 tranches and compare each tranche's exposure to prepayment risk. Construct your sequential-pay CMO as follows: Assume that the WAC is 3.50%, the WAM is 360, and that the PSA is 150. Tranche A B D Total Principal $224,000,000 $44,500,000 $96,500,000 $33,000,000 $400,000,000 Coupon 4.25% 4.25% 4.25% 4.25% Payment rules: 1. For payment of periodic coupon interest: Disburse periodic coupon interest to each tranche on the basis of the amount of principal outstanding at the beginning of the period. 2. For disbursement of principal payments: Disburse principal payments to tranche A until it is paid off completely. After tranche A is paid off completely, disburse principal payments to tranche B until it is paid off completely. After tranche B is paid off completely, disburse principal payments to tranche C until it is paid off completely. After tranche C is paid off completely, disburse principal payments to tranche D until it is paid completely. a. Provide the balance and complete set of cash flows to Tranches A and D over the lifetime of the CMO. Be sure to separate Principal payment from Interest payment. (15 points) Your answer should look like the following. 5 TRANCHE A Principal Interest Balance Payment Payment TRANCHE D Principal Interest Payment Payment Month Balance 1 2 8. In this question, you will create a CMO structure, price 2 tranches and compare each tranche's exposure to prepayment risk. Construct your sequential-pay CMO as follows: Assume that the WAC is 3.50%, the WAM is 360, and that the PSA is 150. Tranche A B D Total Principal $224,000,000 $44,500,000 $96,500,000 $33,000,000 $400,000,000 Coupon 4.25% 4.25% 4.25% 4.25% Payment rules: 1. For payment of periodic coupon interest: Disburse periodic coupon interest to each tranche on the basis of the amount of principal outstanding at the beginning of the period. 2. For disbursement of principal payments: Disburse principal payments to tranche A until it is paid off completely. After tranche A is paid off completely, disburse principal payments to tranche B until it is paid off completely. After tranche B is paid off completely, disburse principal payments to tranche C until it is paid off completely. After tranche C is paid off completely, disburse principal payments to tranche D until it is paid completely. a. Provide the balance and complete set of cash flows to Tranches A and D over the lifetime of the CMO. Be sure to separate Principal payment from Interest payment. (15 points) Your answer should look like the following. 5 TRANCHE A Principal Interest Balance Payment Payment TRANCHE D Principal Interest Payment Payment Month Balance 1 2