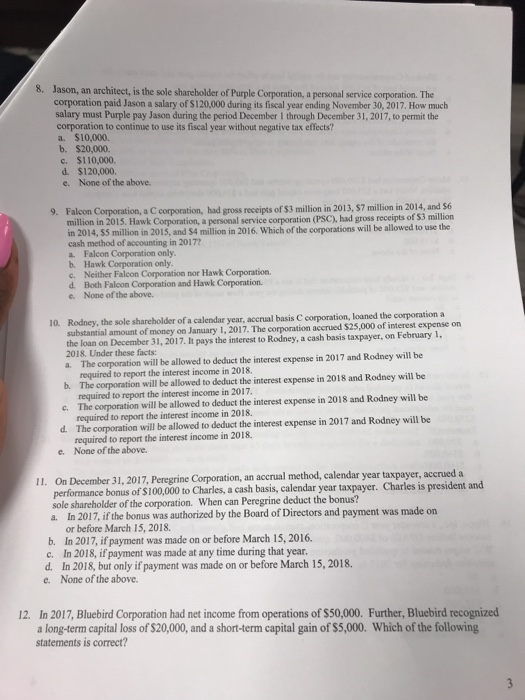

8. Jason, an architect, is the sole shareholder of Purple Corporation, a personal service corporation. The corporation paid Jason a salary of $120,000 during its fiscal year ending November 30, 2017. How much salary must Purple pay Jason during the period December I through December 31, 2017, to permit the corporation to continue to use its fiscal year without negative tax effects? a. $10,000. b. $20,000. C. $110,000. d. $120,000. e. None of the above. Falcon Corporation, a C corporation, had gross receipts of $3 million in 2013, $7 million in 2014, and $6 million in 2015. Hawk Corporation, a personal service corporation (PSC), had gross receipts of S3 million in 2014, $S million in 2015, and S4 million in 2016. Which of the corporations will be allowed to use the 9. cash method of accounting in 2017? a. Falcon Corporation only b. Hawk Corporation only c. Neither Falcon Corporation nor Hawk Corporation. d. Both Falcon Corporation and Hawk Corporation. e. None of the above sole shareholder of a calendar year, acerual basis C corporation, loaned the corporation a substantial amount of money on January 1, 2017. The corporation accrued $25,000 of interest expense on the loan on December 31, 2017. It pays the interest to Rodney, a cash basis taxpayer, on F 2018. Under these facts: a. The corporation will be allowed to deduct the interest expense in 2017 and Rodney will be b. The corporation will be allowed to deduct the interest expense in 2018 and Rodney will be c. The corporation will be allowed to deduct the interest expense in 2018 and Rodney will be d. The corporation will be allowed to deduct the interest expense in 2017 and Rodney will be required to report the interest income in 2018. required to report the interest income in 2017 required to report the interest income in 2018. required to report the interest income in 2018. e. None of the above. ion, an accrual method, calendar year taxpayer, accrued a I1. On December 31, 2017, Peregrine Corporat performance bonus of $100,000 to Charles, a cash basis, calendar year taxpayer. Charles is president and sole shareholder of the corporation. When can Peregrine deduct the bonus? In 2017, if the bonus was authorized by the Board of Directors and payment was made on a. or before March 15, 2018 b. In 2017, if payment was made on or before March 15, 2016. C. In 2018, ifpayment was made at any time during that year. d. In 2018, but only if payment was made on or before March 15, 2018. e. None of the above. 12. In 2017, Bluebird Corporation had net income from operations of $50,000. Further, Bluebird recognized a long-term capital loss of $20,000, and a short-term capital gain of $5,000. Which of the following statements is correct