Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8 multiple choice questions 7. Using the information provided for United Corp, and answer the questions that follow. United Corp. sells merchandise only on credit.

8 multiple choice questions

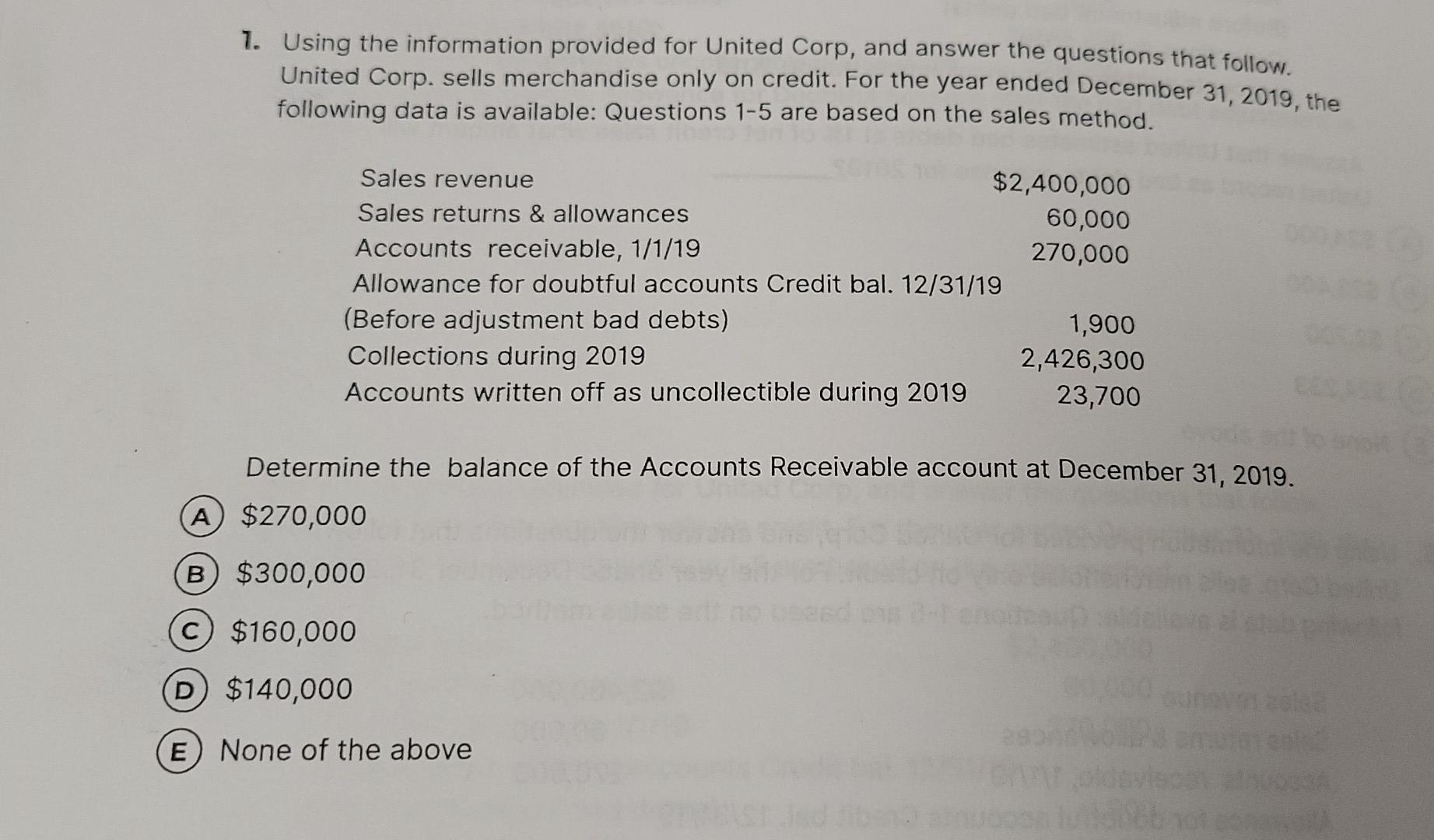

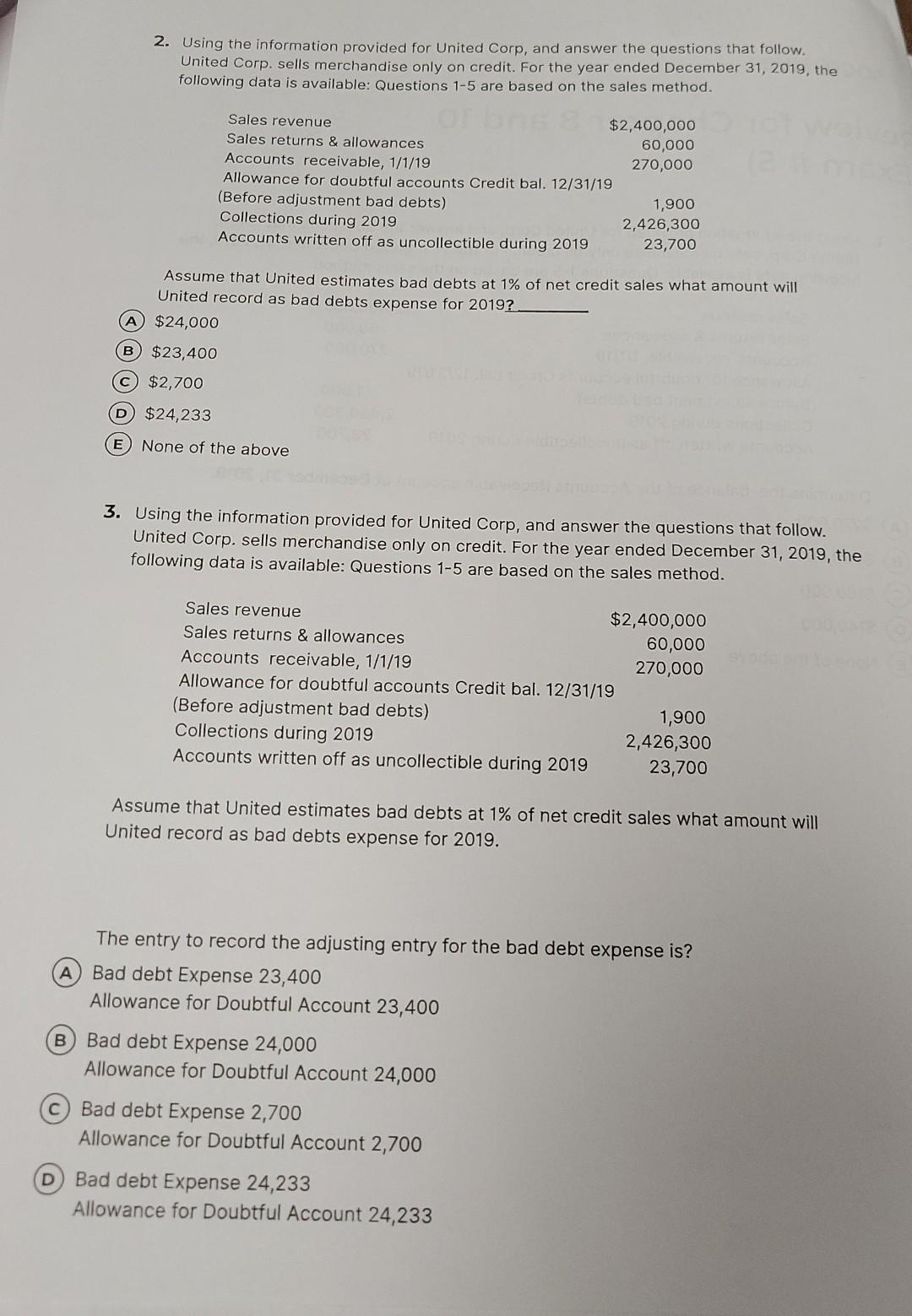

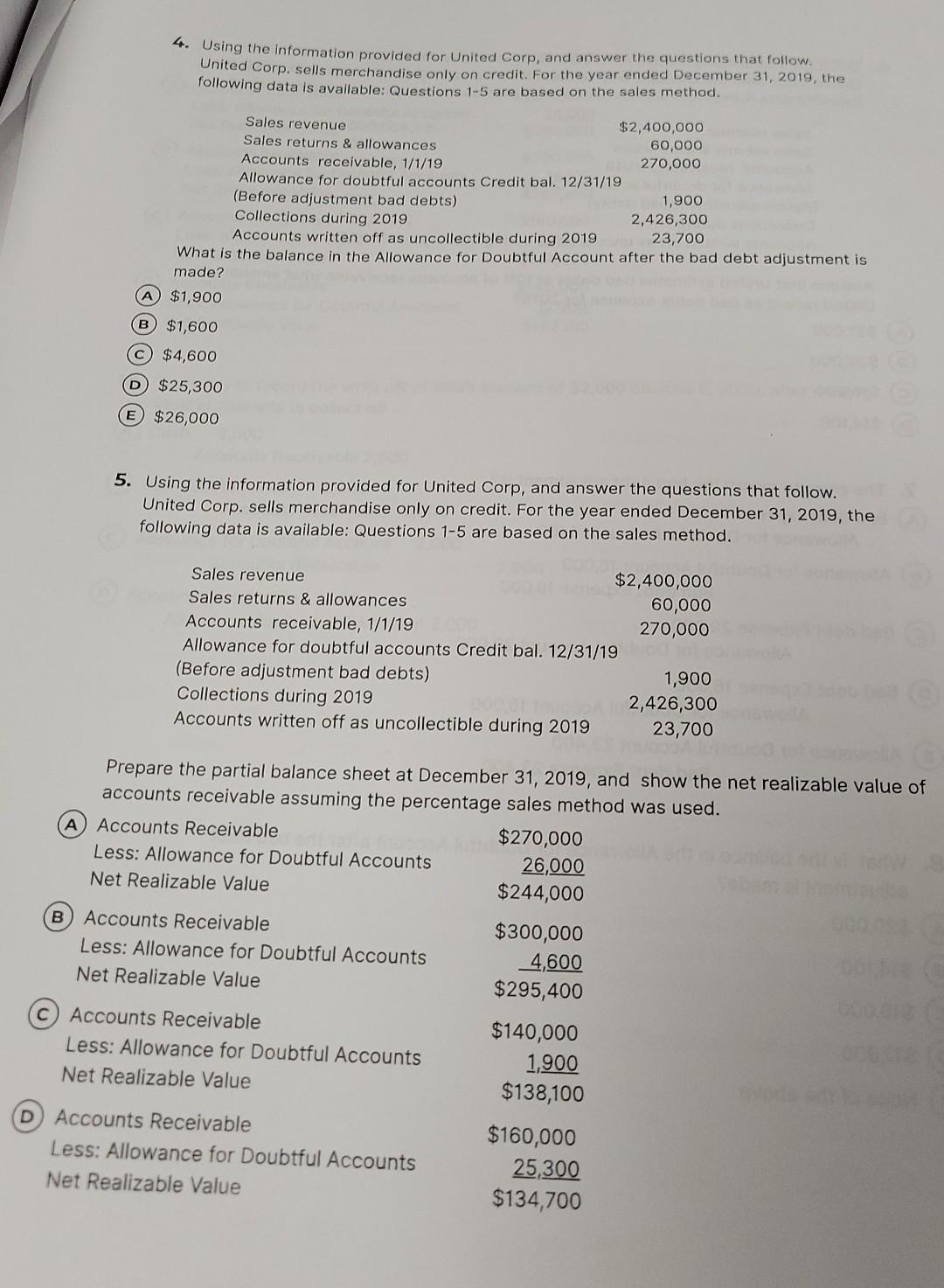

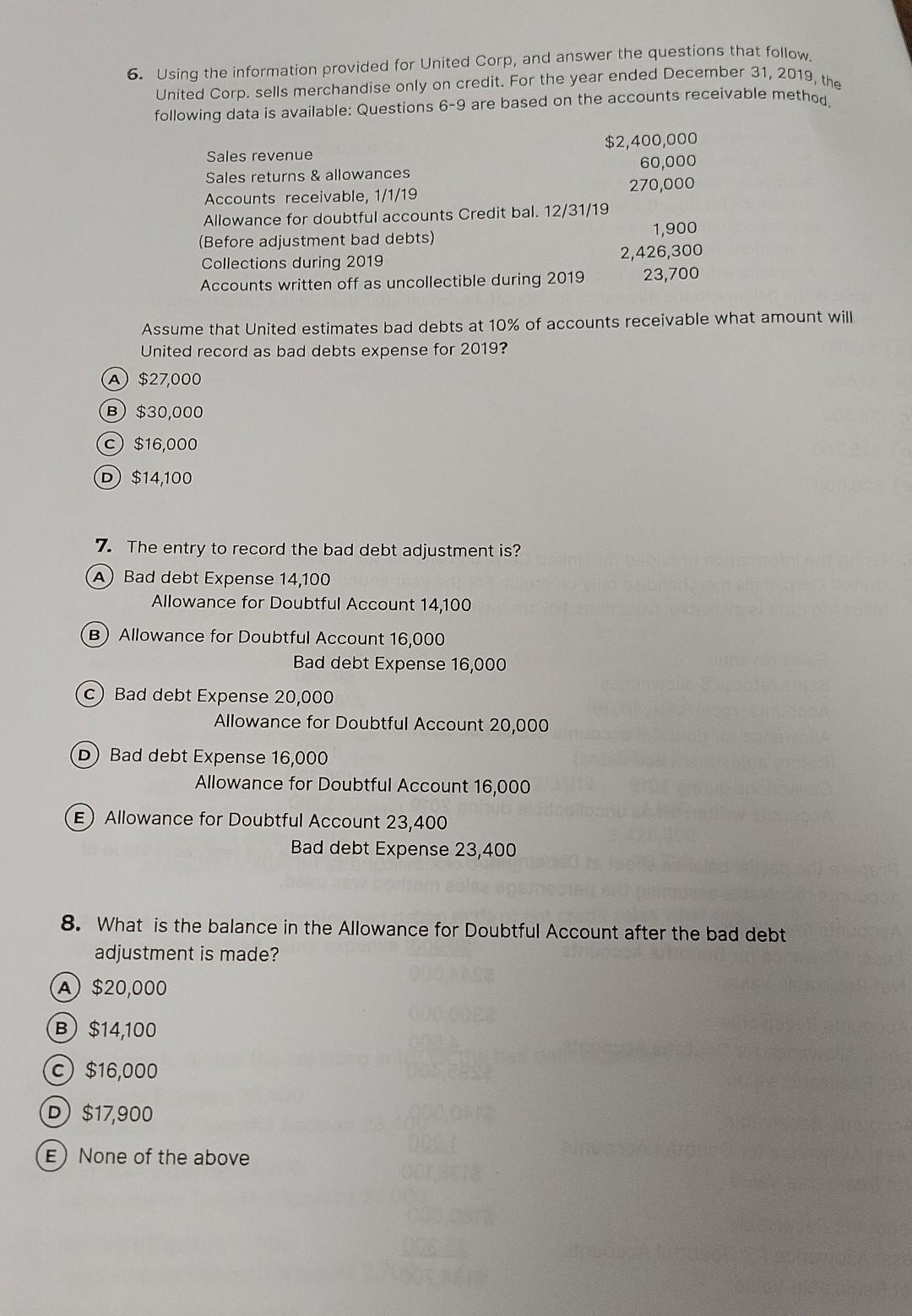

7. Using the information provided for United Corp, and answer the questions that follow. United Corp. sells merchandise only on credit. For the year ended December 31, 2019, the following data is available: Questions 1-5 are based on the sales method. Sales revenue $2,400,000 Sales returns & allowances 60,000 Accounts receivable, 1/1/19 270,000 Allowance for doubtful accounts Credit bal. 12/31/19 (Before adjustment bad debts) 1,900 Collections during 2019 2,426,300 Accounts written off as uncollectible during 2019 23,700 Determine the balance of the Accounts Receivable account at December 31, 2019. A $270,000 B $300,000 C $160,000 D $140,000 E None of the above 2. Using the information provided for United Corp, and answer the questions that follow. United Corp. sells merchandise only on credit. For the year ended December 31, 2019, the following data is available: Questions 1-5 are based on the sales method. Sales revenue $2,400,000 Sales returns & allowances 60,000 Accounts receivable, 1/1/19 270,000 Allowance for doubtful accounts Credit bal. 12/31/19 (Before adjustment bad debts) 1,900 Collections during 2019 2,426,300 Accounts written off as uncollectible during 2019 23,700 Assume that United estimates bad debts at 1% of net credit sales what amount will United record as bad debts expense for 2019? A $24,000 B $23,400 C $2,700 D $24,233 E None of the above 3. Using the information provided for United Corp, and answer the questions that follow. United Corp. sells merchandise only on credit. For the year ended December 31, 2019, the following data is available: Questions 1-5 are based on the sales method. Sales revenue $2,400,000 Sales returns & allowances 60,000 Accounts receivable, 1/1/19 270,000 Allowance for doubtful accounts Credit bal. 12/31/19 (Before adjustment bad debts) 1,900 Collections during 2019 2,426,300 Accounts written off as uncollectible during 2019 23,700 Assume that United estimates bad debts at 1% of net credit sales what amount will United record as bad debts expense for 2019. The entry to record the adjusting entry for the bad debt expense is? Bad debt Expense 23,400 Allowance for Doubtful Account 23,400 B Bad debt Expense 24,000 Allowance for Doubtful Account 24,000 Bad debt Expense 2,700 Allowance for Doubtful Account 2,700 Bad debt Expense 24,233 Allowance for Doubtful Account 24,233 4. Using the information provided for United Corp, and answer the questions that follow. United Corp. sells merchandise only on credit. For the year ended December 31, 2019, the following data is available: Questions 1-5 are based on the sales method. Sales revenue $2,400,000 Sales returns & allowances 60,000 Accounts receivable, 1/1/19 270,000 Allowance for doubtful accounts Credit bal. 12/31/19 (Before adjustment bad debts) 1,900 Collections during 2019 2,426,300 Accounts written off as uncollectible during 2019 23,700 What is the balance in the Allowance for Doubtful Account after the bad debt adjustment is made? A $1,900 B $1,600 C$4,600 D) $25,300 E $26,000 5. Using the information provided for United Corp, and answer the questions that follow. United Corp. sells merchandise only on credit. For the year ended December 31, 2019, the following data is available: Questions 1-5 are based on the sales method. Sales revenue $2,400,000 Sales returns & allowances 60,000 Accounts receivable, 1/1/19 270,000 Allowance for doubtful accounts Credit bal. 12/31/19 (Before adjustment bad debts) 1,900 Collections during 2019 2,426,300 Accounts written off as uncollectible during 2019 23,700 Prepare the partial balance sheet at December 31, 2019, and show the net realizable value of accounts receivable assuming the percentage sales method was used. A Accounts Receivable $270,000 Less: Allowance for Doubtful Accounts 26,000 Net Realizable Value $244,000 B) Accounts Receivable $300,000 Less: Allowance for Doubtful Accounts 4,600 Net Realizable Value $295,400 Accounts Receivable Less: Allowance for Doubtful Accounts Net Realizable Value D) Accounts Receivable Less: Allowance for Doubtful Accounts Net Realizable Value $140,000 1,900 $138,100 $160,000 25,300 $134,700 6. Using the information provided for United Corp, and answer the questions that follow. United Corp. sells merchandise only on credit. For the year ended December 31, 2019, the following data is available: Questions 6-9 are based on the accounts receivable method Sales revenue $2,400,000 Sales returns & allowances 60,000 Accounts receivable, 1/1/19 270,000 Allowance for doubtful accounts Credit bal. 12/31/19 (Before adjustment bad debts) 1,900 Collections during 2019 2,426,300 Accounts written off as uncollectible during 2019 23,700 Assume that United estimates bad debts at 10% of accounts receivable what amount will United record as bad debts expense for 2019? A $27,000 B $30,000 $16,000 $14,100 7. The entry to record the bad debt adjustment is? A Bad debt Expense 14,100 Allowance for Doubtful Account 14,100 B) Allowance for Doubtful Account 16,000 Bad debt Expense 16,000 Bad debt Expense 20,000 Allowance for Doubtful Account 20,000 D Bad debt Expense 16,000 Allowance for Doubtful Account 16,000 Allowance for Doubtful Account 23,400 Bad debt Expense 23,400 8. What is the balance in the Allowance for Doubtful Account after the bad debt adjustment is made? A $20,000 B $14,100 C $16,000 D$17,900 E None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started