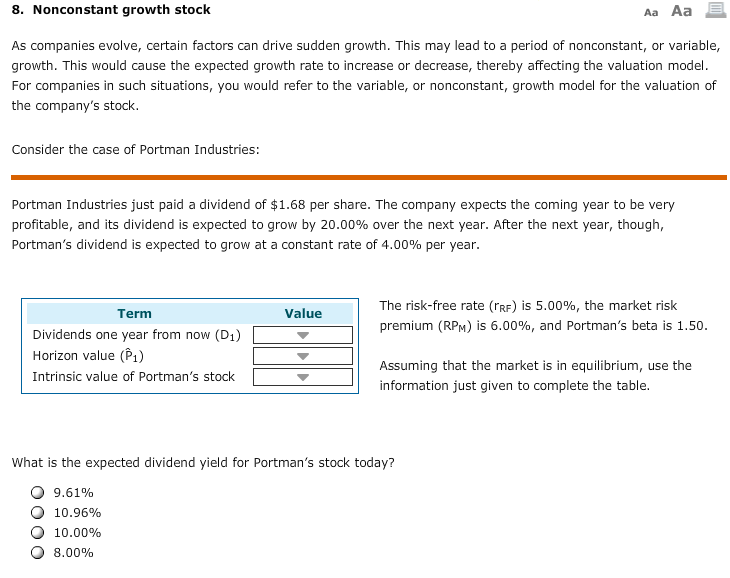

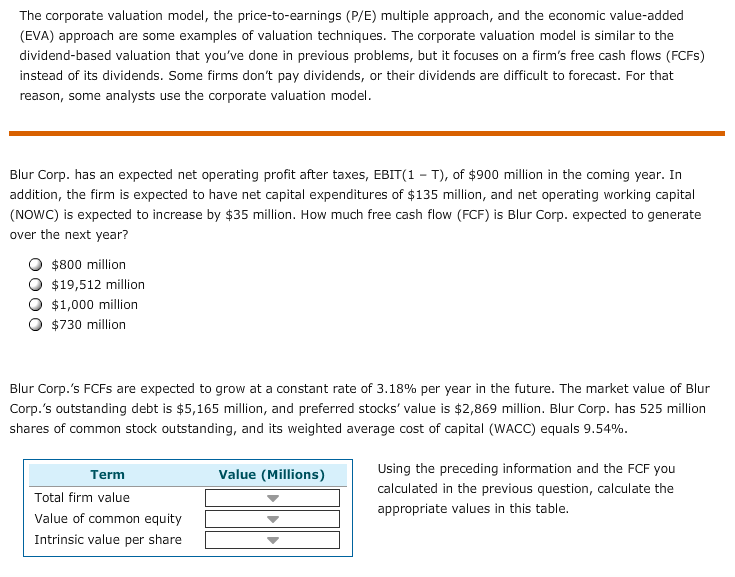

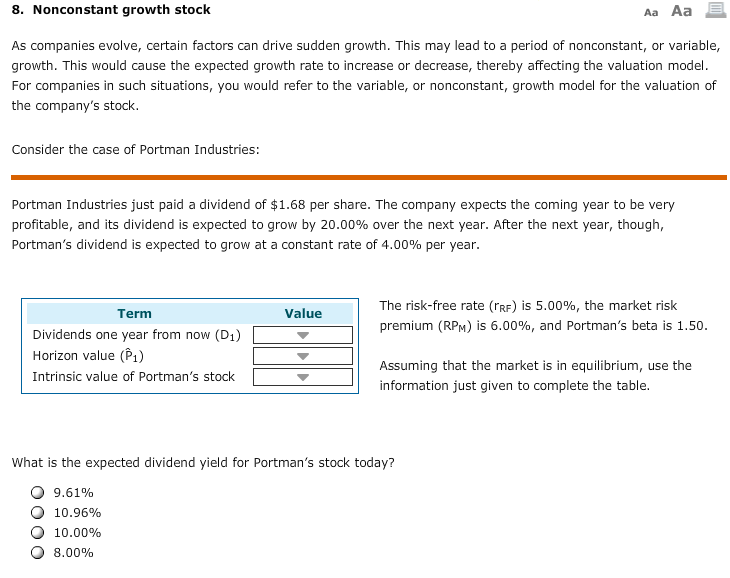

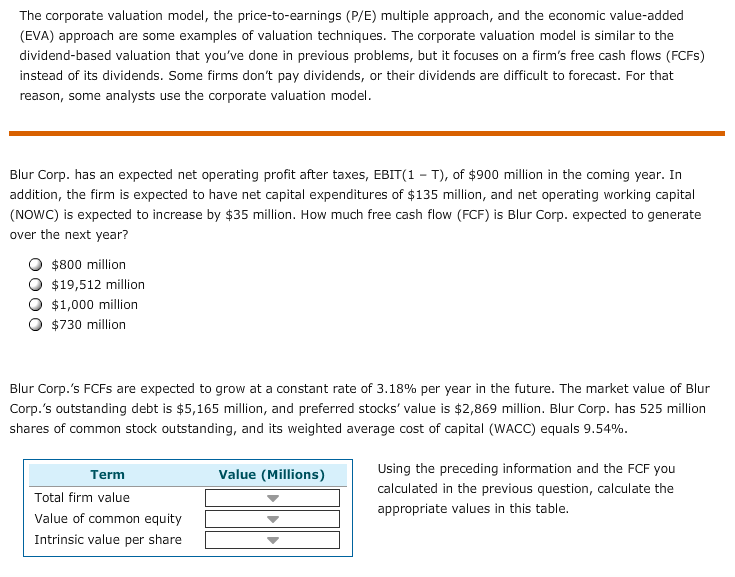

8. Nonconstant growth stock Aa Aa As companies evolve, certain factors can drive sudden growth. This may lead to a period of nonconstant, or variable, growth. This would cause the expected growth rate to increase or decrease, thereby affecting the valuation model. For companies in such situations, you would refer to the variable, or nonconstant, growth model for the valuation of the company's stock. Consider the case of Portman Industries: Portman Industries just paid a dividend of $1.68 per share. The company expects the coming year to be very profitable, and its dividend is expected to grow by 20.00% over the next year. After the next year, though, Portman's dividend is expected to grow at a constant rate of 4.00% per year. The risk-free rate (RE) is 5.00%, the market risk premium (RPM) is 6.00%, and Portman's beta is 1.50. Term Value Dividends one year from now (D1) Horizon value (P1) Intrinsic value of Portman's stock Assuming that the market is in equilibrium, use the information just given to complete the table. What is the expected dividend yield for Portman's stock today? 9.61% 10.96% 10.00% 8.00% The corporate valuation model, the price-to-earnings (P/E) multiple approach, and the economic value-added (EVA) approach are some examples of valuation techniques. The corporate valuation model is similar to the dividend-based valuation that you've done in previous problems, but it focuses on a firm's free cash flows (FCFs) instead of its dividends. Some firms don't pay dividends, or their dividends are difficult to forecast. For that reason, some analysts use the corporate valuation model. Blur Corp. has an expected net operating profit after taxes, EBIT 1 T), of $900 million in the coming year. In addition, the firm is expected to have net capital expenditures of $135 million, and net operating working capital NOWC) is expected to increase by $35 million. How much free cash flow (FCF) is Blur Corp. expected to generate over the next year? $800 million O $19,512 million O $1,000 million O $730 million Blur Corp.'s FCFs are expected to grow at a constant rate of 3.18% per year in the future. The market value of Blur Corp.'s outstanding debt is $5,165 million, and preferred stocks' value is $2,869 million. Blur Corp. has 525 million shares of common stock outstanding, and its weighted average cost of capital (WACC) equals 9.54%. Using the preceding information and the FCF you calculated in the previous question, calculate the appropriate values in this table. Value (Millions) Term Total firm value Value of common equity| Intrinsic value per share