Answered step by step

Verified Expert Solution

Question

1 Approved Answer

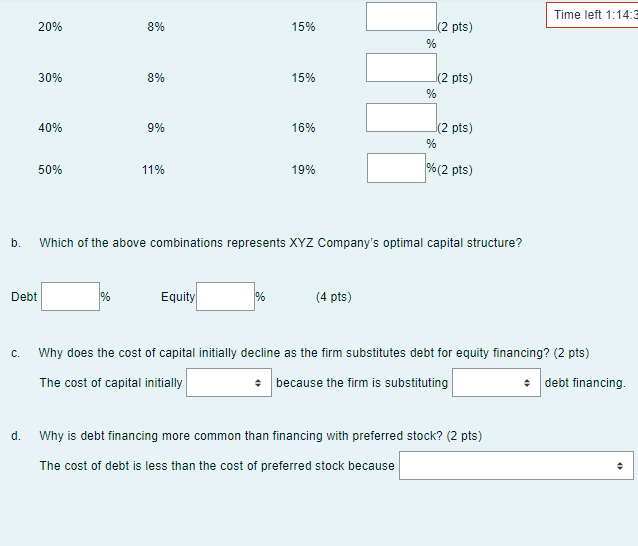

first blank: Increases or Delines 2nd blank: cheaper or expensive 3rd blank: preferred stock is more expensive, of the tax advantage or debt finacing is

first blank: Increases or Delines

2nd blank: cheaper or expensive

3rd blank: preferred stock is more expensive, of the tax advantage or debt finacing is always cheaper

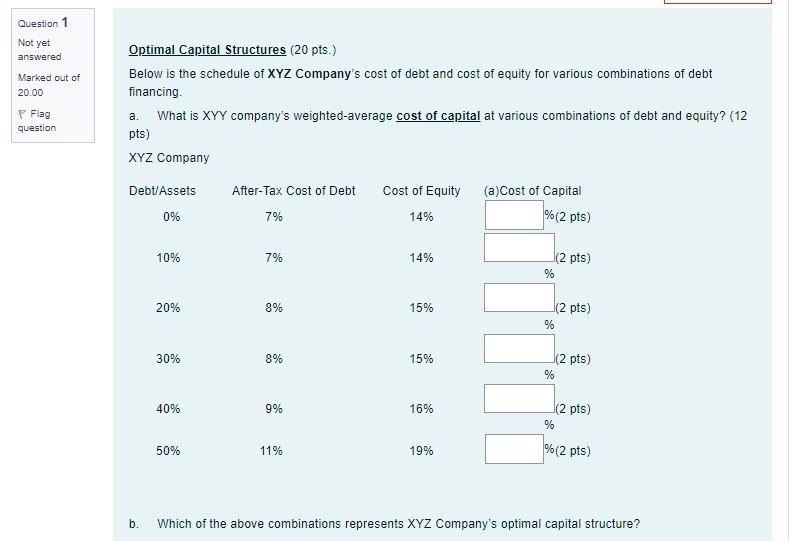

Question 1 Not yet answered Marked out of 20.00 Flag question Optimal Capital Structures (20 pts.) Below is the schedule of XYZ Company's cost of debt and cost of equity for various combinations of debt financing a. What is XYY company's weighted-average cost of capital at various combinations of debt and equity? (12 pts) XYZ Company Debt/Assets After-Tax Cost of Debt Cost of Equity (a)Cost of Capital 0% 7% 14% % (2 pts) 10% 7% 14% (2 pts) % 20% 8% 15% (2 pts) % 30% 8% 15% (2 pts) % 40% 9% 16% (2 pts) % 50% 11% 19% %(2 pts) b. Which of the above combinations represents XYZ Company's optimal capital structure? Time left 1:14 20% 8% 15% (2 pts) % 30% 8% 15% (2 pts) % 40% 9% 16% (2 pts) % 50% 11% 19% %(2 pts) b. Which of the above combinations represents XYZ Company's optimal capital structure? Debt % Equity % (4 pts) C. Why does the cost of capital initially decline as the firm substitutes debt for equity financing? (2 pts) The cost of capital initially because the firm is substituting debt financing d. Why is debt financing more common than financing with preferred stock? (2 pts) The cost of debt is less than the cost of preferred stock becauseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started