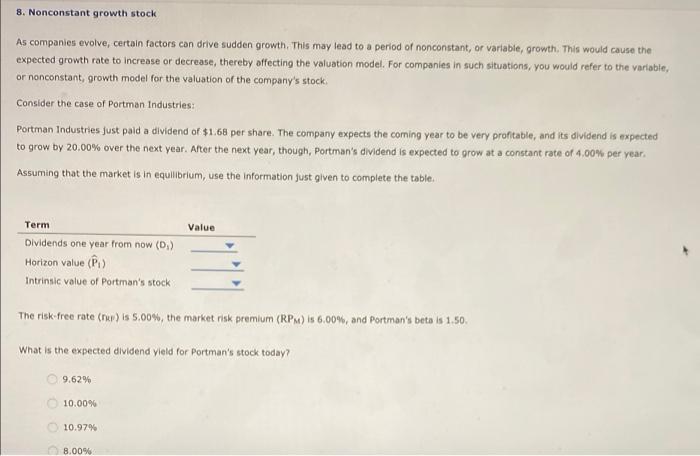

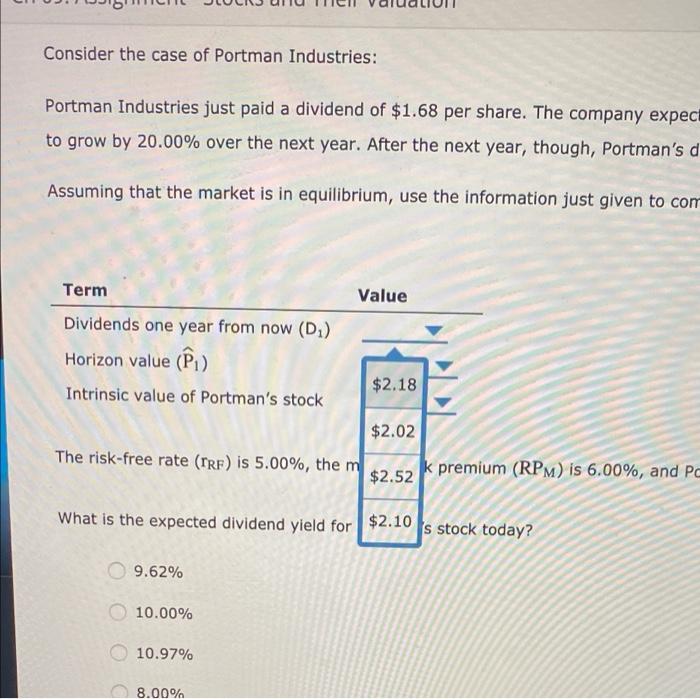

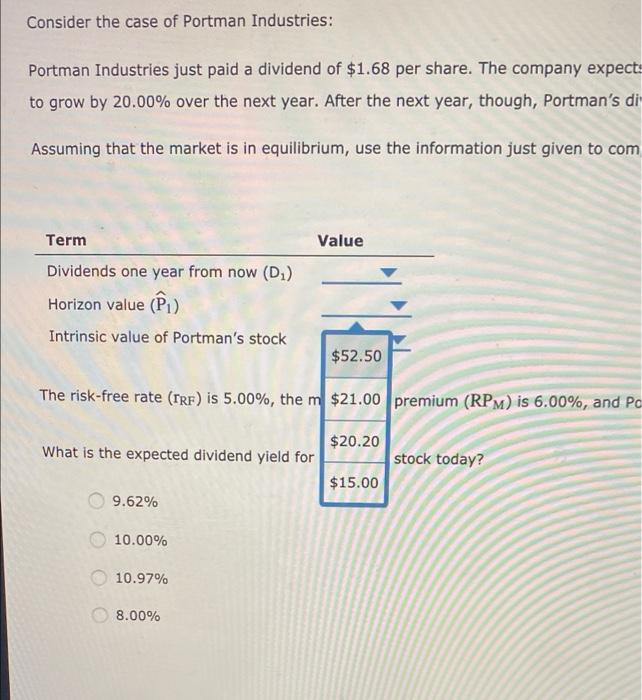

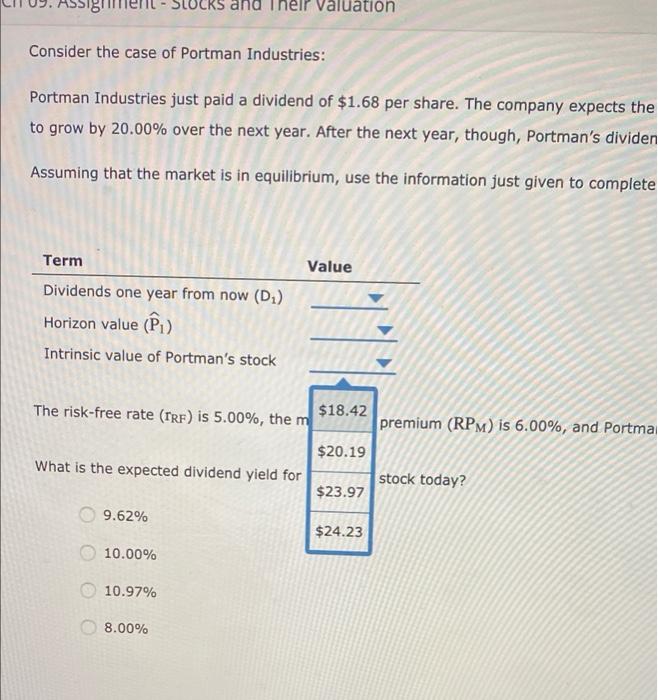

8. Nonconstant growth stock As companies evolve, certain factors can drive sudden growth. This may lead to a period of nonconstant, or variable, growth. This would cause the expected growth rate to Increase or decrease, thereby offecting the valuation model. For companies in such situations, you would refer to the variable, or nonconstant growth model for the valuation of the company's stock, Consider the case of Portman Industries: Portman Industries just paid a dividend of $1.68 per share. The company expects the coming year to be very profitable, and its dividend is expected to grow by 20.00% over the next year. After the next year, though, Portman's dividend is expected to grow at a constant rate of 4,00% per year. Assuming that the market is in equilibrium, use the information just given to complete the table. Value Term Dividends one year from now (D) Horizon value (PU) Intrinsic value of Portman's stock The risk free rate (nu) is 5.00%, the market risk premium (RPM) is 6.00%, and Portman's beta is 1.50 What is the expected dividend yield for Portman's stock today? 9.62% 10.0096 10.97% 8.00% Consider the case of Portman Industries: Portman Industries just paid a dividend of $1.68 per share. The company expect to grow by 20.00% over the next year. After the next year, though, Portman's d Assuming that the market is in equilibrium, use the information just given to com Term Value Dividends one year from now (D) Horizon value (fi) $2.18 Intrinsic value of Portman's stock $2.02 The risk-free rate (TRF) is 5.00%, the m $2.52 k premium (RPM) is 6.00%, and PC What is the expected dividend yield for $2.10 s stock today? 9.62% 10.00% 10.97% 8.00% Consider the case of Portman Industries: Portman Industries just paid a dividend of $1.68 per share. The company expect to grow by 20.00% over the next year. After the next year, though, Portman's di Assuming that the market is in equilibrium, use the information just given to com Term Value Dividends one year from now (D) Horizon value (fi) Intrinsic value of Portman's stock $52.50 The risk-free rate (TRF) is 5.00%, the m $21.00 premium (RPM) is 6.00%, and Po $20.20 What is the expected dividend yield for stock today? $15.00 9.62% 10.00% 10.97% 8.00% Valuation Consider the case of Portman Industries: Portman Industries just paid a dividend of $1.68 per share. The company expects the to grow by 20.00% over the next year. After the next year, though, Portman's dividen Assuming that the market is in equilibrium, use the information just given to complete Term Value Dividends one year from now (D) Horizon value (fi) Intrinsic value of Portman's stock The risk-free rate (IRF) is 5.00%, the m $18.42 premium (RPM) is 6.00%, and Portma $20.19 What is the expected dividend yield for stock today? $23.97 9.62% $24.23 10.00% 10.97% 8.00%