Answered step by step

Verified Expert Solution

Question

1 Approved Answer

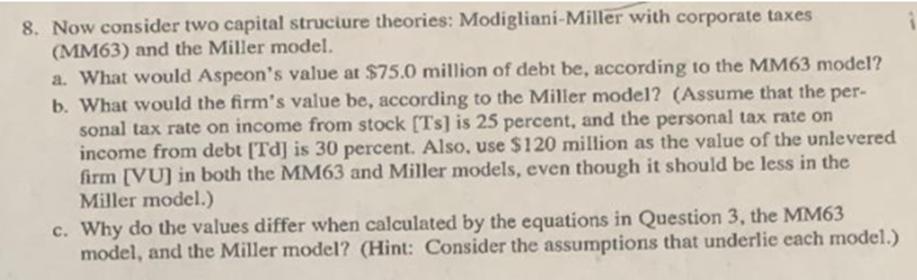

8. Now consider two capital structure theories: Modigliani-Miller with corporate taxes (MM63) and the Miller model. a. What would Aspeon's value at $75.0 million

8. Now consider two capital structure theories: Modigliani-Miller with corporate taxes (MM63) and the Miller model. a. What would Aspeon's value at $75.0 million of debt be, according to the MM63 model? b. What would the firm's value be, according to the Miller model? (Assume that the per- sonal tax rate on income from stock [Ts] is 25 percent, and the personal tax rate on income from debt [Td] is 30 percent. Also, use $120 million as the value of the unlevered firm [VU] in both the MM63 and Miller models, even though it should be less in the Miller model.) Why do the values differ when calculated by the equations in Question 3, the MM63 model, and the Miller model? (Hint: Consider the assumptions that underlie each model.)

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started