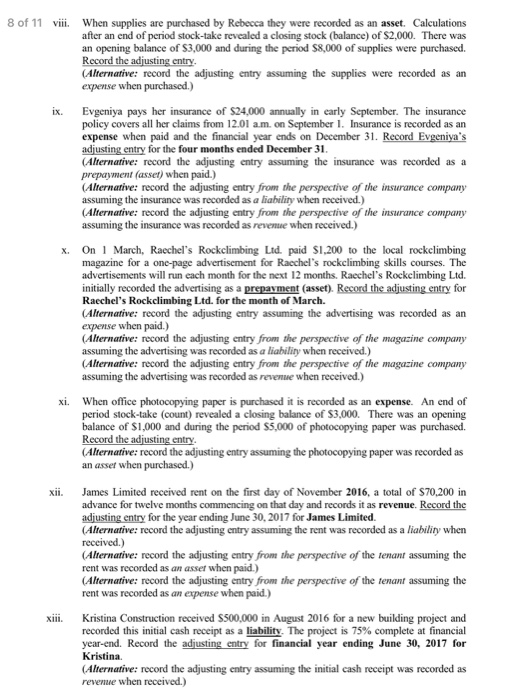

8 of 11 viii. When supplies are purchased by Rebecca they were recorded as an asset. Calculations after an end of period stock-take revealed a closing stock (balance) of S2,000. There was an opening balance of S3,000 and during the period S8,000 of supplies were purchased. Alternative: record the adjusting entry assuming the supplies were recorded as an expense when purchased.) ix. Evgeniya pays her insurance of $24,000 annually in early September. The insurance policy covers all her claims from 12.01 am. on September1. Insurance is recorded as an expense when paid and the financial year ends on December 31. Record Evgeniya's adjusting entry for the four months ended December 31 (Alternative: record the adjusting entry assuming the insurance was recorded as a prepayment (asset) when paid.) (Alternative: record the adjusting entry from the perspective of the insurance company assuming the insurance was recorded as a liability when received.) Alternative: record the adjusting entry from the perspective of the insurance company assuming the insurance was recorded as revenue when received.) x. On March, Raechel's Rockclimbing Ltd. paid S1,200 to the local rockclimbing magazine for a one-page advertisement for Raechel's rockclimbing skills courses. The advertisements will run each month for the next 12 months. Racchel's Rockclimbing Ltd. initially recorded the advertising as a prepayment (asset). Record the adjusting entry for Racchel's Rockclimbing Ltd. for the month of March. (Alternative: record the adjusting entry assuming the advertising was recorded as an expense when paid.) Alternative: record the adjusting entry from the perspective of the magazine company assuming the advertising was recorded as a liability when received.) Alternative: record the adjusting entry from the perspective of the magazine company assuming the advertising was recorded as revenue when received.) xi. When office photocopying paper is purchased it is recorded as an expense. An end of period stock-take (count) revealed a closing balance of S3,000. There was an opening balance of $1,000 and during the period $5,000 of photocopying paper was purchased. Record the (Alternative: record the adjusting entry assuming the photocopying paper was recorded as an asset when purchased.) xii. James Limited received rent on the first day of November 2016, a total of S70,200 in advance for twelve months commencing on that day and records it as revenue. Record the adjusting entry for the year ending June 30. 2017 for James Limited. (Alternative: record the adjusting entry assuming the rent was recorded as a liability when received.) (Alternative: record the adjusting entry from the perspective of the tenant assuming the rent was recorded as an asset when paid.) Alternative: record the adjusting entry from the perspective of the tenant assuming the rent was recorded as an expense when paid.) xiii. Kristina Construction received S500,000 in August 2016 for a new building project and recorded this initial cash receipt as a liability. The project is 75% complete at financial year-end. Record the adjusting entry for financial year ending June 30, 2017 for Kristina. (Alternative: record the adjusting entry assuming the initial cash receipt was recorded as revenue when received.)