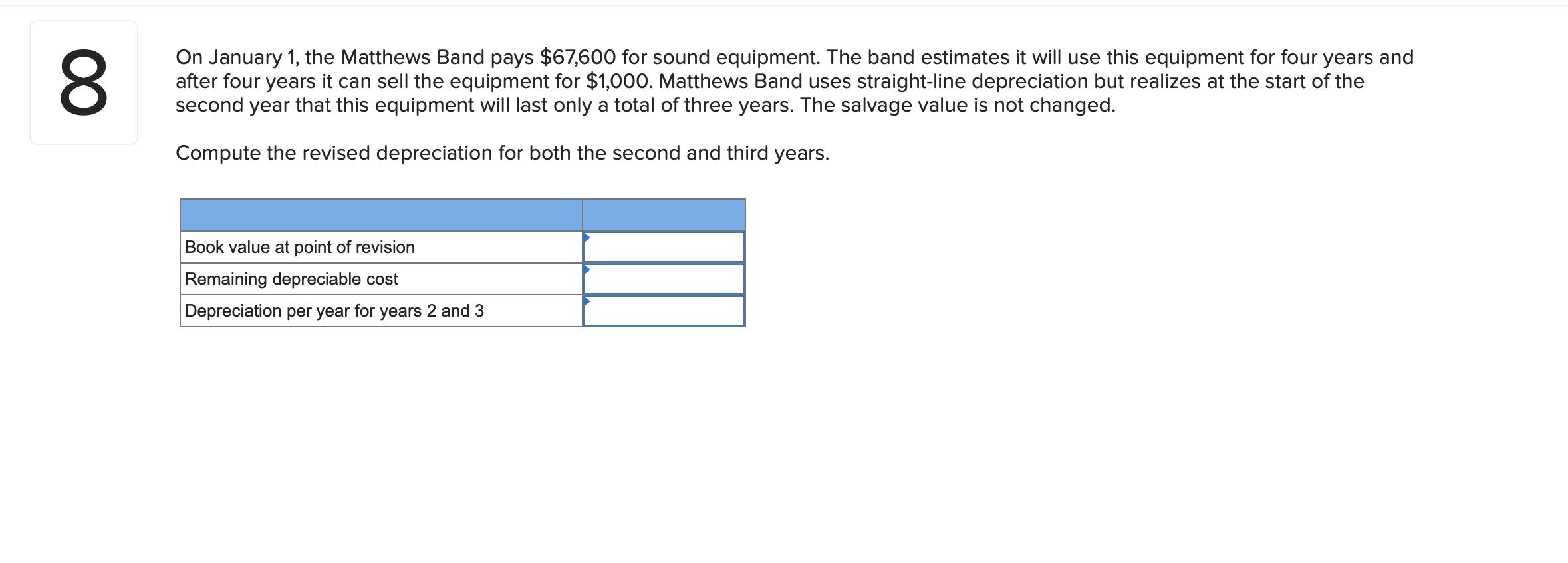

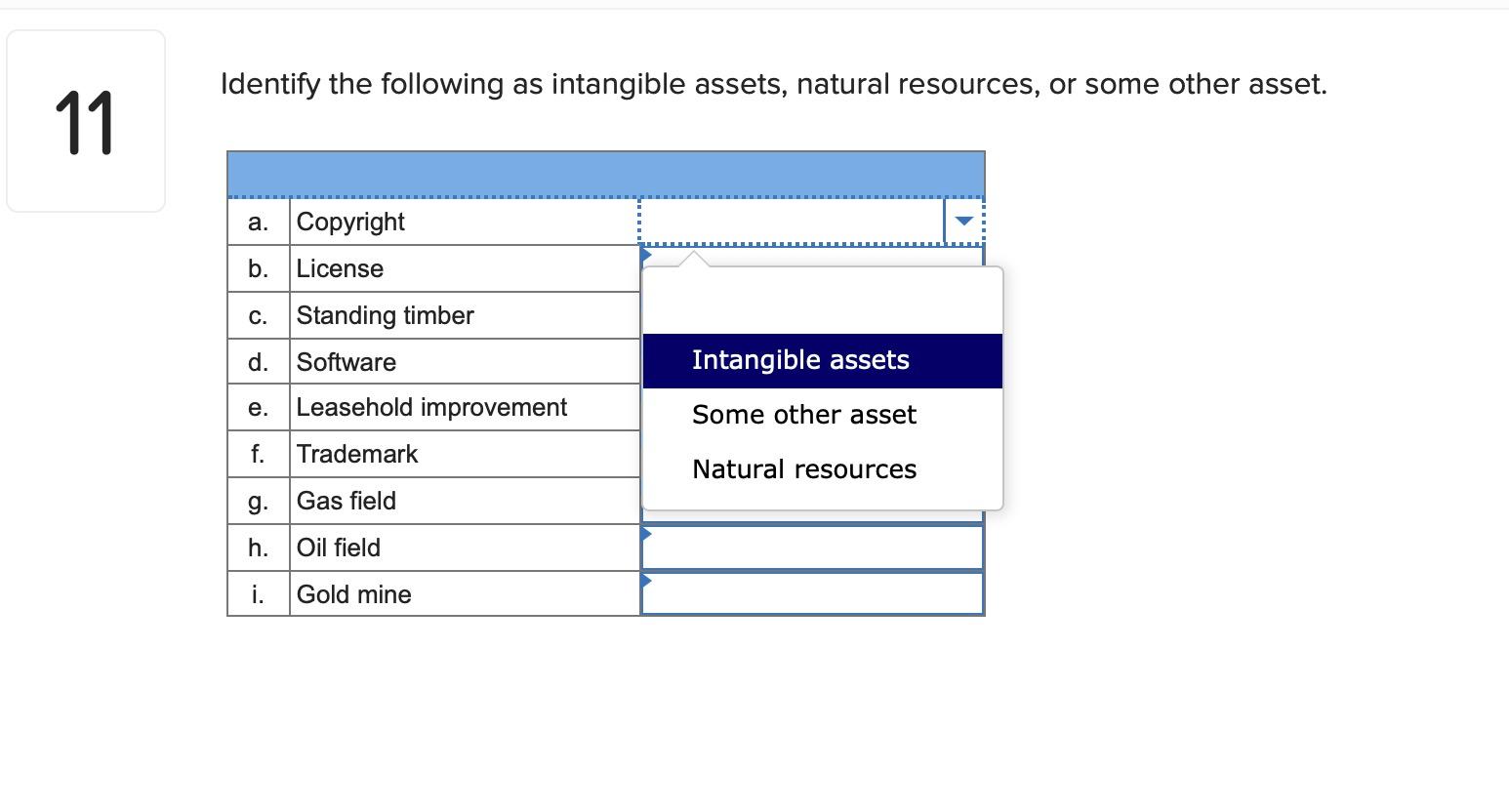

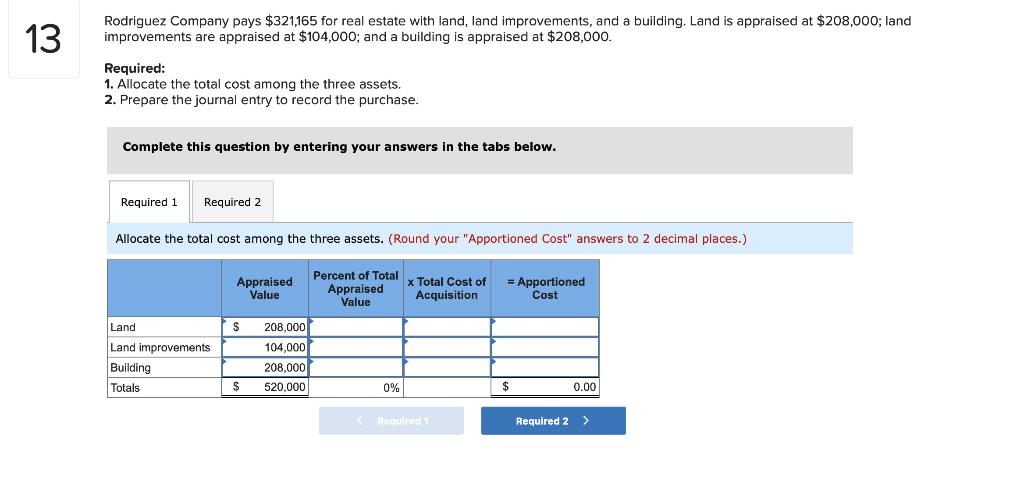

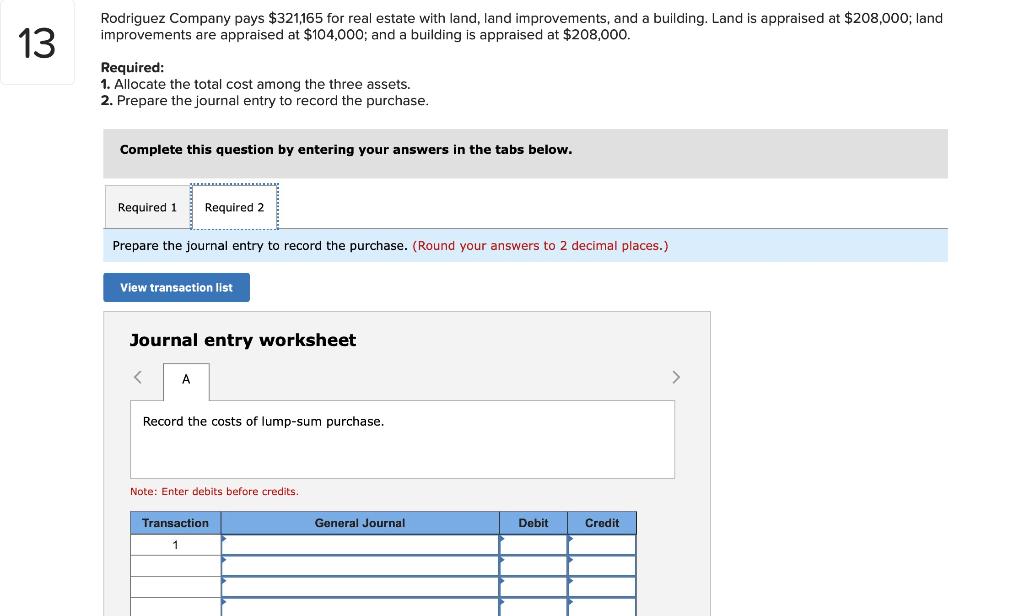

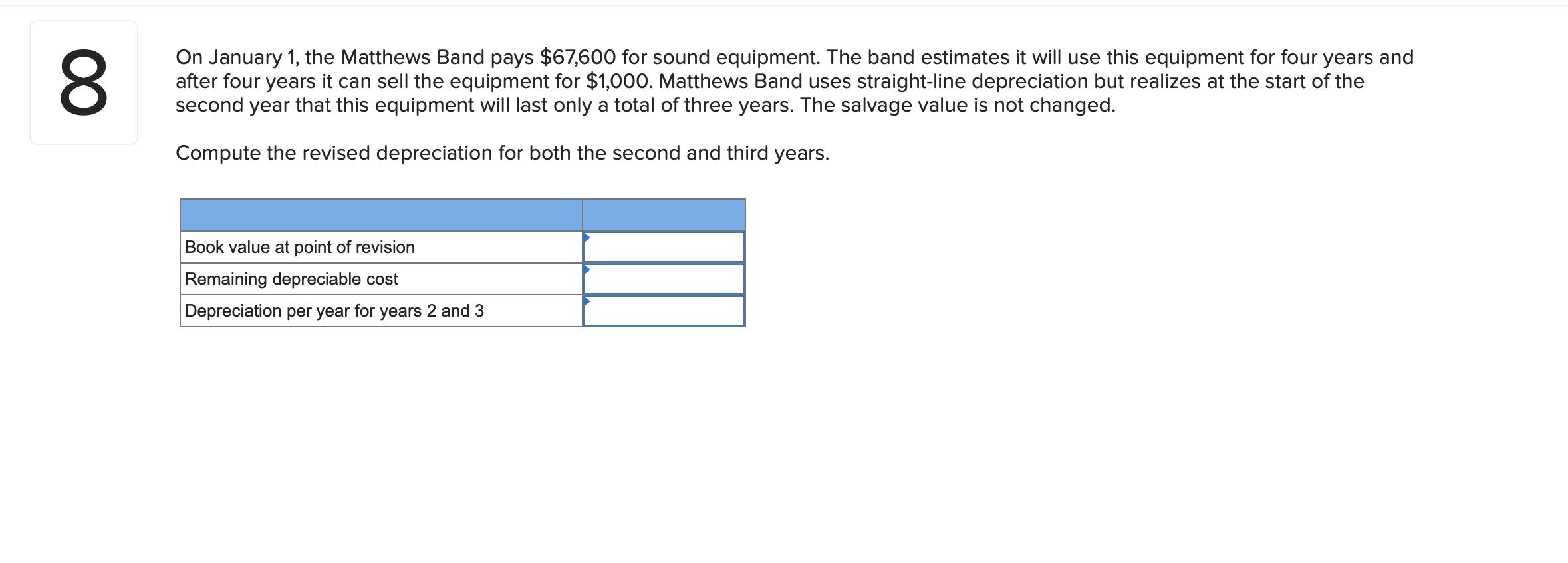

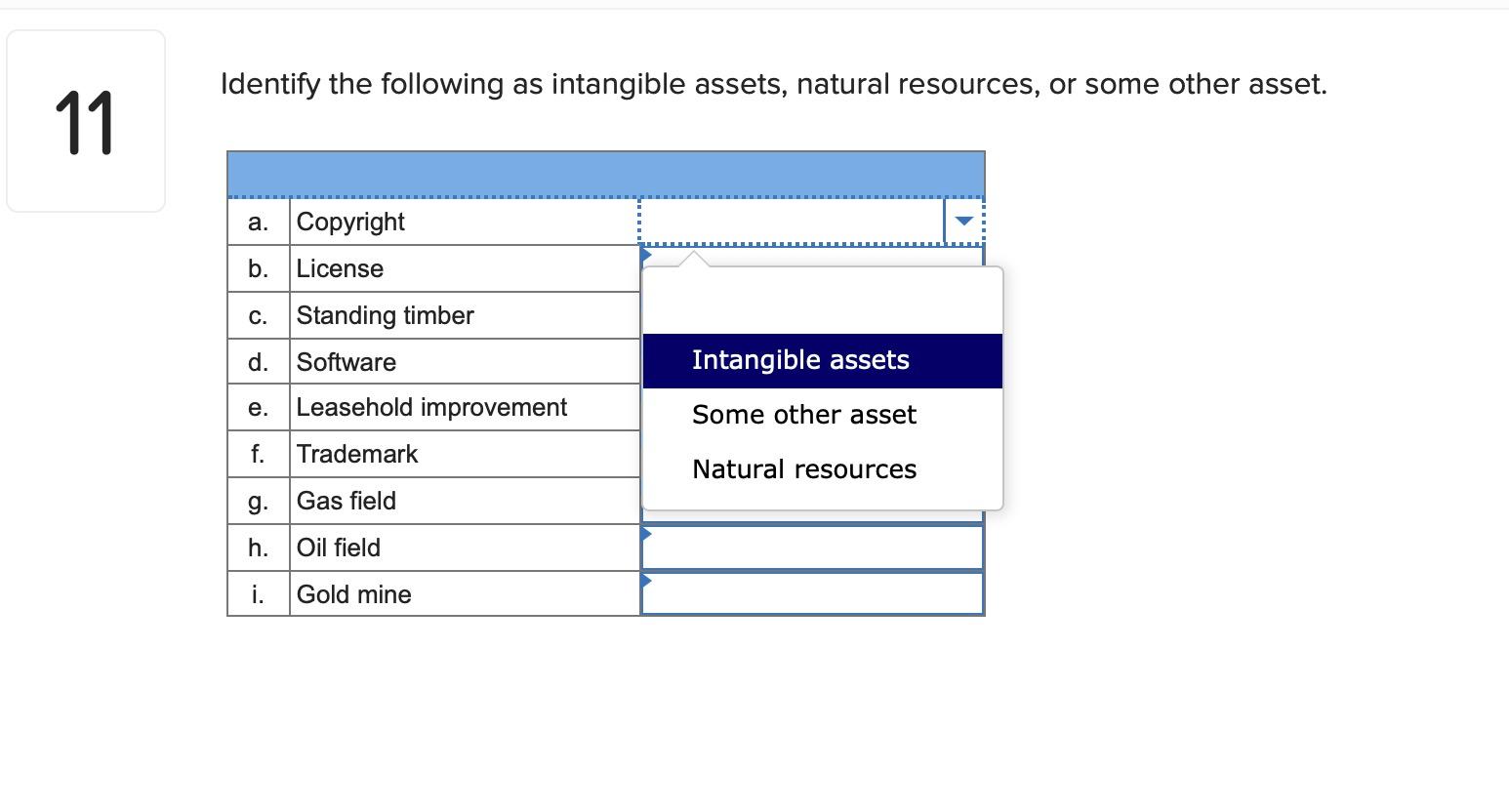

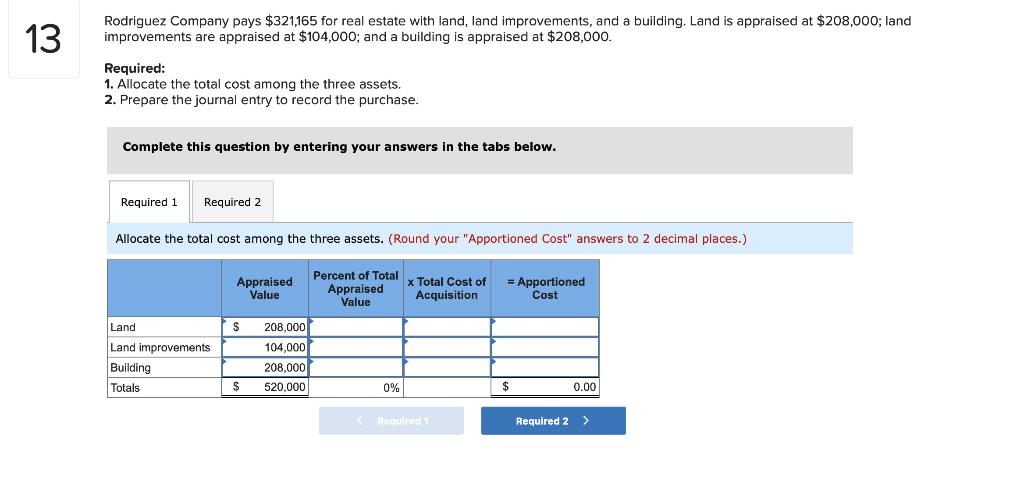

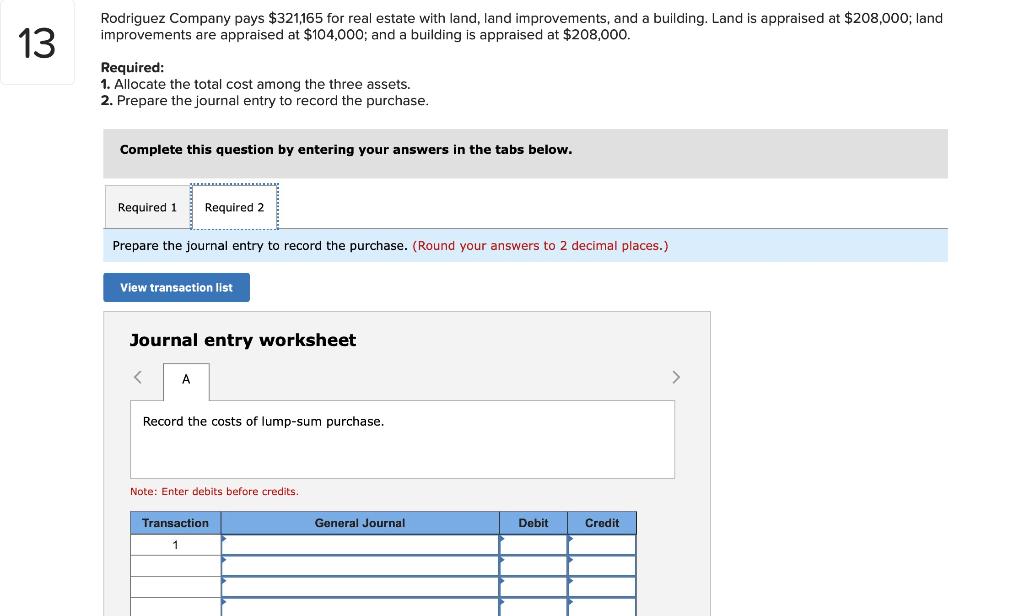

8 On January 1, the Matthews Band pays $67,600 for sound equipment. The band estimates it will use this equipment for four years and after four years it can sell the equipment for $1,000. Matthews Band uses straight-line depreciation but realizes at the start of the second year that this equipment will last only a total of three years. The salvage value is not changed. Compute the revised depreciation for both the second and third years. Book value at point of revision Remaining depreciable cost Depreciation per year for years 2 and 3 Identify the following as intangible assets, natural resources, or some other asset. 11 a. Copyright b. License c. Standing timber d. Software Intangible assets Some other asset Natural resources e. Leasehold improvement f. Trademark g. Gas field h. Oil field i. Gold mine 13 Rodriguez Company pays $321,165 for real estate with land, land improvements, and a building, Land is appraised at $208,000; land improvements are appraised at $104,000; and a building is appraised at $208,000. Required: 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate the total cost among the three assets. (Round your "Apportioned Cost" answers to 2 decimal places.) Appraised Value Percent of Total Appraised Value x Total Cost of Acquisition = Apportioned Cost Land $ Land improvements Building Totals 208,000 104,000 208,000 520,000 $ 0% $ 0.00 Round Required 2 13 Rodriguez Company pays $321,165 for real estate with land, land improvements, and a building. Land is appraised at $208,000; land improvements are appraised at $104,000; and a building is appraised at $208,000. Required: 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry to record the purchase. (Round your answers to 2 decimal places.) View transaction list Journal entry worksheet