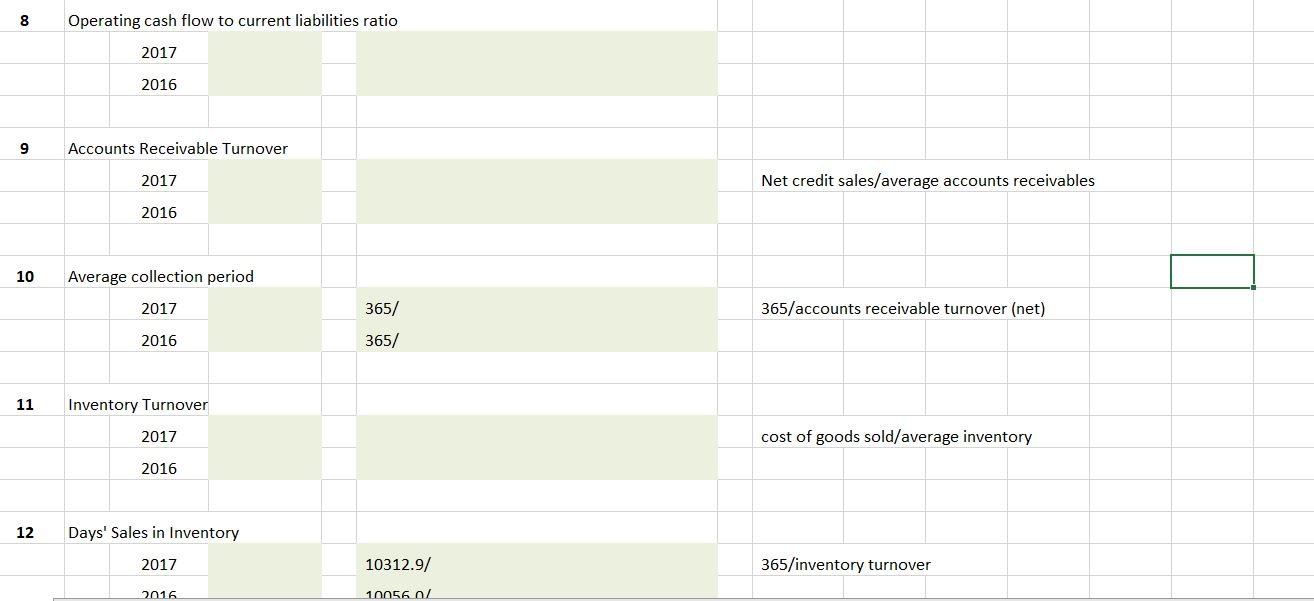

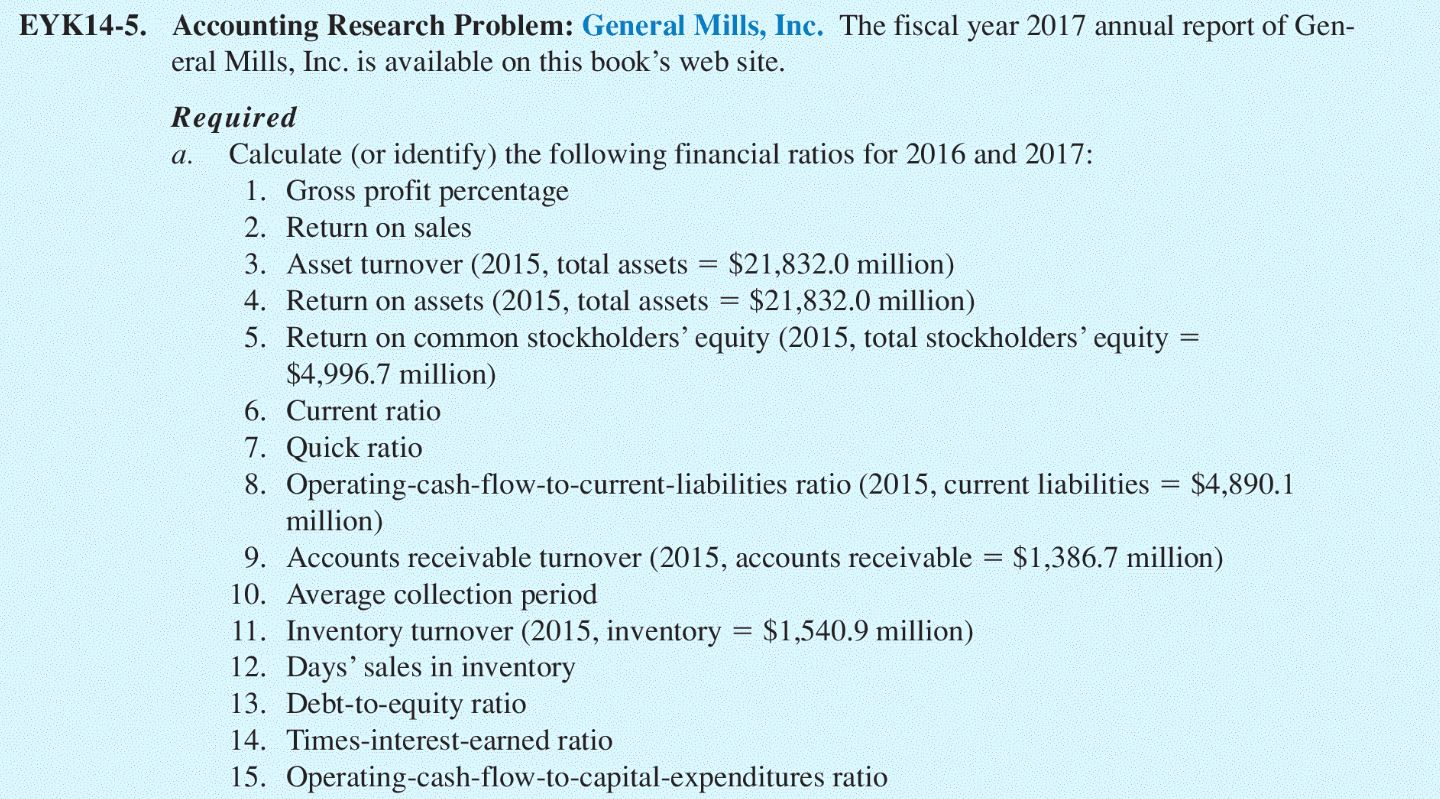

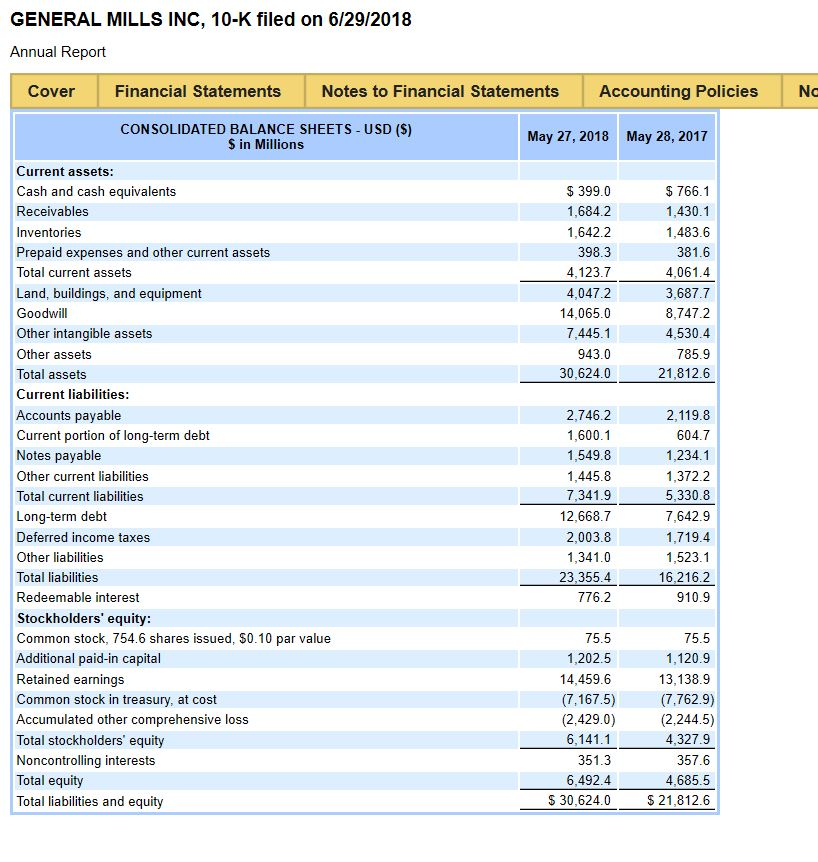

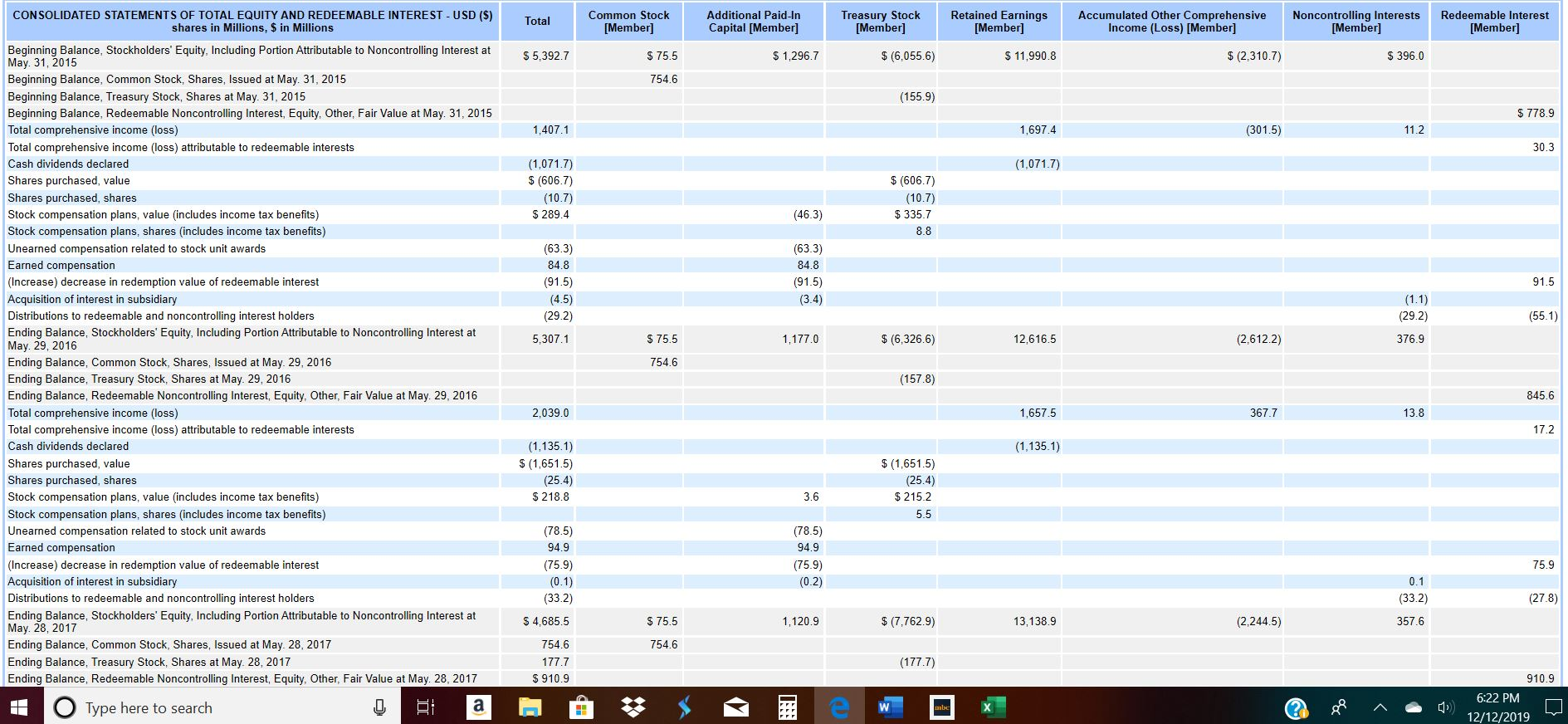

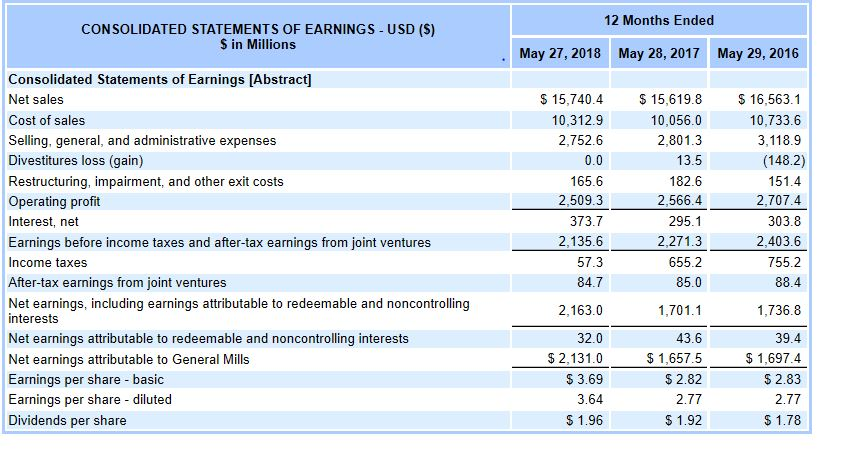

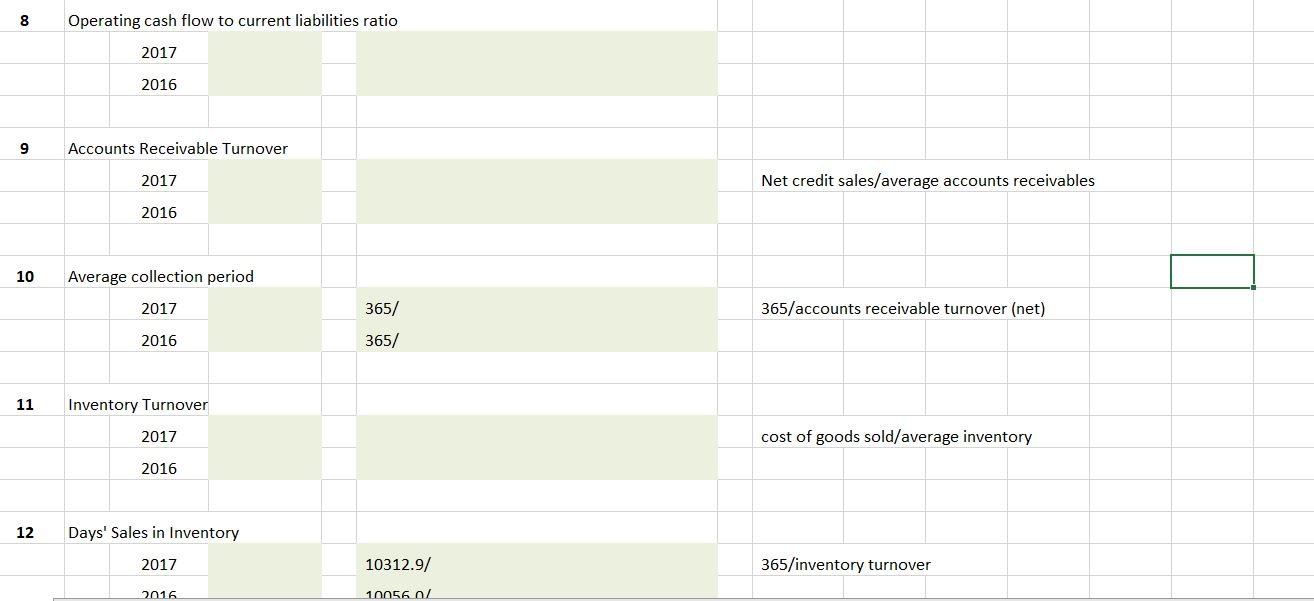

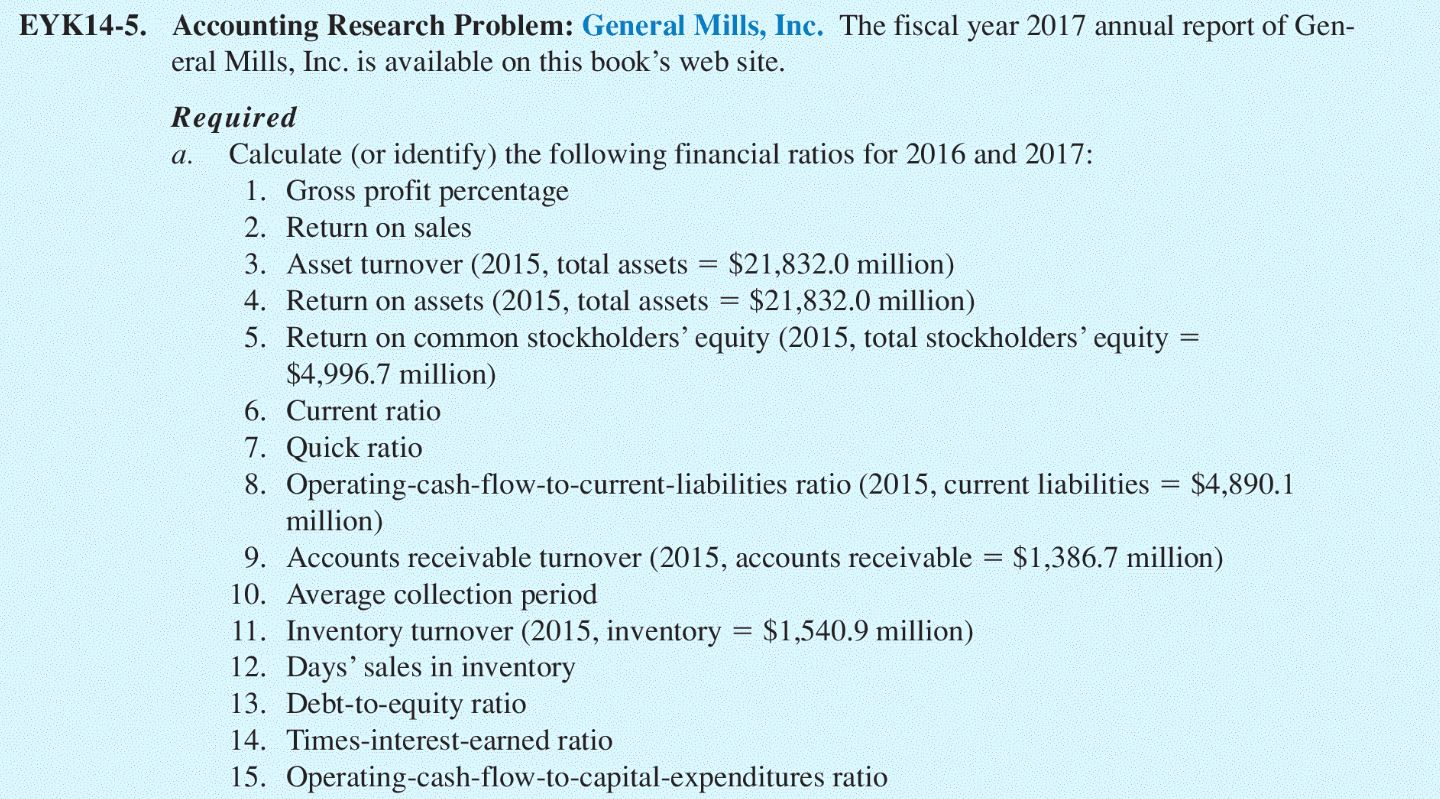

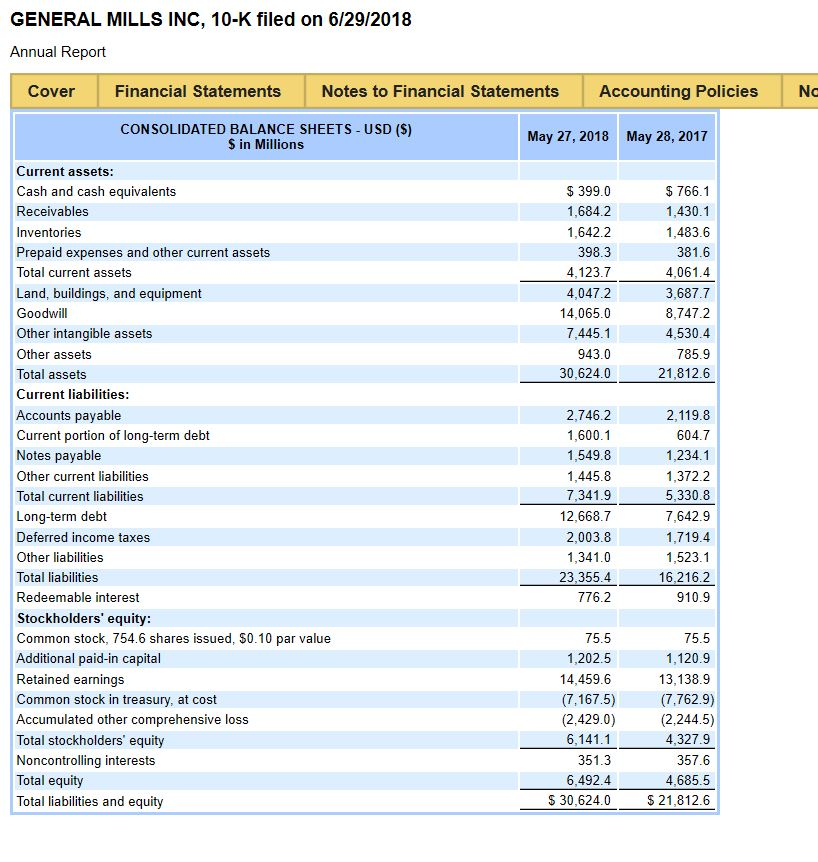

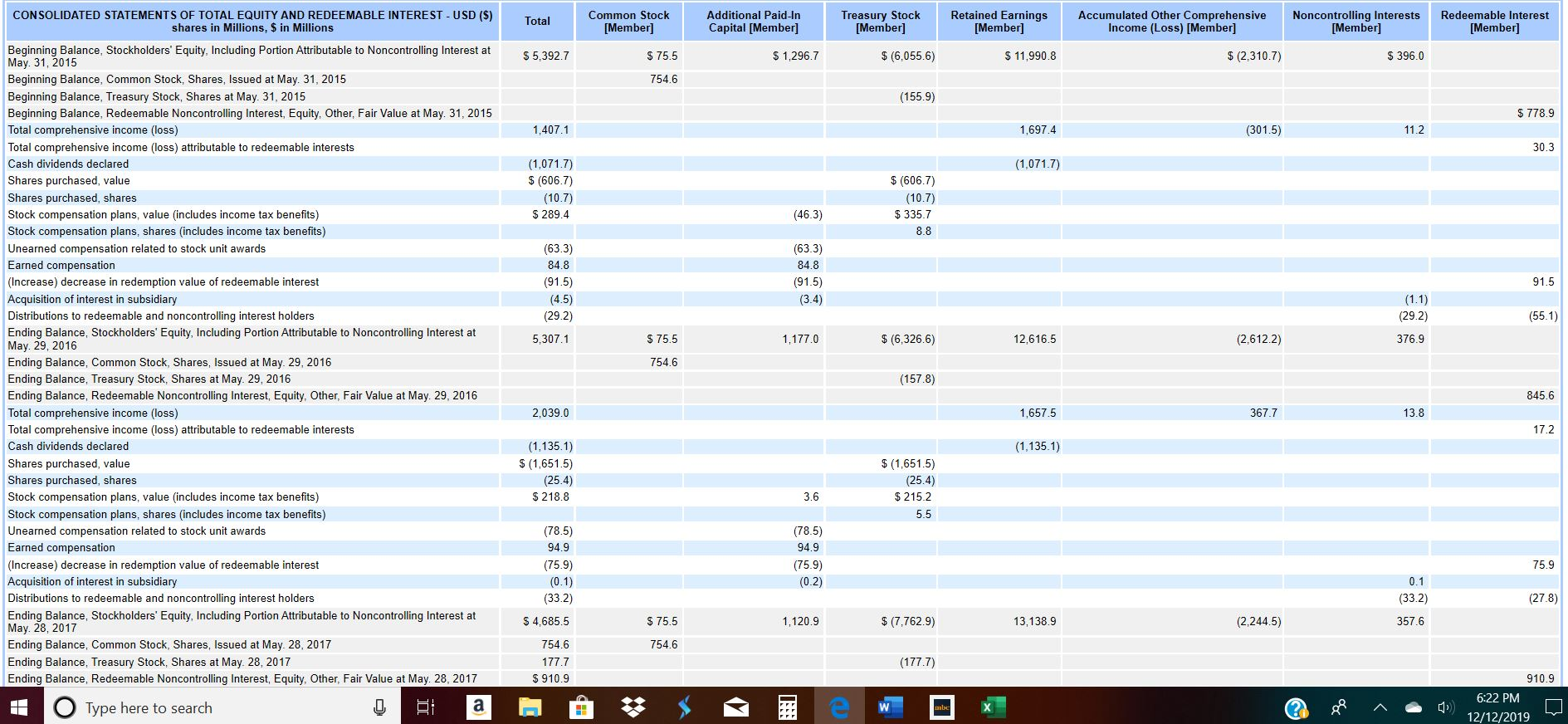

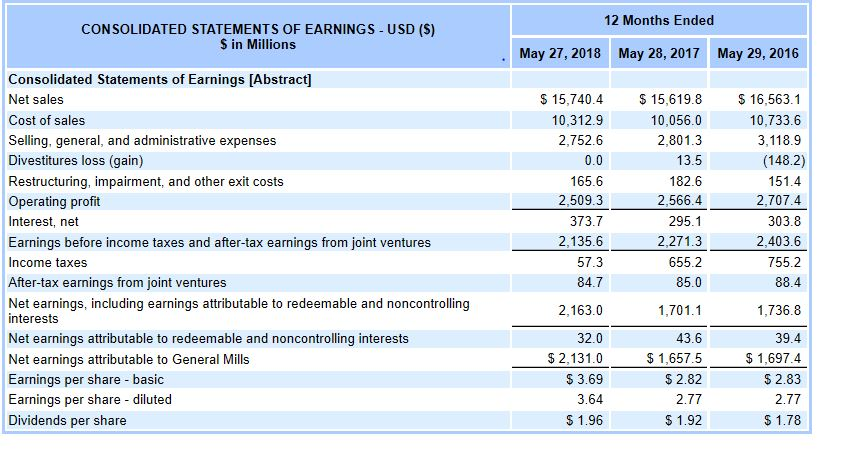

8 Operating cash flow to current liabilities ratio 2017 2016 9 Accounts Receivable Turnover 2017 Net credit sales/average accounts receivables 2016 10 Average collection period 2017 365/ 365/accounts receivable turnover (net) 2016 365/ 11 Inventory Turnover 2017 cost of goods sold/average inventory 2016 12 Days' Sales in Inventory 2017 10312.9/ 365/inventory turnover 2016 10056 0/ GENERAL MILLS INC, 10-K filed on 6/29/2018 Annual Report Cover Financial Statements Notes to Financial Statements Accounting Policies No CONSOLIDATED BALANCE SHEETS - USD ($) Sin Millions May 27, 2018 May 28, 2017 $ 399.0 1,684.2 1,642.2 398.3 4,123.7 4,047.2 14,065.0 7,445.1 943.0 30,624.0 $ 766.1 1,430.1 1,483.6 381.6 4,061.4 3,687.7 8,747.2 4,530.4 785.9 21,812.6 Current assets: Cash and cash equivalents Receivables Inventories Prepaid expenses and other current assets Total current assets Land, buildings, and equipment Goodwill Other intangible assets Other assets Total assets Current liabilities: Accounts payable Current portion of long-term debt Notes payable Other current liabilities Total current liabilities Long-term debt Deferred income taxes Other liabilities Total liabilities Redeemable interest Stockholders' equity: Common stock, 754.6 shares issued, $0.10 par value Additional paid-in capital Retained earnings Common stock in treasury, at cost Accumulated other comprehensive loss Total stockholders' equity Noncontrolling interests Total equity Total liabilities and equity 2,746.2 1,600.1 1,549.8 1,445.8 7,341.9 12,668.7 2,003.8 1,341.0 23,355.4 776.2 2,119.8 604.7 1,234.1 1,372.2 5,330.8 7,642.9 1,719.4 1,523.1 16,216.2 910.9 75.5 1,202.5 14,459.6 (7,167.5) (2.429.0) 6,141.1 351.3 6,492.4 $ 30,624.0 75.5 1,120.9 13,138.9 (7,762.9) (2,244.5) 4.327.9 357.6 4.685.5 $21,812.6 12 Months Ended CONSOLIDATED STATEMENTS OF EARNINGS- USD ($) S in Millions May 27, 2018 May 28, 2017 May 29, 2016 Consolidated Statements of Earnings [Abstract] Net sales Cost of sales Selling, general, and administrative expenses Divestitures loss (gain) Restructuring, impairment, and other exit costs Operating profit Interest, net Earnings before income taxes and after-tax earnings from joint ventures Income taxes After-tax earnings from joint ventures Net earnings, including earnings attributable to redeemable and noncontrolling interests Net earnings attributable to redeemable and noncontrolling interests Net earnings attributable to General Mills Earnings per share - basic Earnings per share - diluted Dividends per share $ 15,740.4 10,312.9 2,752.6 0.0 165.6 2,509.3 373.7 2,135.6 57.3 84.7 2,163.0 $ 15,619.8 10,056.0 2,801.3 13.5 182.6 2,566.4 295.1 2,271.3 655.2 85.0 $ 16,563.1 10,733.6 3,118.9 (148.2) 151.4 2,707.4 303.8 2,403.6 755.2 88.4 1,701.1 1,736.8 43.6 32.0 $ 2,131.0 $ 3.69 3.64 $ 1.96 $ 1,657.5 $ 2.82 2.77 $ 1.92 39.4 $ 1,697.4 $ 2.83 2.77 $ 1.78