Answered step by step

Verified Expert Solution

Question

1 Approved Answer

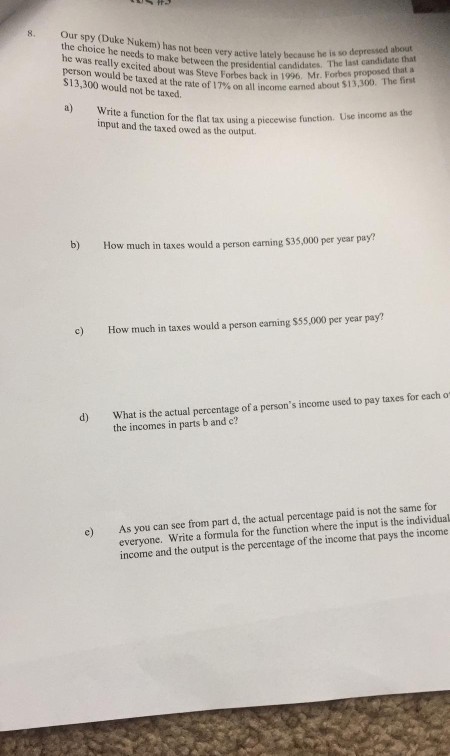

8. Our spy (Duke Nukem) has not ben vary acive lately becaea the choice he needs to make between the presidential candid Mr. Forbes propo

8. Our spy (Duke Nukem) has not ben vary acive lately becaea the choice he needs to make between the presidential candid Mr. Forbes propo The first about presidential candidates. The last candidate that carned about $13,300. The finst is so he was really excited about was Steve Forbes back in 1996 person would be taxed at the rate of 17% on all income S13,300 would not be taxed. the flat tax using a piecewise function. Use income as the owed as the output input and the taxed b) How much in taxes would a person earning $35,000 per year pay? c) How much in taxes would a person earning $55,000 per year pay? d) What is the actual percentage of a person's income used to pay taxes for each o the incomes in parts b and c? everyone. Write a formula for the function where the input is the individual income and the output is the percentage of the income that pays the income e) As you can see from part d, the actual percentage paid is not the same for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started