Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. Please take a look at the account names before Pharoah Co. owes $198,200 to Novak Inc. The debt is a 10 -year, 11% note.

8.

Please take a look at the account names before

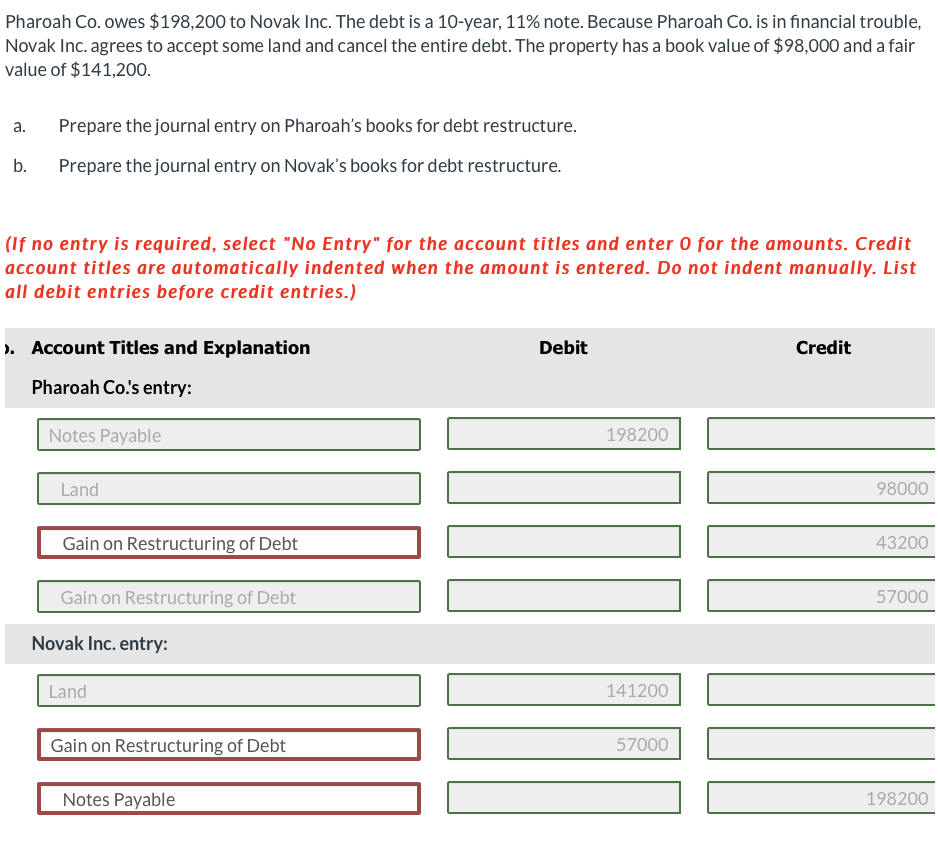

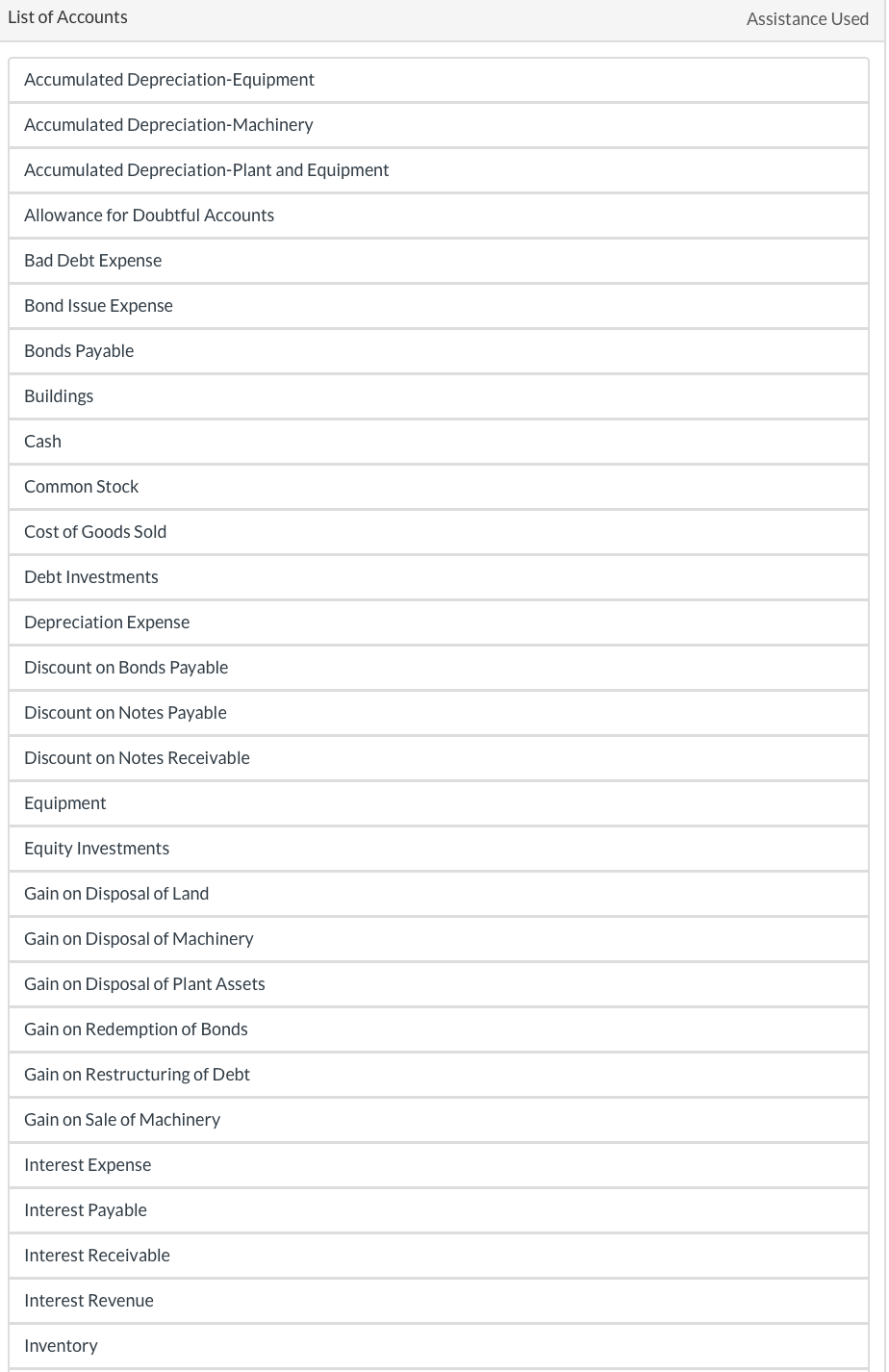

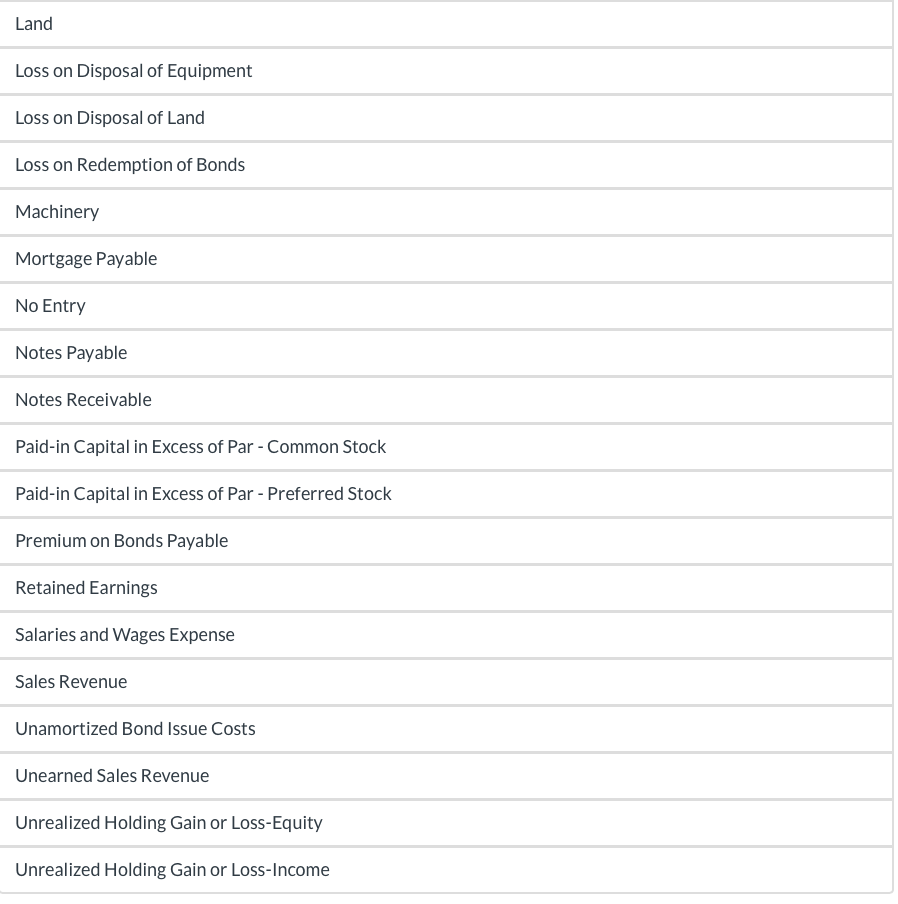

Pharoah Co. owes $198,200 to Novak Inc. The debt is a 10 -year, 11% note. Because Pharoah Co. is in financial trouble, Novak Inc. agrees to accept some land and cancel the entire debt. The property has a book value of $98,000 and a fair value of $141,200. a. Prepare the journal entry on Pharoah's books for debt restructure. b. Prepare the journal entry on Novak's books for debt restructure. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) List of Accounts Assistance Used Accumulated Depreciation-Equipment Accumulated Depreciation-Machinery Accumulated Depreciation-Plant and Equipment Allowance for Doubtful Accounts Bad Debt Expense Bond Issue Expense Bonds Payable Buildings Cash Common Stock Cost of Goods Sold Debt Investments Depreciation Expense Discount on Bonds Payable Discount on Notes Payable Discount on Notes Receivable Equipment Equity Investments Gain on Disposal of Land Gain on Disposal of Machinery Gain on Disposal of Plant Assets Gain on Redemption of Bonds Gain on Restructuring of Debt Gain on Sale of Machinery Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Loss on Disposal of Equipment Loss on Disposal of Land Loss on Redemption of Bonds Machinery Mortgage Payable No Entry Notes Payable Notes Receivable Paid-in Capital in Excess of Par - Common Stock Paid-in Capital in Excess of Par - Preferred Stock Premium on Bonds Payable Retained Earnings Salaries and Wages Expense Sales Revenue Unamortized Bond Issue Costs Unearned Sales Revenue Unrealized Holding Gain or Loss-Equity Unrealized Holding Gain or Loss-Income

Pharoah Co. owes $198,200 to Novak Inc. The debt is a 10 -year, 11% note. Because Pharoah Co. is in financial trouble, Novak Inc. agrees to accept some land and cancel the entire debt. The property has a book value of $98,000 and a fair value of $141,200. a. Prepare the journal entry on Pharoah's books for debt restructure. b. Prepare the journal entry on Novak's books for debt restructure. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) List of Accounts Assistance Used Accumulated Depreciation-Equipment Accumulated Depreciation-Machinery Accumulated Depreciation-Plant and Equipment Allowance for Doubtful Accounts Bad Debt Expense Bond Issue Expense Bonds Payable Buildings Cash Common Stock Cost of Goods Sold Debt Investments Depreciation Expense Discount on Bonds Payable Discount on Notes Payable Discount on Notes Receivable Equipment Equity Investments Gain on Disposal of Land Gain on Disposal of Machinery Gain on Disposal of Plant Assets Gain on Redemption of Bonds Gain on Restructuring of Debt Gain on Sale of Machinery Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Loss on Disposal of Equipment Loss on Disposal of Land Loss on Redemption of Bonds Machinery Mortgage Payable No Entry Notes Payable Notes Receivable Paid-in Capital in Excess of Par - Common Stock Paid-in Capital in Excess of Par - Preferred Stock Premium on Bonds Payable Retained Earnings Salaries and Wages Expense Sales Revenue Unamortized Bond Issue Costs Unearned Sales Revenue Unrealized Holding Gain or Loss-Equity Unrealized Holding Gain or Loss-Income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started