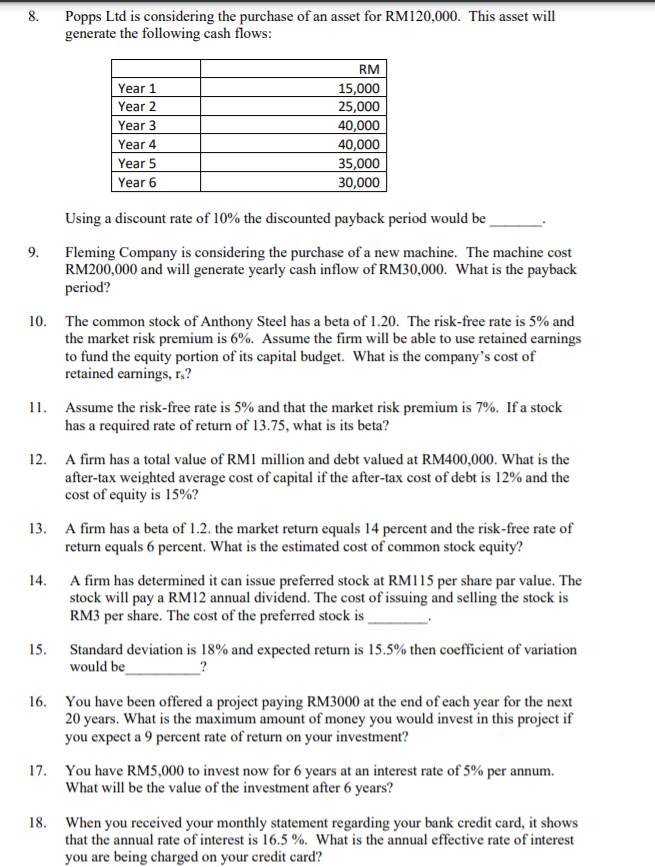

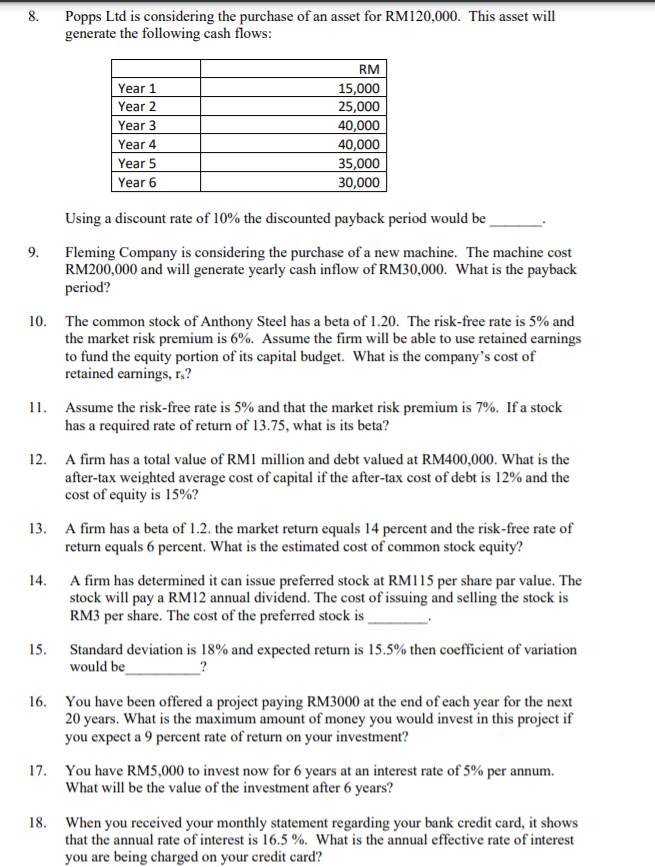

8. Popps Ltd is considering the purchase of an asset for RM120,000. This asset will generate the following cash flows: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 RM 15,000 25,000 40,000 40,000 35,000 30,000 Using a discount rate of 10% the discounted payback period would be 9. Fleming Company is considering the purchase of a new machine. The machine cost RM200,000 and will generate yearly cash inflow of RM30,000. What is the payback period? 10. The common stock of Anthony Steel has a beta of 1.20. The risk-free rate is 5% and the market risk premium is 6%. Assume the firm will be able to use retained earnings to fund the equity portion of its capital budget. What is the company's cost of retained earnings, rs? 11. Assume the risk-free rate is 5% and that the market risk premium is 7%. If a stock has a required rate of return of 13.75, what is its beta? 12. A firm has a total value of RM1 million and debt valued at RM400,000. What is the after-tax weighted average cost of capital if the after-tax cost of debt is 12% and the cost of equity is 15%? 13. A firm has a beta of 1.2. the market return equals 14 percent and the risk-free rate of return equals 6 percent. What is the estimated cost of common stock equity? A firm has determined it can issue preferred stock at RM115 per share par value. The stock will pay a RM12 annual dividend. The cost of issuing and selling the stock is RM3 per share. The cost of the preferred stock is 15. Standard deviation is 18% and expected return is 15.5% then coefficient of variation would be 14. 16. You have been offered a project paying RM3000 at the end of each year for the next 20 years. What is the maximum amount of money you would invest in this project if you expect a 9 percent rate of return on your investment? 17. You have RM5,000 to invest now for 6 years at an interest rate of 5% per annum. What will be the value of the investment after 6 years? 18. When you received your monthly statement regarding your bank credit card, it shows that the annual rate of interest is 16.5 %. What is the annual effective rate of interest you are being charged on your credit card? 19. What is the present value of a RM10,000 perpetuity discounted at 8%? 20. You plan to invest RM500 each month for three years, starting at the end of this month. If you make 36 monthly investments at the end of each month, what will your total investment be worth at the end of 3 years? The rate of interest on your savings will be 0.5% per month. [60 Marks