Question: 8. Portab. electronics manufacturer is considering developing a new portable printer. Their preliminary analysis has determined the first-year selling price, administrative cost, and advertising

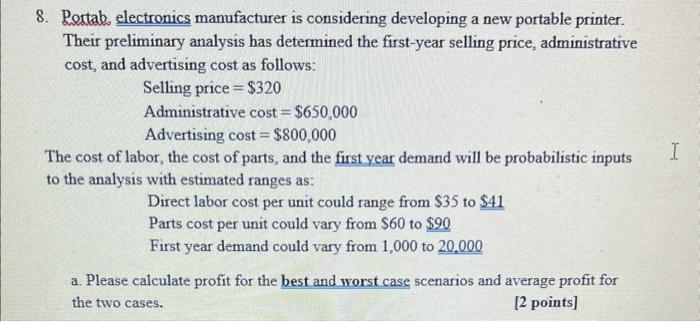

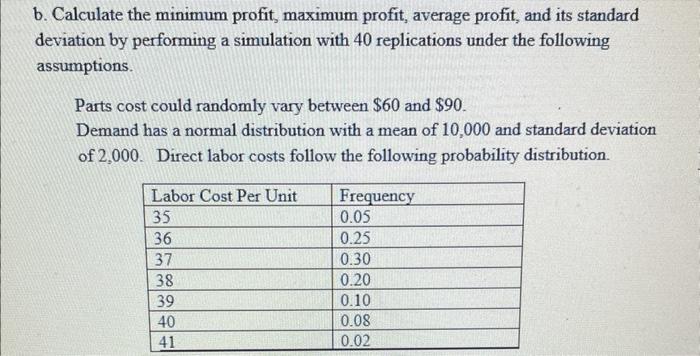

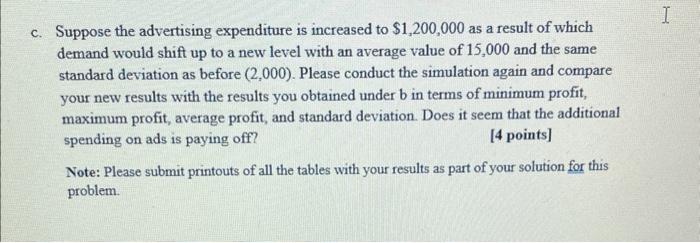

8. Portab. electronics manufacturer is considering developing a new portable printer. Their preliminary analysis has determined the first-year selling price, administrative cost, and advertising cost as follows: Selling price $320 Administrative cost = $650,000 Advertising cost $800,000 The cost of labor, the cost of parts, and the first year demand will be probabilistic inputs to the analysis with estimated ranges as: Direct labor cost per unit could range from $35 to $41 Parts cost per unit could vary from $60 to $90 First year demand could vary from 1,000 to 20,000 = a. Please calculate profit for the best and worst case scenarios and average profit for the two cases. [2 points] I b. Calculate the minimum profit, maximum profit, average profit, and its standard deviation by performing a simulation with 40 replications under the following assumptions. Parts cost could randomly vary between $60 and $90. Demand has a normal distribution with a mean of 10,000 and standard deviation of 2,000. Direct labor costs follow the following probability distribution. Labor Cost Per Unit 35 36 37 38 39 40 41 Frequency 0.05 0.25 0.30 0.20 0.10 0.08 0.02 c. Suppose the advertising expenditure is increased to $1,200,000 as a result of which demand would shift up to new level with an average value of 15,000 and the same standard deviation as before (2,000). Please conduct the simulation again and compare your new results with the results you obtained under b in terms of minimum profit, maximum profit, average profit, and standard deviation. Does it seem that the additional spending on ads is paying off? [4 points] Note: Please submit printouts of all the tables with your results as part of your solution for this problem. I 8. Portab. electronics manufacturer is considering developing a new portable printer. Their preliminary analysis has determined the first-year selling price, administrative cost, and advertising cost as follows: Selling price $320 Administrative cost = $650,000 Advertising cost $800,000 The cost of labor, the cost of parts, and the first year demand will be probabilistic inputs to the analysis with estimated ranges as: Direct labor cost per unit could range from $35 to $41 Parts cost per unit could vary from $60 to $90 First year demand could vary from 1,000 to 20,000 = a. Please calculate profit for the best and worst case scenarios and average profit for the two cases. [2 points] I b. Calculate the minimum profit, maximum profit, average profit, and its standard deviation by performing a simulation with 40 replications under the following assumptions. Parts cost could randomly vary between $60 and $90. Demand has a normal distribution with a mean of 10,000 and standard deviation of 2,000. Direct labor costs follow the following probability distribution. Labor Cost Per Unit 35 36 37 38 39 40 41 Frequency 0.05 0.25 0.30 0.20 0.10 0.08 0.02 c. Suppose the advertising expenditure is increased to $1,200,000 as a result of which demand would shift up to new level with an average value of 15,000 and the same standard deviation as before (2,000). Please conduct the simulation again and compare your new results with the results you obtained under b in terms of minimum profit, maximum profit, average profit, and standard deviation. Does it seem that the additional spending on ads is paying off? [4 points] Note: Please submit printouts of all the tables with your results as part of your solution for this problem. I 8. Portab. electronics manufacturer is considering developing a new portable printer. Their preliminary analysis has determined the first-year selling price, administrative cost, and advertising cost as follows: Selling price $320 Administrative cost = $650,000 Advertising cost $800,000 The cost of labor, the cost of parts, and the first year demand will be probabilistic inputs to the analysis with estimated ranges as: Direct labor cost per unit could range from $35 to $41 Parts cost per unit could vary from $60 to $90 First year demand could vary from 1,000 to 20,000 = a. Please calculate profit for the best and worst case scenarios and average profit for the two cases. [2 points] I b. Calculate the minimum profit, maximum profit, average profit, and its standard deviation by performing a simulation with 40 replications under the following assumptions. Parts cost could randomly vary between $60 and $90. Demand has a normal distribution with a mean of 10,000 and standard deviation of 2,000. Direct labor costs follow the following probability distribution. Labor Cost Per Unit 35 36 37 38 39 40 41 Frequency 0.05 0.25 0.30 0.20 0.10 0.08 0.02 c. Suppose the advertising expenditure is increased to $1,200,000 as a result of which demand would shift up to new level with an average value of 15,000 and the same standard deviation as before (2,000). Please conduct the simulation again and compare your new results with the results you obtained under b in terms of minimum profit, maximum profit, average profit, and standard deviation. Does it seem that the additional spending on ads is paying off? [4 points] Note: Please submit printouts of all the tables with your results as part of your solution for this problem. I

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts