Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(8) Q.4:- Following are the direct exchange rates of Euro (EUR) and Canadian Dollar (CAD) at the beginning of each of the last 10

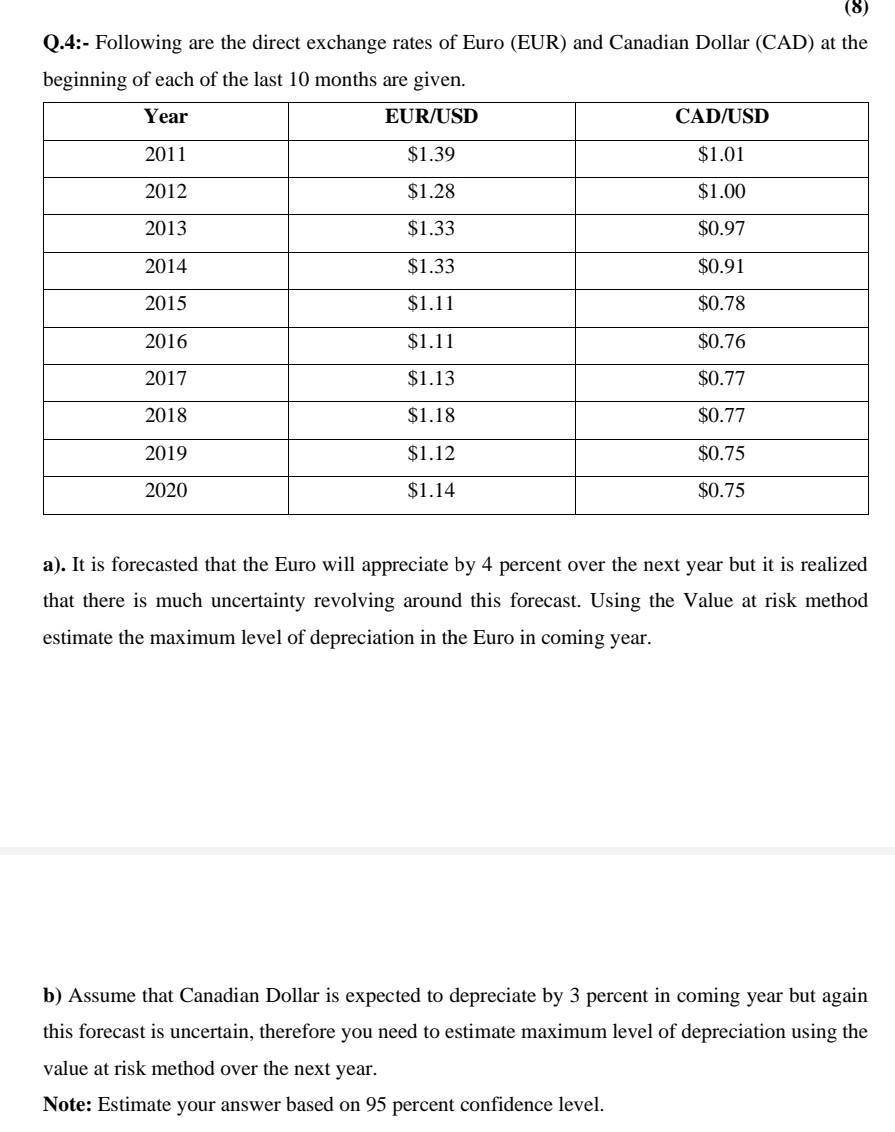

(8) Q.4:- Following are the direct exchange rates of Euro (EUR) and Canadian Dollar (CAD) at the beginning of each of the last 10 months are given. Year EUR/USD CAD/USD 2011 $1.39 $1.01 2012 $1.28 $1.00 2013 $1.33 $0.97 2014 $1.33 $0.91 2015 $1.11 $0.78 2016 $1.11 $0.76 2017 $1.13 $0.77 2018 $1.18 $0.77 2019 $1.12 $0.75 2020 $1.14 $0.75 a). It is forecasted that the Euro will appreciate by 4 percent over the next year but it is realized that there is much uncertainty revolving around this forecast. Using the Value at risk method estimate the maximum level of depreciation in the Euro in coming year. b) Assume that Canadian Dollar is expected to depreciate by 3 percent in coming year but again this forecast is uncertain, therefore you need to estimate maximum level of depreciation using the value at risk method over the next year. Note: Estimate your answer based on 95 percent confidence level.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The maximum level of depreciation in the Euro in coming year can be estimated using the Value a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started