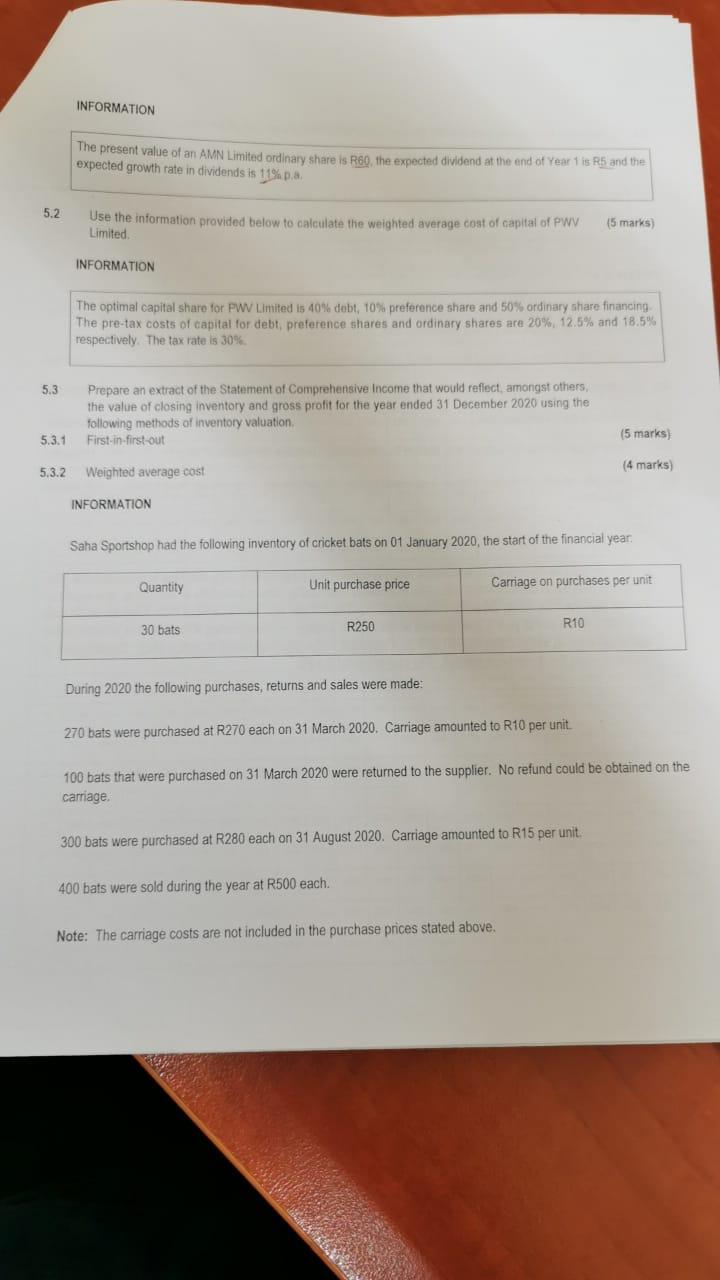

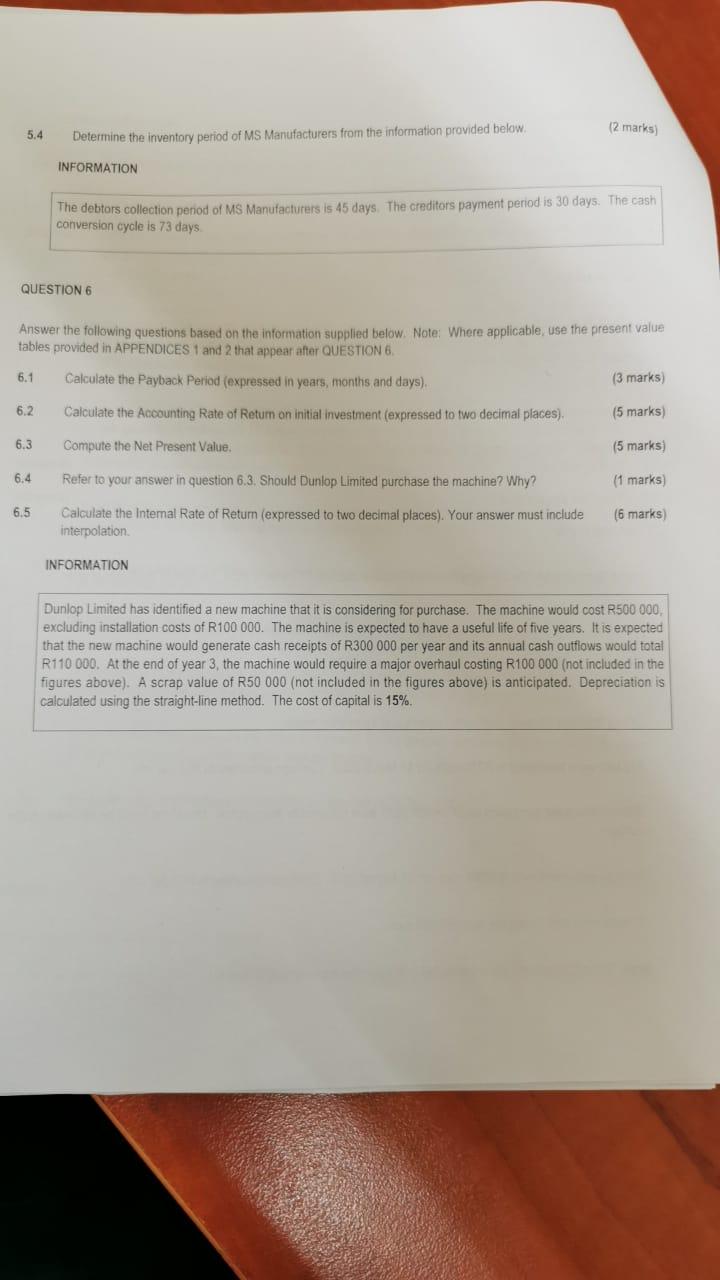

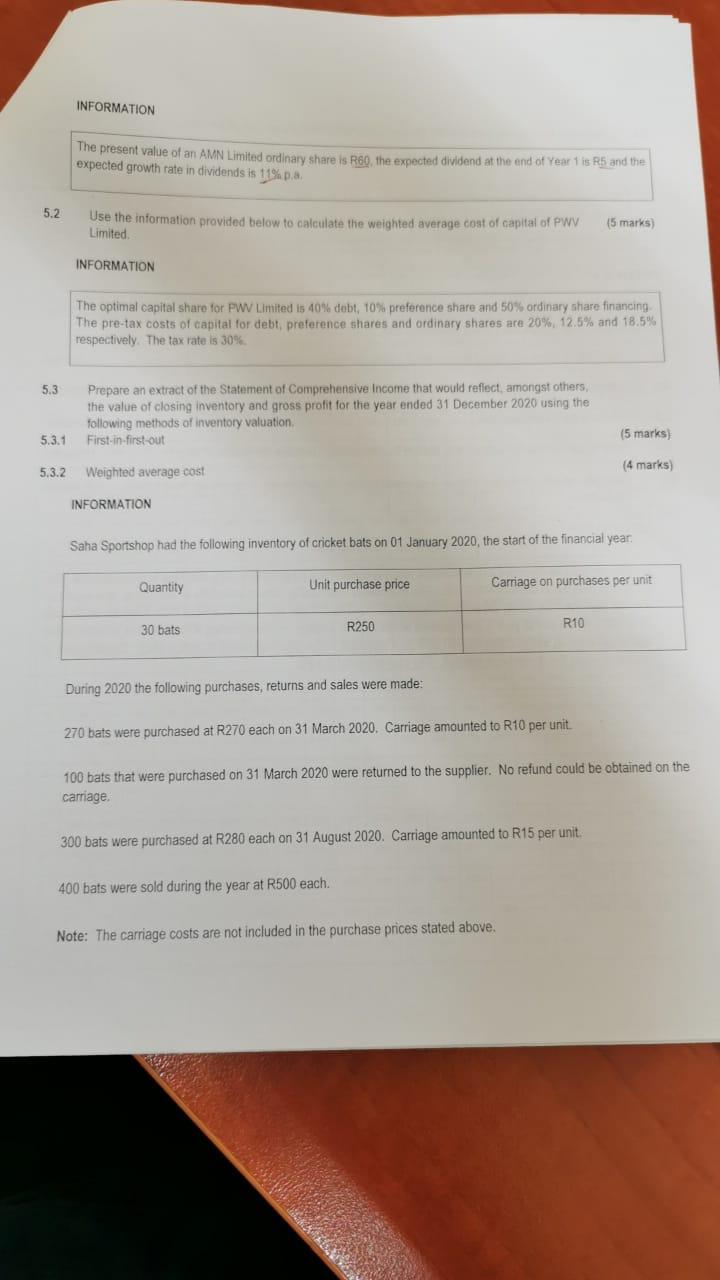

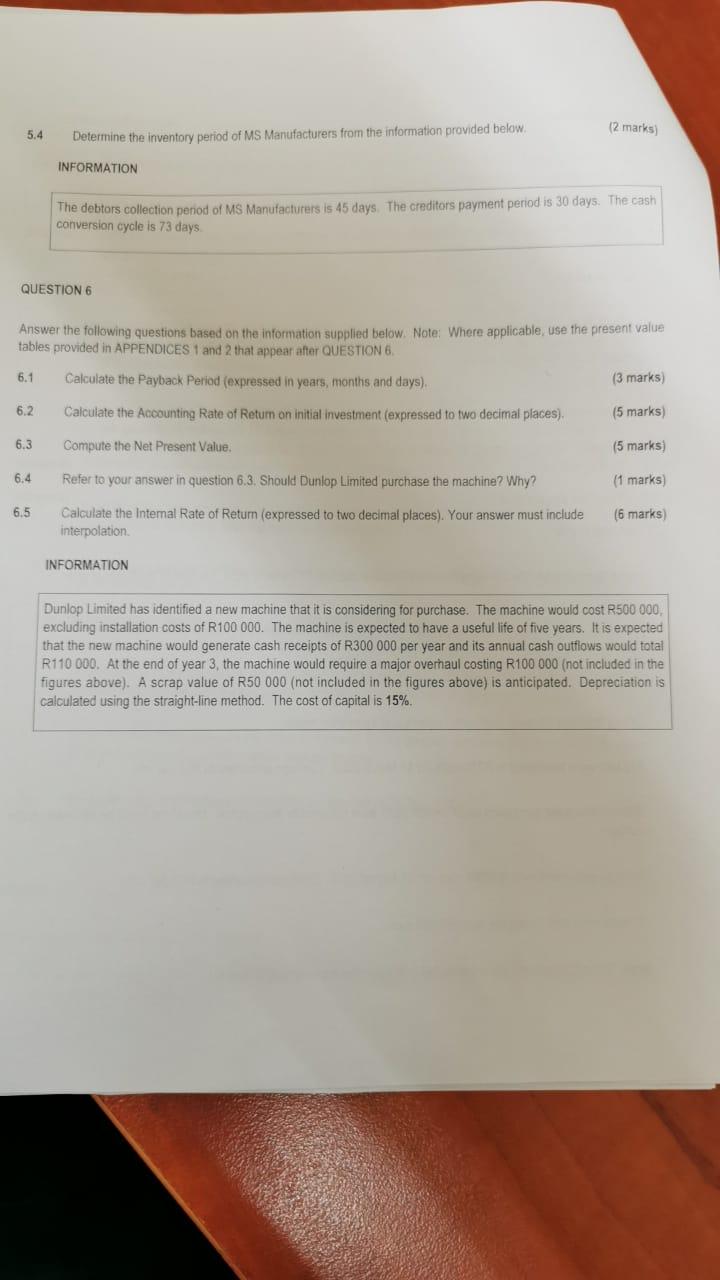

8. Rates and taxes will be paid cents (R0.80) per R100 on the value of the premises. The premises are valued at R3 000 000. 9. Other operating expenses are expected to increase by 5% and are spread evenly throughout the year. They are paid for in the month in which they are incurred. 10. An unfavourable bank balance of R180 000 is expected on 31 May 2022. QUESTION 5 Answer the questions from the information provided. (4 marks) 5.1 Use the Gordon growth model to estimate the cost of the ordinary shares of AMN Limited from the information provided below. INFORMATION The present value of an AMN Limited ordinary share is REO, the expected dividend at the end of Year 1 is R5 and the expected growth rate in dividends is 11% pa 5.2. Use the information provided below to calculate the weighted average cost of capital of PWV Limited (5 marks INFORMATION The optimal capital share for PW Limited is 40% debt, 10% preference share and 50% ordinary share financing The pre-tax costs of capital for debt, preference shares and ordinary shares are 20% 12,5% and 18.5% respectively. The tax rate is 30% 5.3 Prepare an extract of the Statement of Comprehensive Income that would reflect, amongst others, the value of closing inventory and gross profit for the year ended 31 December 2020 using the following methods of inventory valuation First-in-first-out 5.3.1 (5 marks) 5.3.2 (4 marks) Weighted average cost INFORMATION Saha Sportshop had the following inventory of cricket bats on 01 January 2020, the start of the financial year Quantity Unit purchase price Carriage on purchases per unit 30 bats R250 R10 During 2020 the following purchases, returns and sales were made: 270 bats were purchased at R270 each on 31 March 2020. Carriage amounted to R10 per unit 100 bats that were purchased on 31 March 2020 were returned to the supplier. No refund could be obtained on the carriage 300 bats were purchased at R280 each on 31 August 2020. Carriage amounted to R15 per unit. 400 bats were sold during the year at R500 each. Note: The carriage costs are not included in the purchase prices stated above. (2 marks) 5.4 Determine the inventory period of MS Manufacturers from the information provided below INFORMATION The debtors collection period of MS Manufacturers is 45 days. The creditors payment period is 30 days. The cash conversion cycle is 73 days QUESTION 6 Answer the following questions based on the information supplied below. Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 6. 6.1 Calculate the Payback Period (expressed in years, months and days) (3 marks) 6.2 Calculate the Accounting Rate of Retum on initial investment (expressed to two decimal places) (5 marks) 6.3 Compute the Net Present Value. (5 marks) 6.4 Refer to your answer in question 6.3. Should Dunlop Limited purchase the machine? Why? (1 marks) 6.5 (6 marks) Calculate the internal Rate of Retum (expressed to two decimal places). Your answer must include interpolation INFORMATION Dunlop Limited has identified a new machine that it is considering for purchase. The machine would cost R500 000, excluding installation costs of R100 000. The machine is expected to have a useful life of five years. It is expected that the new machine would generate cash receipts of R300 000 per year and its annual cash outflows would total R110 000. At the end of year 3, the machine would require a major overhaul costing R100 000 (not included in the figures above). A scrap value of R50 000 (not included in the figures above) is anticipated. Depreciation is calculated using the straight-line method. The cost of capital is 15%