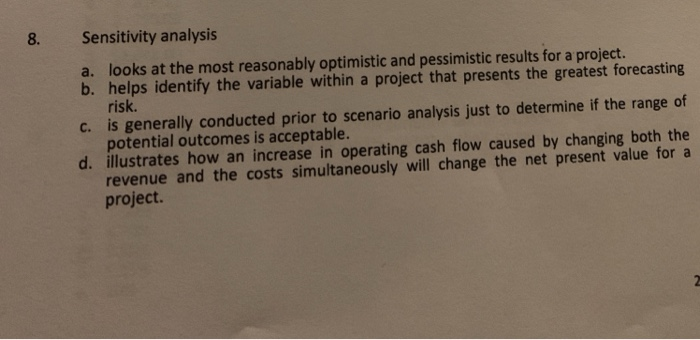

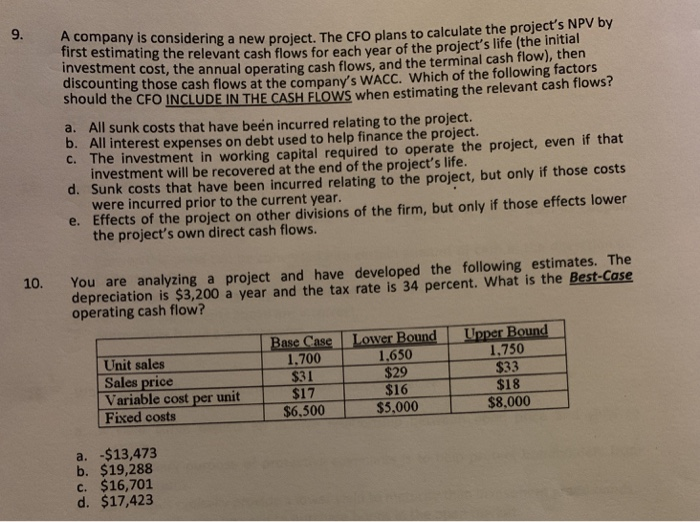

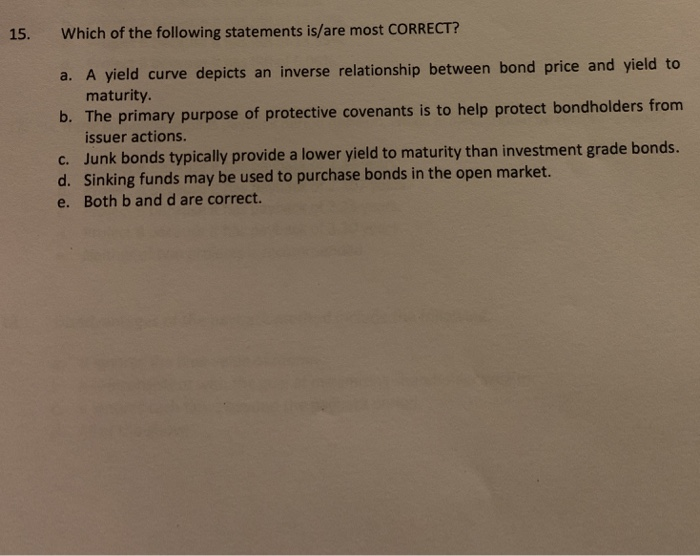

8. Sensitivity analysis looks at the most reasonably optimistic and pessimistic results for a project. risk. potential outcomes is acceptable. revenue and the costs simultaneously will change the net present value for a a. b. helps identify the variable within a project that presents the greatest forecasting c. is generally conducted prior to scenario analysis just to determine if the range of d. illustrates how an increase in operating cash flow caused by changing both the project. frpany isconsidering a new project. The CFO plans to calculate the project's NPV by first estimating the relevant invest discountirn cash flows for each vear of the project's life (the initial ment cost, the annual operating cash flows, and the terminal cash flow), then oung those cash flows at the company's WACC. Which of the following factors Should the CFO INCLUDENTHE CASH FLOWS whenestimating the relevant cash flows? All sunk costs that have ben incurred relating to the project. All interest expenses on debt used to help finance the project. a. b. C. The investment in working capital required to operate the project, even if that d. Sunk costs that have been incurred relating to the project, but only if those costs investment will be recovered at the end of the project's life. were incurred prior to the current year. e. Effects of the project on other divisions of the firm, but only if those effects lower the project's own direct cash flows. 10. You are analyzing a project and have developed the following estimates. The depreciation is $3,200 a year and the tax rate is 34 percent. What is the Best-Case operating cash flow? -BaseCase l-Lower Bound-I-Upper Bound 1.650 $29 $16 $5,000 Unit sales 1.750 $33 $18 $8,000 1.700 $31 Sales price Variable cost per unit Fixed costs $6.500 a. $13,473 b. $19,288 c. $16,701 d. $17,423 15. Which of the following statements is/are most CORRECT? a. A yield curve depicts an inverse relationship between bond price and yield to maturity. b. The primary purpose of protective covenants is to help protect bondholders from c. d. e. issuer actions Junk bonds typically provide a lower yield to maturity than investment grade bonds. Sinking funds may be used to purchase bonds in the open market. Both b and d are correct