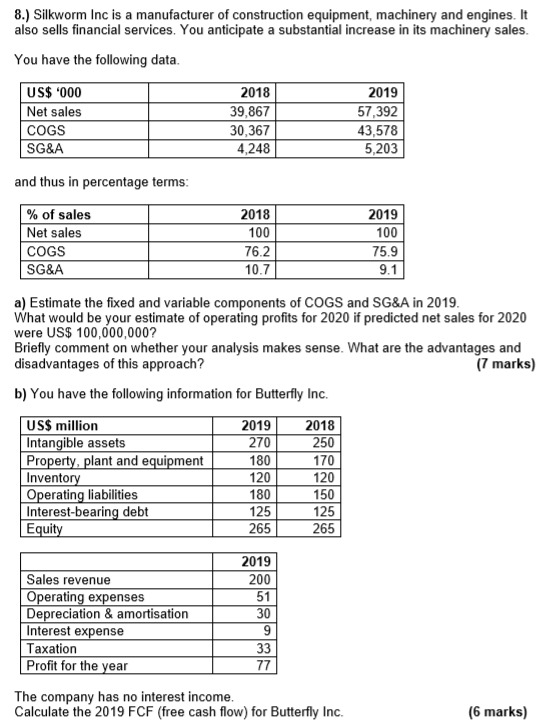

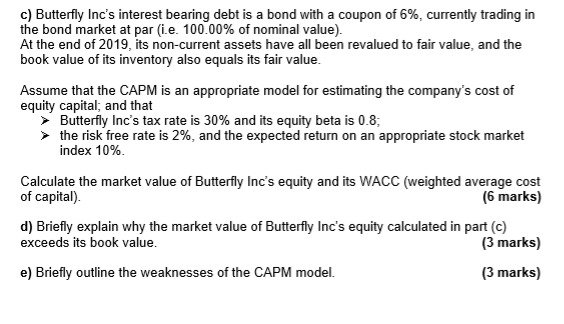

8.) Silkworm Inc is a manufacturer of construction equipment, machinery and engines. It also sells financial services. You anticipate a substantial increase in its machinery sales. You have the following data. US$ '000 2018 2019 Net sales 39,867 57,392 COGS 30,367 43,578 SG&A 4,248 5,203 and thus in percentage terms: % of sales 2018 2019 Net sales 100 100 COGS 76.2 75.9 SG&A 10.7 9.1 a) Estimate the fixed and variable components of COGS and SG&A in 2019. What would be your estimate of operating profits for 2020 if predicted net sales for 2020 were US$ 100,000,000? Briefly comment on whether your analysis makes sense. What are the advantages and disadvantages of this approach? (7 marks) b) You have the following information for Butterfly Inc. US$ million 2019 2018 Intangible assets 270 250 Property, plant and equipment 180 170 Inventory 120 120 Operating liabilities 180 150 Interest-bearing debt 125 125 Equity 265 265 2019 Sales revenue 200 Operating expenses 51 Depreciation & amortisation 30 Interest expense 9 Taxation 33 Profit for the year 77 The company has no interest income. Calculate the 2019 FCF (free cash flow) for Butterfly Inc. (6 marks) c) Butterfly Inc's interest bearing debt is a bond with a coupon of 6%, currently trading in the bond market at par (i.e. 100.00% of nominal value). At the end of 2019, its non-current assets have all been revalued to fair value, and the book value of its inventory also equals its fair value. Assume that the CAPM is an appropriate model for estimating the company's cost of equity capital; and that Butterfly Inc's tax rate is 30% and its equity beta is 0.8; the risk free rate is 2%, and the expected return on an appropriate stock market index 10% Calculate the market value of Butterfly Inc's equity and its WACC (weighted average cost of capital) (6 marks) d) Briefly explain why the market value of Butterfly Inc's equity calculated in part (c) exceeds its book value. (3 marks) e) Briefly outline the weaknesses of the CAPM model. (3 marks) 8.) Silkworm Inc is a manufacturer of construction equipment, machinery and engines. It also sells financial services. You anticipate a substantial increase in its machinery sales. You have the following data. US$ '000 2018 2019 Net sales 39,867 57,392 COGS 30,367 43,578 SG&A 4,248 5,203 and thus in percentage terms: % of sales 2018 2019 Net sales 100 100 COGS 76.2 75.9 SG&A 10.7 9.1 a) Estimate the fixed and variable components of COGS and SG&A in 2019. What would be your estimate of operating profits for 2020 if predicted net sales for 2020 were US$ 100,000,000? Briefly comment on whether your analysis makes sense. What are the advantages and disadvantages of this approach? (7 marks) b) You have the following information for Butterfly Inc. US$ million 2019 2018 Intangible assets 270 250 Property, plant and equipment 180 170 Inventory 120 120 Operating liabilities 180 150 Interest-bearing debt 125 125 Equity 265 265 2019 Sales revenue 200 Operating expenses 51 Depreciation & amortisation 30 Interest expense 9 Taxation 33 Profit for the year 77 The company has no interest income. Calculate the 2019 FCF (free cash flow) for Butterfly Inc. (6 marks) c) Butterfly Inc's interest bearing debt is a bond with a coupon of 6%, currently trading in the bond market at par (i.e. 100.00% of nominal value). At the end of 2019, its non-current assets have all been revalued to fair value, and the book value of its inventory also equals its fair value. Assume that the CAPM is an appropriate model for estimating the company's cost of equity capital; and that Butterfly Inc's tax rate is 30% and its equity beta is 0.8; the risk free rate is 2%, and the expected return on an appropriate stock market index 10% Calculate the market value of Butterfly Inc's equity and its WACC (weighted average cost of capital) (6 marks) d) Briefly explain why the market value of Butterfly Inc's equity calculated in part (c) exceeds its book value. (3 marks) e) Briefly outline the weaknesses of the CAPM model