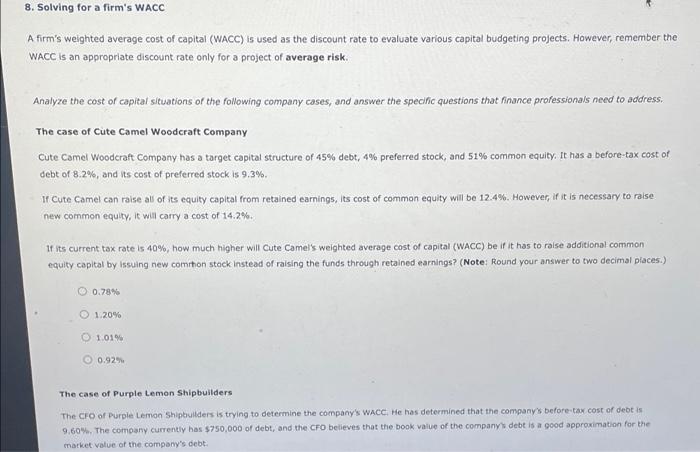

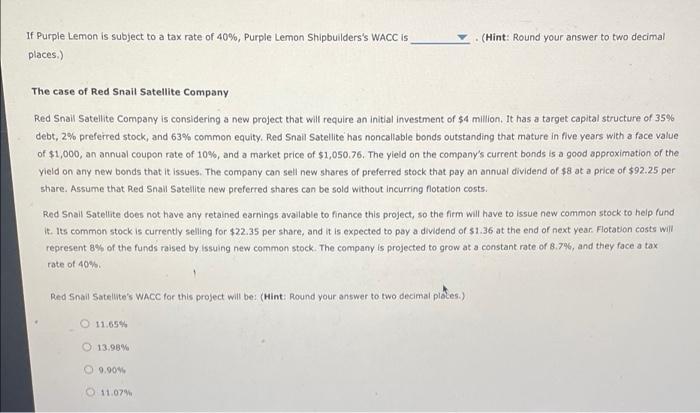

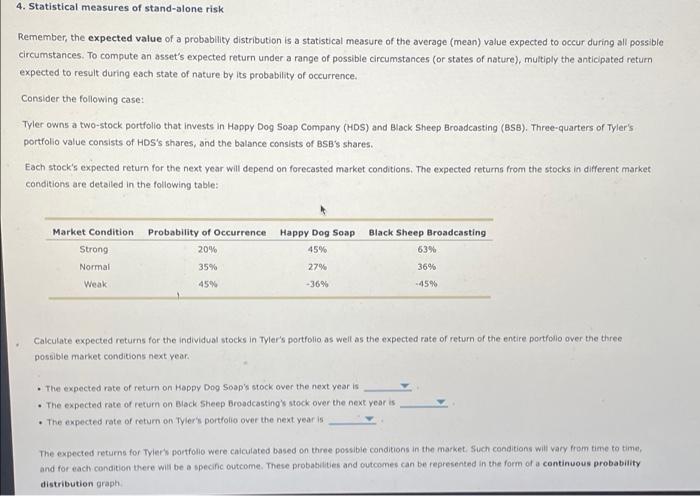

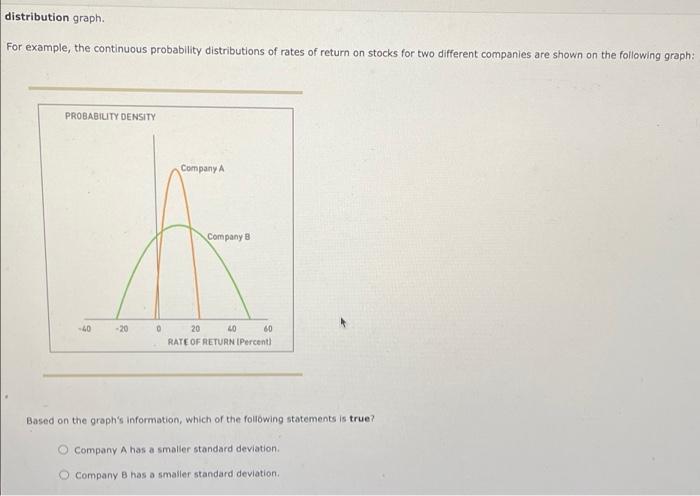

8. Solving for a firm's WACC A firm's weighted average cost of capital (WACC) is used as the discount rate to evaluate various capital budgeting projects. However, remember the WACC is an appropriate discount rate only for a project of average risk. Analyze the cost of capital situations of the following company cases, and answer the specific questions that finance professionals need to address. The case of Cute Camel Woodcraft Company Cute Camel Woodcraft Company has a target capital structure of 45% debt, 4% preferred stock, and 51% common equity. It has a before-tax cost of debt of 8.2%, and its cost of preferred stock is 9.3%. If Cute Camel can raise all of its equity capital from retained earnings, its cost of common equity will be 12.4%. However, if it is necessary to raise new common equity, it will carry a cost of 14.2%. If its current tax rate is 40%, how much higher will Cute Camel's weighted average cost of capital (WACC) be if it has to raise additional common equity capital by issuing new commhon stock instead of raising the funds through retained earnings? (Note: Round your answer to two decimal places.) 0.78% 1.20% O 1.01% 0.92% The case of Purple Lemon Shipbuilders The CFO of Purple Lemon Shipbuilders is trying to determine the company's WACC. He has determined that the company's before-tax cost of debt is 9.60%. The company currently has $750,000 of debt, and the CFO believes that the book value of the company's debt is a good approximation for the market value of the company's debt. (Hint: Round your answer to two decimal If Purple Lemon is subject to a tax rate of 40% , Purple Lemon Shipbuilders's WACC is places.) The case of Red Snail Satellite Company Red Snail Satellite Company is considering a new project that will require an initial investment of $4 million. It has a target capital structure of 35% debt, 2% preferred stock, and 63% common equity. Red Snail Satellite has noncallable bonds outstanding that mature in five years with a face value of $1,000, an annual coupon rate of 10%, and a market price of $1,050.76. The yield on the company's current bonds is a good approximation of the yield on any new bonds that it issues. The company can sell new shares of preferred stock that pay an annual dividend of $8 at a price of $92.25 per share. Assume that Red Snail Satellite new preferred shares can be sold without incurring flotation costs. it. Its common Red Snail Satellite does not have any retained earnings available to finance this project, so the firm will have to issue new common stock to help fund is currently selling for $22.35 per share, and it is expected to pay a dividend of $1.36 at the end of next year. Flotation costs will represent 8% of the funds raised by issuing new common stock. The company is projected to grow at a constant rate of 8.7%, and they face a tax rate of 40%. Red Snail Satellite's WACC for this project will be: (Hint: Round your answer to two decimal places.) 11.65% 13.98 % 9.90% 11.07% 4. Statistical measures of stand-alone risk Remember, the expected value of a probability distribution is a statistical measure of the average (mean) value expected to occur during all possible circumstances. To compute an asset's expected return under a range of possible circumstances (or states of nature), multiply the anticipated return expected to result during each state of nature by its probability of occurrence. Consider the following case: Tyler owns a two-stock portfolio that invests in Happy Dog Soap Company (HDS) and Black Sheep Broadcasting (BSB). Three-quarters of Tyler's portfolio value consists of HDS's shares, and the balance consists of BSB's shares. Each stock's expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Market Condition Probability of Occurrence Happy Dog Soap Black Sheep Broadcasting 20% 45% 63% Strong Normal 35% 27% 36% Weak 45% -36% -45% Calculate expected returns for the individual stocks in Tyler's portfolio as well as the expected rate of return of the entire portfolio over the three possible market conditions next year. The expected rate of return on Happy Dog Soap's stock over the next year is The expected rate of return on Black Sheep Broadcasting's stock over the next year is The expected rate of return on Tyler's portfolio over the next year is The expected returns for Tyler's portfolio were calculated based on three possible conditions in the market. Such conditions will vary from time to time, and for each condition there will be a specific outcome. These probabilities and outcomes can be represented in the form of a continuous probability distribution graph distribution graph. For example, the continuous probability distributions of rates of return on stocks for two different companies are shown on the following graph: PROBABILITY DENSITY Company A Company B -40 -20 60 20 40 RATE OF RETURN [Percent) Based on the graph's information, which of the following statements is true? Company A has a smaller standard deviation. Company B has a smaller standard deviation. 0