Answered step by step

Verified Expert Solution

Question

1 Approved Answer

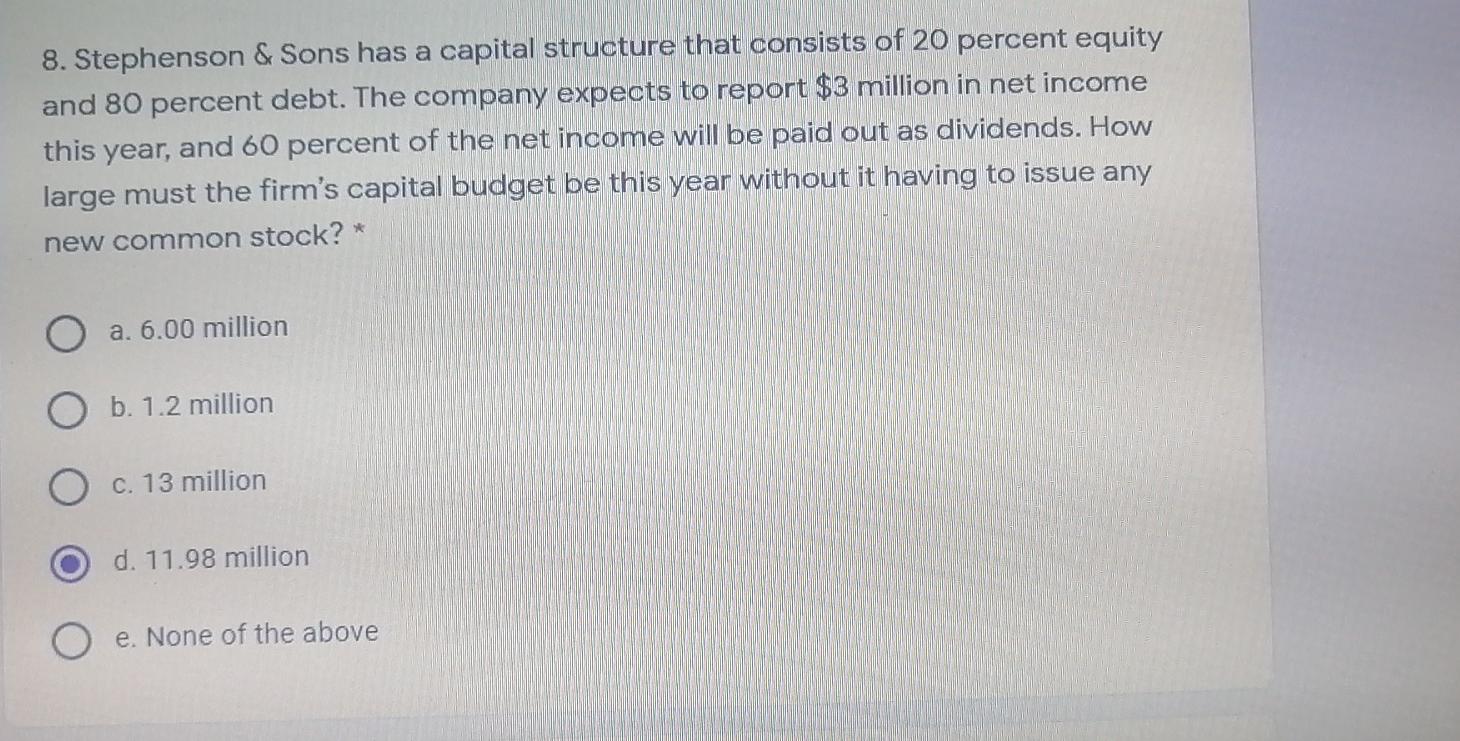

8. Stephenson & Sons has a capital structure that consists of 20 percent equity and 80 percent debt. The company expects to report $3 million

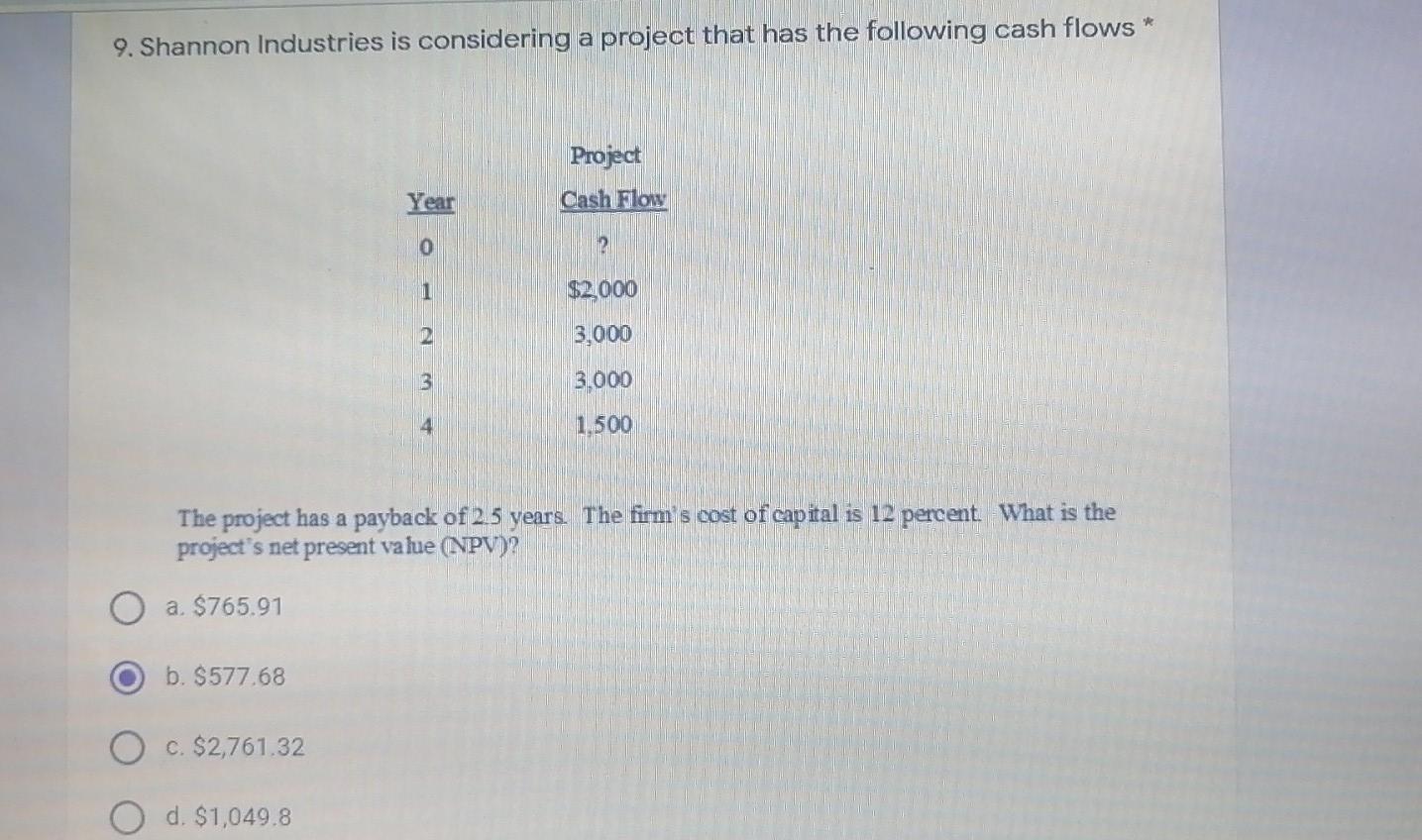

8. Stephenson & Sons has a capital structure that consists of 20 percent equity and 80 percent debt. The company expects to report $3 million in net income this year, and 60 percent of the net income will be paid out as dividends. How large must the firm's capital budget be this year without it having to issue any new common stock? * O a. 6.00 million O b. 1.2 million C. 13 million d. 11.98 million e. None of the above 9. Shannon Industries is considering a project that has the following cash flows * Project Cash Flow Year O 2 1 $2.000 3,000 3.000 1.500 The project has a payback of 2.5 years. The firm's cost of capital is 12 percent What is the project's net present value (NPV)? a $765.91 b. $577.68 O c. $2,761.32 O d. $1,049.8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started