Support-department cost allocations; single-department cost pools; direct step-down, and reciprocal methods. The Manes Company has two products.

Question:

Support-department cost allocations; single-department cost pools; direct step-down, and reciprocal methods. The Manes Company has two products. Product 1 is manufactured entirely in Department X. Product 2 is manufactured entirely in Department V. To produce these two products, the Manes Company has two support departments: A (a materials-handling department) and B (a power- generating department).

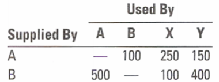

An analysis of the work done by departments A and B in a typical period follows:

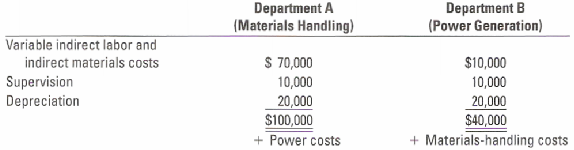

The work done in Department A is measured by the direct labor-hours of materials-handling time. The work done in Department B is measured by the kilowatt-hours of power. The budgeted costs of the support departments for the coming year are:

The budgeted costs of the operating departments for the coming year are $1,500,000 for Department X and $800,000 for Department Y.

Supervision costs are salary costs. Depreciation in Department B is the straight-line depreciation of power-generation equipment in its nineteenth year of an estimated 25-year useful life; it is old, but well- maintained, equipment

1. What are the allocations of costs of support departments A and B to operating departments X and Y using )a) the direct method, )b) the step-down method (allocate Department A first), )c) the step-down method (allocate Department B first), and )d) the reciprocal method?

2. An outside company has offered to supply all the power needed by the Manes Company and to provide all the services of the present power department. The cost of this service will be $40 per kilowatt-hour of power. Should Manes accept? Explain.

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav