Answered step by step

Verified Expert Solution

Question

1 Approved Answer

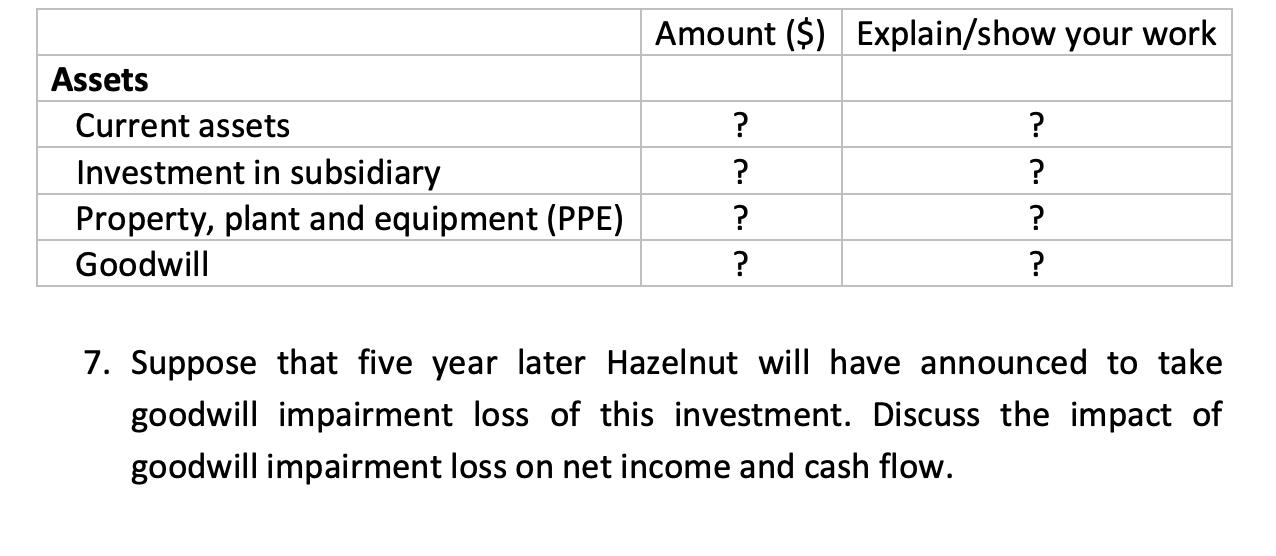

8. Suppose that on January 1, 20X1, Hazelnut Group acquired 25% shares of Cashew Nut Corporation for $17,000. All other information is the same as

8. Suppose that on January 1, 20X1, Hazelnut Group acquired 25% shares of Cashew Nut Corporation for $17,000. All other information is the same as above. During 20X1, Cashew Nut Corporation has net loss of $8,000 and dividend payment of $5,000. a. Show purchase price allocation of this transaction. b. What is the amount of investment in Cashew Nut as of December 31, 20x1? Show your work.

8. Suppose that on January 1, 20X1, Hazelnut Group acquired 25% shares of Cashew Nut Corporation for $17,000. All other information is the same as above. During 20X1, Cashew Nut Corporation has net loss of $8,000 and dividend payment of $5,000. a. Show purchase price allocation of this transaction. b. What is the amount of investment in Cashew Nut as of December 31, 20x1? Show your work.

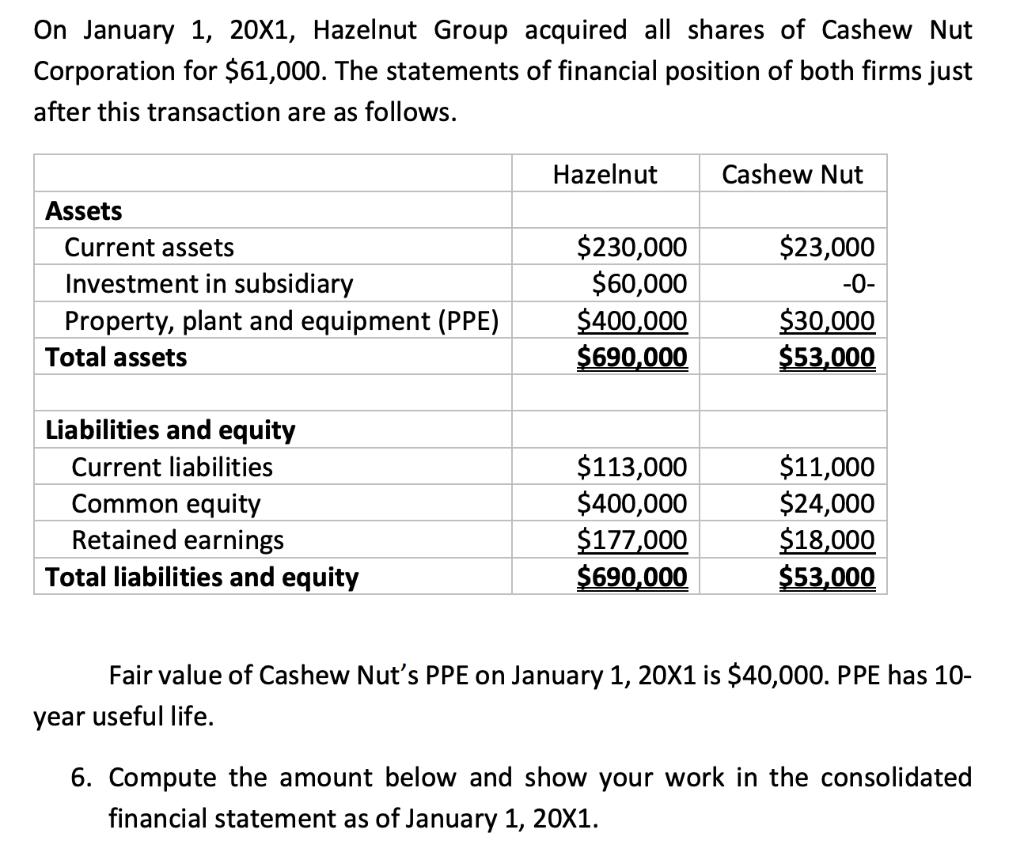

On January 1, 20X1, Hazelnut Group acquired all shares of Cashew Nut Corporation for $61,000. The statements of financial position of both firms just after this transaction are as follows. Assets Current assets Investment in subsidiary Property, plant and equipment (PPE) Total assets Liabilities and equity Current liabilities Common equity Retained earnings Total liabilities and equity Hazelnut $230,000 $60,000 $400,000 $690,000 $113,000 $400,000 $177,000 $690,000 Cashew Nut $23,000 -0- $30,000 $53,000 $11,000 $24,000 $18,000 $53,000 Fair value of Cashew Nut's PPE on January 1, 20X1 is $40,000. PPE has 10- year useful life. 6. Compute the amount below and show your work in the consolidated financial statement as of January 1, 20X1.

Step by Step Solution

★★★★★

3.50 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

6 Calculate and show the amounts on the consolidated financial statement as of January 1 20X1 Assets Current assets 230000 Hazelnut 23000 Cashew Nut 253000 To calculate the consolidated value of Inves...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started