Answered step by step

Verified Expert Solution

Question

1 Approved Answer

8. The current market price of Apple stock is $154.30. Its earnings per share (EPS) in the last quarter (quarter ending June 30, 2021) was

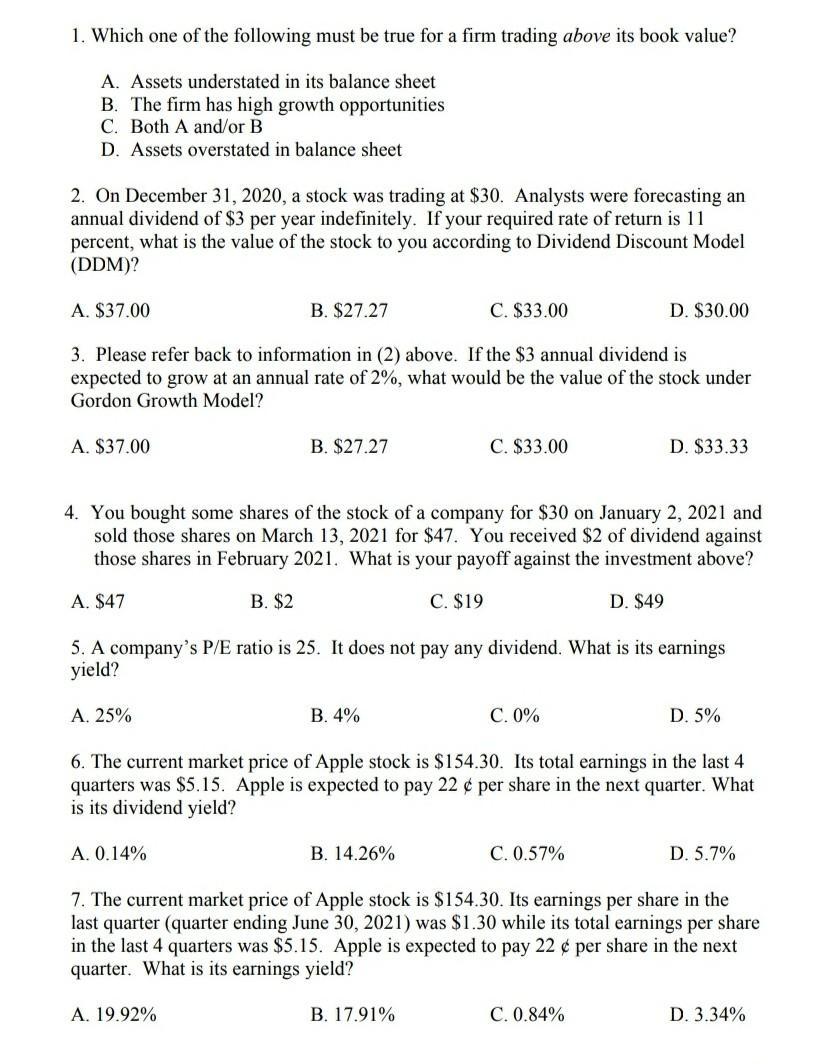

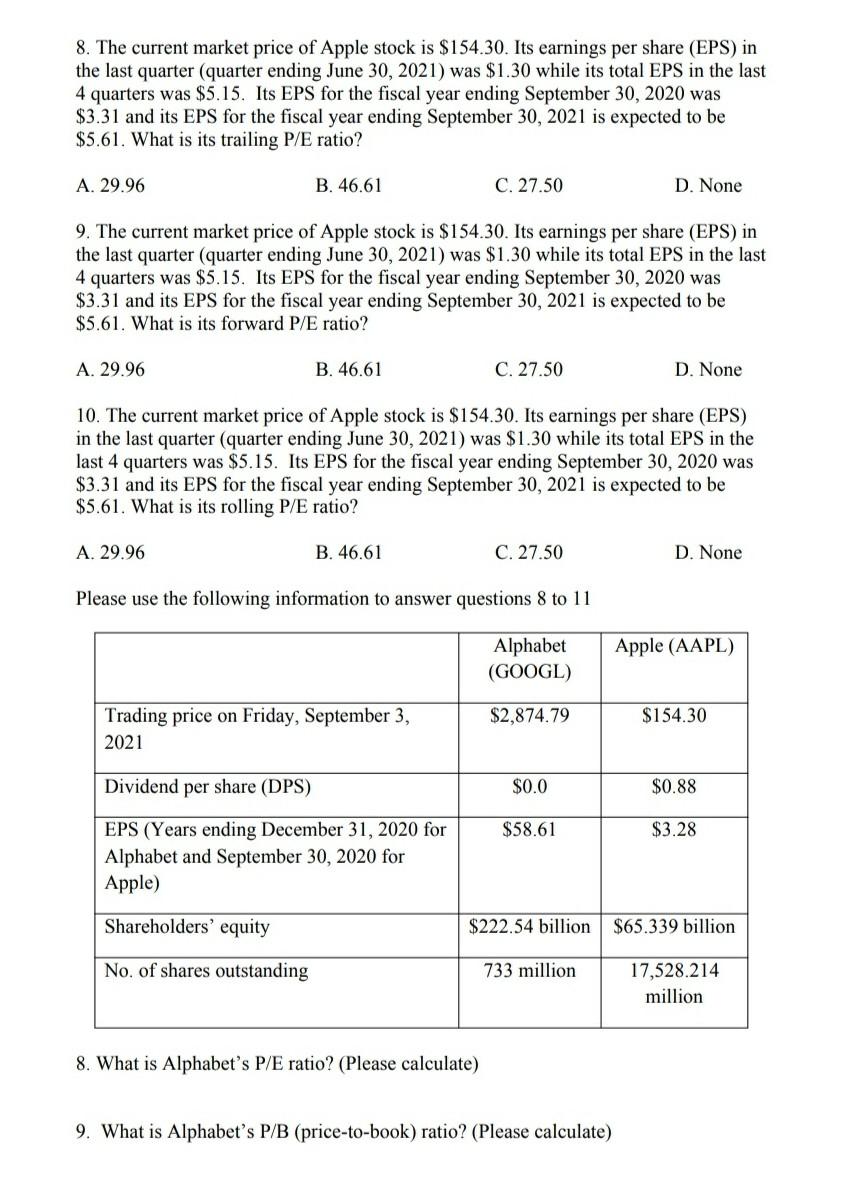

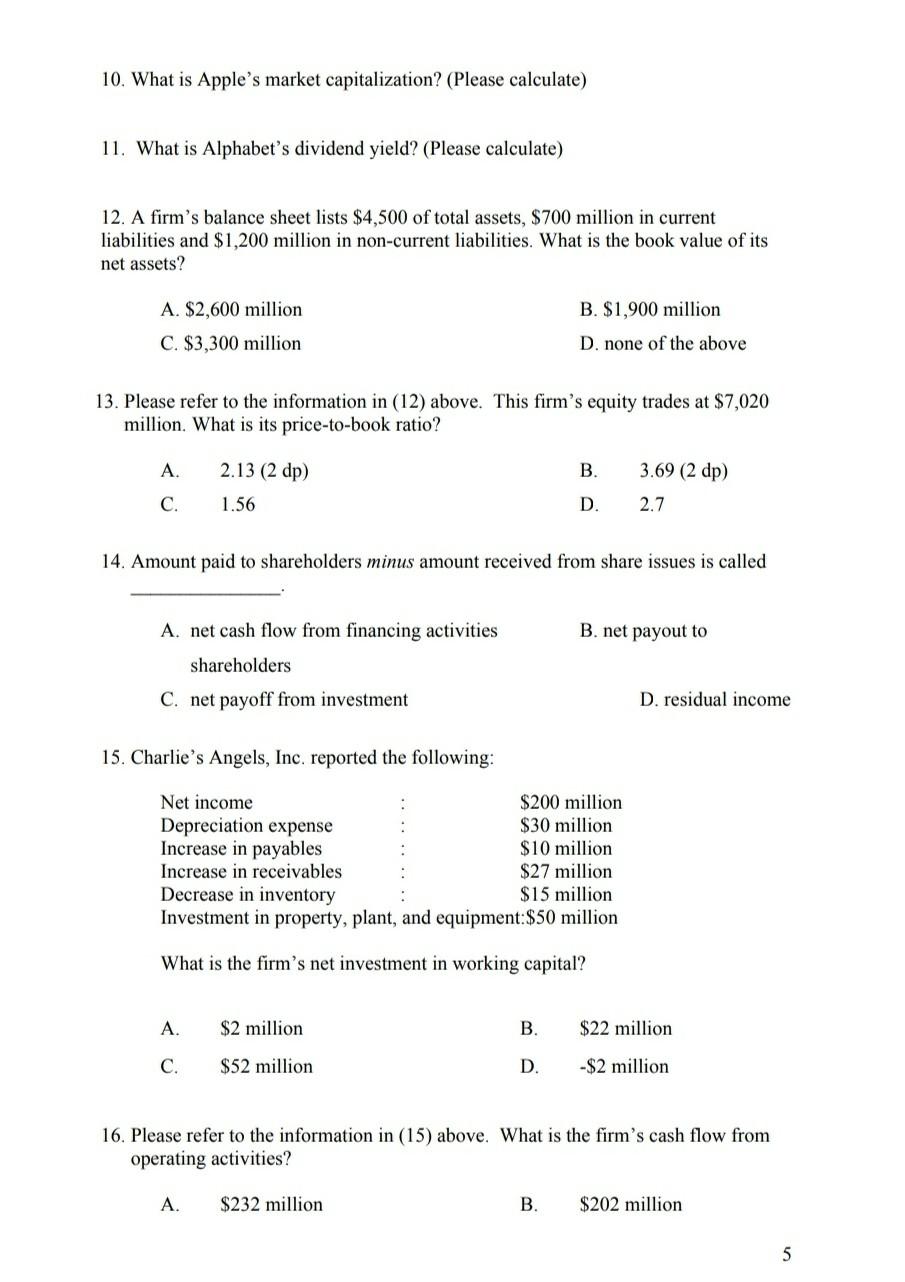

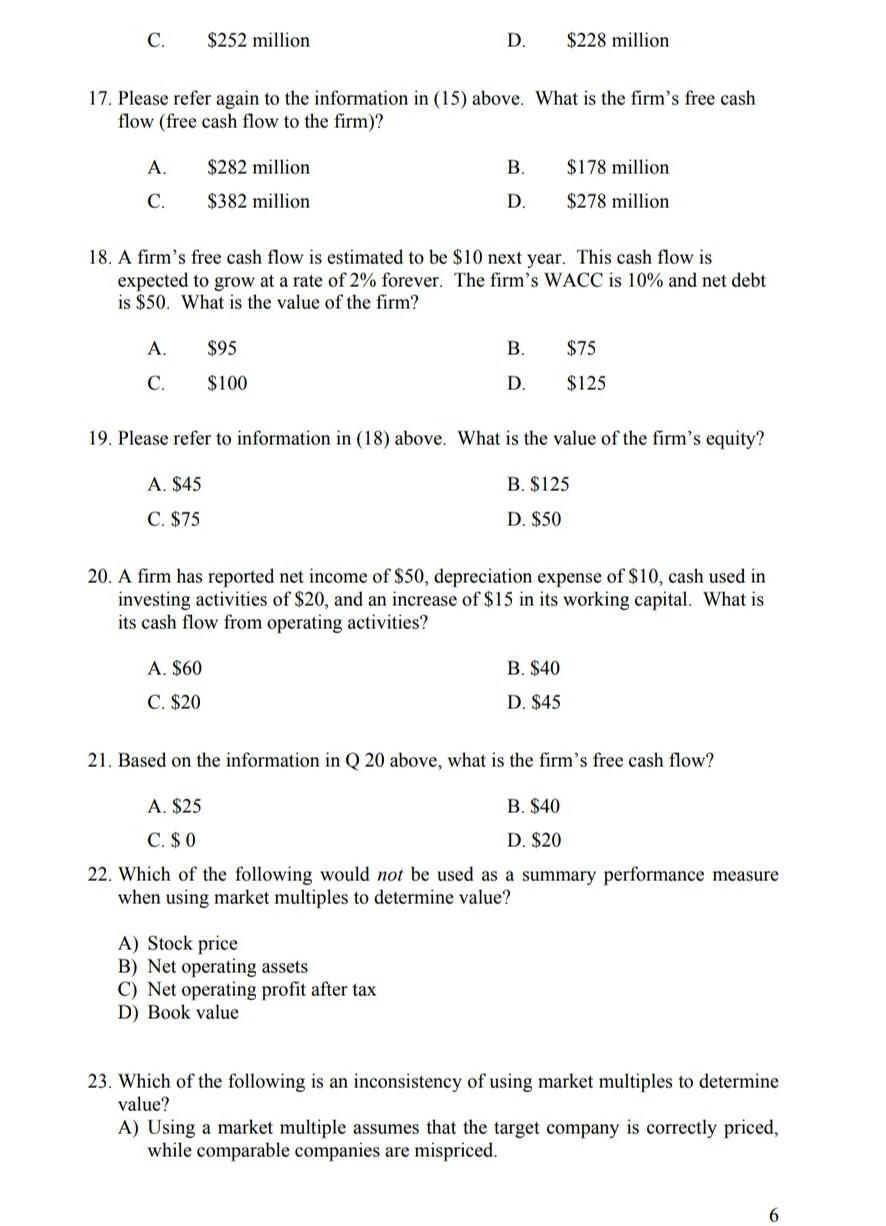

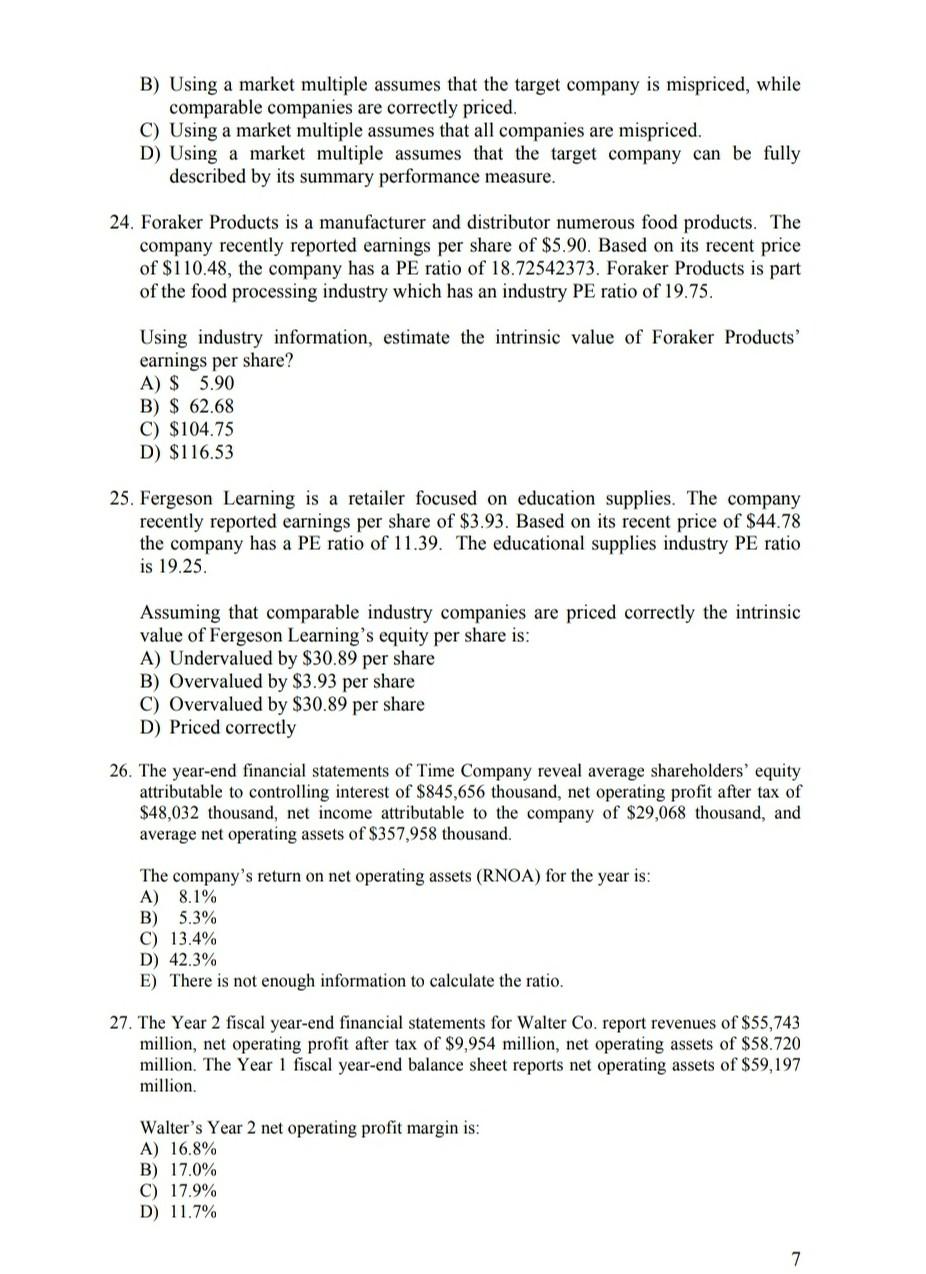

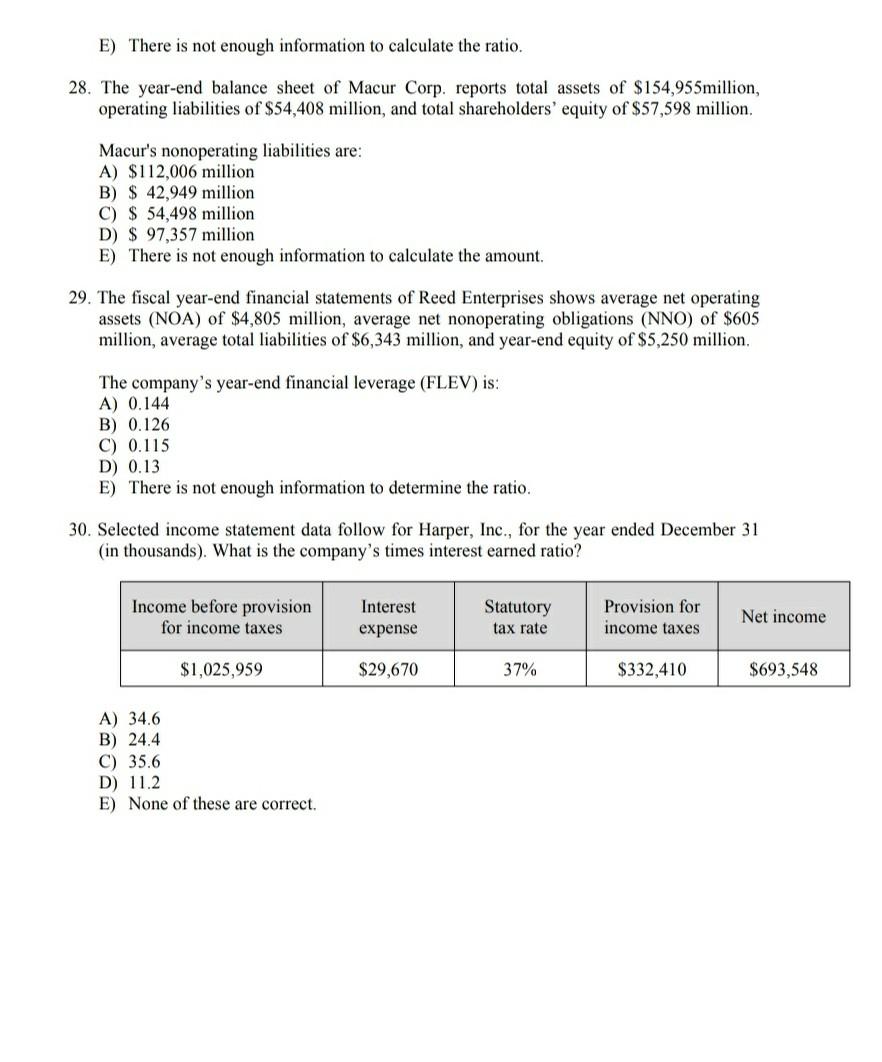

8. The current market price of Apple stock is $154.30. Its earnings per share (EPS) in the last quarter (quarter ending June 30, 2021) was $1.30 while its total EPS in the last 4 quarters was $5.15. Its EPS for the fiscal year ending September 30, 2020 was $3.31 and its EPS for the fiscal year ending September 30, 2021 is expected to be $5.61. What is its trailing P/E ratio? A. 29.96 B. 46.61 C. 27.50 D. None 9. The current market price of Apple stock is $154.30. Its earnings per share (EPS) in the last quarter (quarter ending June 30, 2021) was $1.30 while its total EPS in the last 4 quarters was $5.15. Its EPS for the fiscal year ending September 30, 2020 was $3.31 and its EPS for the fiscal year ending September 30, 2021 is expected to be $5.61. What is its forward P/E ratio? A. 29.96 B. 46.61 C. 27.50 D. None 10. The current market price of Apple stock is $154.30. Its earnings per share (EPS) in the last quarter (quarter ending June 30, 2021) was $1.30 while its total EPS in the last 4 quarters was $5.15. Its EPS for the fiscal year ending September 30, 2020 was $3.31 and its EPS for the fiscal year ending September 30, 2021 is expected to be $5.61. What is its rolling P/E ratio? A. 29.96 B. 46.61 C. 27.50 D. None Please use the following information to answer questions 8 to 11 Apple (AAPL) Alphabet (GOOGL) $2,874.79 $154.30 Trading price on Friday, September 3, 2021 Dividend per share (DPS) $0.0 $0.88 $58.61 $3.28 EPS (Years ending December 31, 2020 for Alphabet and September 30, 2020 for Apple) Shareholders' equity $222.54 billion $65.339 billion No. of shares outstanding 733 million 17,528.214 million 8. What is Alphabet's P/E ratio? (Please calculate) 9. What is Alphabet's P/B (price-to-book) ratio? (Please calculate) 10. What is Apple's market capitalization? (Please calculate) 11. What is Alphabet's dividend yield? (Please calculate) 12. A firm's balance sheet lists $4,500 of total assets, $700 million in current liabilities and $1,200 million in non-current liabilities. What is the book value of its net assets? B. $1,900 million A. $2,600 million C. $3,300 million D. none of the above 13. Please refer to the information in (12) above. This firm's equity trades at $7,020 million. What is its price-to-book ratio? A. 2.13 (2 dp) B. 3.69 (2 dp) 2.7 C. 1.56 D. 14. Amount paid to shareholders minus amount received from share issues is called B. net payout to A. net cash flow from financing activities shareholders C. net payoff from investment D. residual income 15. Charlie's Angels, Inc. reported the following: Net income $200 million Depreciation expense $30 million Increase in payables $10 million Increase in receivables $27 million Decrease in inventory $15 million Investment in property, plant, and equipment:$50 million What is the firm's net investment in working capital? A. $2 million B. $22 million C. $52 million D. -$2 million 16. Please refer to the information in (15) above. What is the firm's cash flow from operating activities? A. $232 million B. $202 million 5 C. $252 million D. $228 million 17. Please refer again to the information in (15) above. What is the firm's free cash flow (free cash flow to the firm)? A. B. $178 million $282 million $382 million C. D. $278 million 18. A firm's free cash flow is estimated to be $10 next year. This cash flow is expected to grow at a rate of 2% forever. The firm's WACC is 10% and net debt is $50. What is the value of the firm? A. $95 B. $75 C. $100 D. $125 19. Please refer to information in (18) above. What is the value of the firm's equity? A. $45 B. $125 C. $75 D. $50 20. A firm has reported net income of $50, depreciation expense of $10, cash used in investing activities of $20, and an increase of $15 in its working capital. What is its cash flow from operating activities? B. $40 A. $60 C. $20 D. $45 21. Based on the information in Q 20 above, what is the firm's free cash flow? A. $25 B. $40 C. $0 D. $20 22. Which of the following would be used as a summary performance measure when using market multiples to determine value? A) Stock price B) Net operating assets C) Net operating profit after tax D) Book value 23. Which of the following is an inconsistency of using market multiples to determine value? A) Using a market multiple assumes that the target company is correctly priced, while comparable companies are mispriced. 6 B) Using a market multiple assumes that the target company is mispriced, while comparable companies are correctly priced. C) Using a market multiple assumes that all companies are mispriced. D) Using a market multiple assumes that the target company can be fully described by its summary performance measure. 24. Foraker Products is a manufacturer and distributor numerous food products. The company recently reported earnings per share of $5.90. Based on its recent price of $110.48, the company has a PE ratio of 18.72542373. Foraker Products is part of the food processing industry which has an industry PE ratio of 19.75. Using industry information, estimate the intrinsic value of Foraker Products' earnings per share? A) $ 5.90 B) $ 62.68 C) $104.75 D) $116.53 25. Fergeson Learning is a retailer focused on education supplies. The company recently reported earnings per share of $3.93. Based on its recent price of $44.78 the company has a PE ratio of 11.39. The educational supplies industry PE ratio is 19.25 Assuming that comparable industry companies are priced correctly the intrinsic value of Fergeson Learning's equity per share is: A) Undervalued by $30.89 per share B) Overvalued by $3.93 per share C) Overvalued by $30.89 per share D) Priced correctly 26. The year-end financial statements of Time Company reveal average shareholders' equity attributable to controlling interest of $845,656 thousand, net operating profit after tax of $48,032 thousand, net income attributable to the company of $29,068 thousand, and average net operating assets of $357,958 thousand. The company's return on net operating assets (RNOA) for the year is: A) 8.1% B) 5.3% C) 13.4% D) 42.3% E) There is not enough information to calculate the ratio. 27. The Year 2 fiscal year-end financial statements for Walter Co. report revenues of $55,743 million, net operating profit after tax of $9,954 million, net operating assets of $58.720 million. The Year 1 fiscal year-end balance sheet reports net operating assets of $59,197 million. Walter's Year 2 net operating profit margin is: A) 16.8% B) 17.0% C) 17.9% D) 11.7% 7 E) There is not enough information to calculate the ratio. 28. The year-end balance sheet of Macur Corp. reports total assets of $154,955million, operating liabilities of $54,408 million, and total shareholders' equity of $57,598 million, Macur's nonoperating liabilities are: A) $112,006 million B) $ 42,949 million C) $ 54,498 million D) $ 97,357 million E) There is not enough information to calculate the amount 29. The fiscal year-end financial statements of Reed Enterprises shows average net operating assets (NOA) of $4,805 million, average net nonoperating obligations (NNO) of $605 million, average total liabilities of $6,343 million, and year-end equity of $5,250 million. The company's year-end financial leverage (FLEV) is: A) 0.144 B) 0.126 C) 0.115 D) 0.13 E) There is not enough information to determine the ratio. 30. Selected income statement data follow for Harper, Inc., for the year ended December 31 (in thousands). What is the company's times interest earned ratio? Income before provision for income taxes Interest expense Statutory tax rate Provision for income taxes Net income $1,025,959 $29,670 37% $332,410 $693,548 A) 34.6 B) 24.4 C) 35.6 D) 11.2 E) None of these are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started