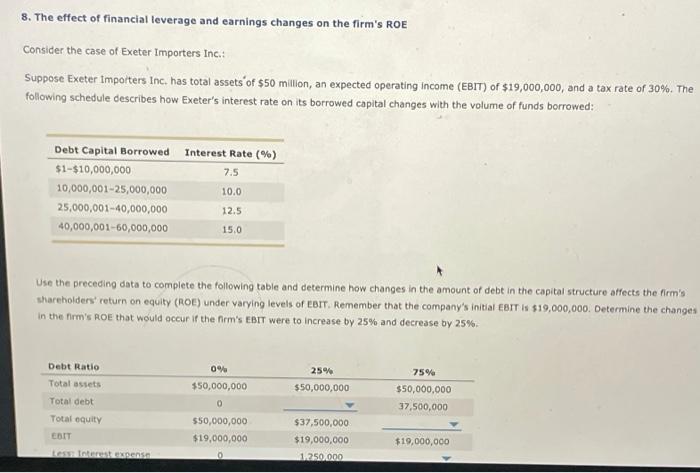

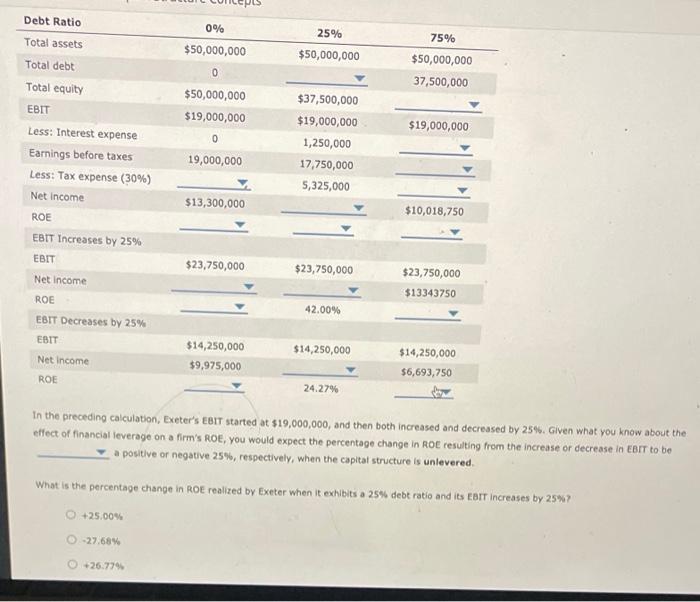

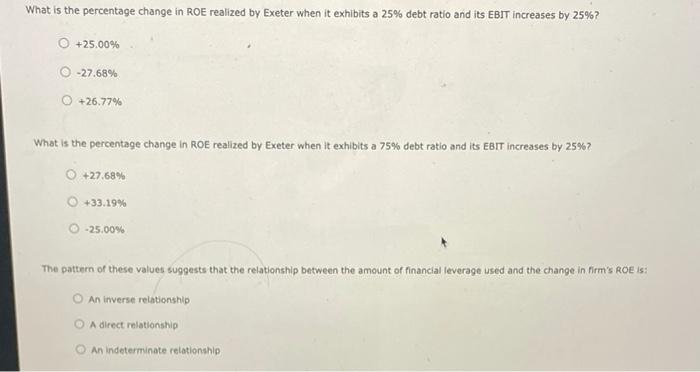

8. The effect of financial leverage and earnings changes on the firm's ROE Consider the case of Exeter Importers Inc.: Suppose Exeter Importers Inc. has total assets of $50 million, an expected operating income (EBIT) of $19,000,000, and a tax rate of 30%. The following schedule describes how Exeter's interest rate on its borrowed capital changes with the volume of funds borrowed: Debt Capital Borrowed Interest Rate (%) $1-$10,000,000 7.5 10,000,001-25,000,000 10.0 25,000,001-40,000,000 12.5 40,000,001-60,000,000 15.0 Use the preceding data to complete the following table and determine how changes in the amount of debt in the capital structure affects the firm's shareholders' return on equity (ROE) under varying levels of corr. Remember that the company's initial EBIT I* $19,000,000. Determine the changes in the firm's ROE that would occur if the firm's EBIT were to increase by 25% and decrease by 25% 0% $50,000,000 25% $50,000,000 Debt Ratio Total assets Total debt Total equity EBIT testerens 75% $50,000,000 37,500,000 0 $50,000,000 $19,000,000 $37,500,000 $19,000,000 1.250.000 $19,000,000 Debt Ratio Total assets 25% $50,000,000 0% $50,000,000 0 $50,000,000 $19,000,000 75% $50,000,000 37,500,000 Total debt Total equity EBIT Less: Interest expense Earnings before taxes Less: Tax expense (30%) Net Income $19,000,000 0 $37,500,000 $19,000,000 1,250,000 17,750,000 5,325,000 19,000,000 $13,300,000 $10,018,750 ROE $23,750,000 $23,750,000 $23,750,000 $13343750 EBIT Increases by 25% EBIT Net Income ROE EBIT Decreases by 25% EBIT Net Income ROE 42.00% $14,250,000 $9,975,000 $14,250,000 $14,250,000 $6,693,750 24.27% In the preceding calculation, Exeter's EBIT started at $19,000,000, and then both increased and decreased by 25%. Given what you know about the effect of financial leverage on a firm's ROE, you would expect the percentage change in ROE resulting from the increase or decrease in EBIT to be a positive or negative 25%, respectively, when the capital structure is unlevered. What is the percentage change in Roe realized by Exeter when it exhibits a 25% debt ratio and its torr increases by 25%? +25.00% -27.68% -26.779 What is the percentage change in ROE realized by Exeter when it exhibits a 25% debt ratio and its EBIT increases by 25%? +25.00% - 27.68% +26.77% What is the percentage change in ROE realized by Exeter when it exhibits a 75% debt ratio and its EBIT increases by 25%? +27.68% +33.19% -25.00% The pattern of these values suggests that the relationship between the amount of financial leverage used and the change in firm's ROE IS: O An inverse relationship O A direct relationship An indeterminate relationship